Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Edition 10ISBN: 978-1285439396

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Edition 10ISBN: 978-1285439396 Exercise 32

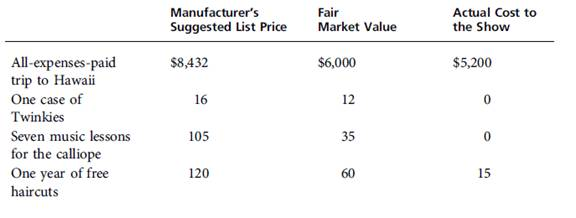

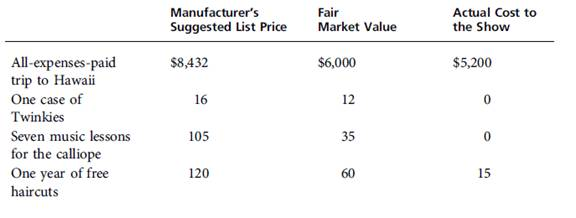

Edna is a well-paid executive with ADley, a firm that uses stock options and deferred compensation as well as high salaries to compensate its most successful employees. When Edna and Ron were divorced, Ron received the rights to a bundle of these deferred-compensation rights. Complete the following table, indicating the required tax results:

Explanation

In this case, stock option also stands t...

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255