Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396 Exercise 29

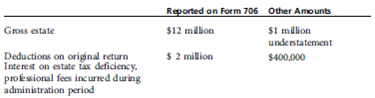

The Bird Estate committed tax fraud when it purposely understated the value of the business created and operated by the decedent, Beverly Bird. Executor Wilma Holmes admitted to the Tax Court that she had withheld several contracts and formulas that, had they been disclosed to the valuation experts used by the government and the estate, would have added $1 million in value to the business and over half that amount in federal estate tax liabilities. Summary data include the following:

Holmes asks you for advice in computing the fraud penalty. Ignore interest amounts. She wonders whether to take the 75 percent civil penalty against the full $1 million understatement or against the $600,000 net amount that the taxable estate would have increased had the administrative expenses been incurred prior to the filing date of the Form 706.

Write to Holmes, an experienced certified public accountant with an extensive tax practice, a letter stating your opinion.

Holmes asks you for advice in computing the fraud penalty. Ignore interest amounts. She wonders whether to take the 75 percent civil penalty against the full $1 million understatement or against the $600,000 net amount that the taxable estate would have increased had the administrative expenses been incurred prior to the filing date of the Form 706.

Write to Holmes, an experienced certified public accountant with an extensive tax practice, a letter stating your opinion.

Explanation

All the major kinds of the penalty in re...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255