Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Edition 10ISBN: 978-1285439396

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Edition 10ISBN: 978-1285439396 Exercise 20

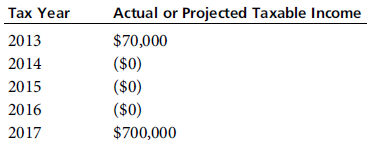

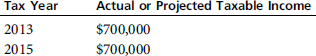

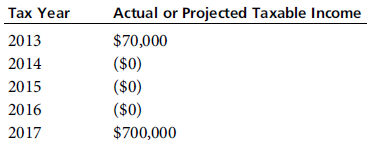

Should Ferris Corporation elect to forgo the carryback of its $60,000 year 2014 net operating loss Ferris is subject to a 16 percent cost of capital. Corporate tax rates are as in I.R.C. § 11.

a.

b.

c.

a.

b.

c.

Explanation

Some taxpayers have cyclic pattern of in...

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255