Introductory Econometrics 4th Edition by Jeffrey Wooldridge

Edition 4ISBN: 978-0324660609

Introductory Econometrics 4th Edition by Jeffrey Wooldridge

Edition 4ISBN: 978-0324660609 Exercise 6

Use the data in LOANAPP.RAW for this exercise.

(i) Estimate the equation in part (iii) of Computer Exercise, computing the heteroskedasticity-robust standard errors. Compare the 95% confidence interval on white with the nonrobust confidence interval.

(ii) Obtain the fitted values from the regression in part (i). Are any of them less than zero Are any of them greater than one What does this mean about applying weighted least squares

Use the data in LOANAPP.RAW for this exercise. The binary variable to be explained is approve, which is equal to one if a mortgage loan to an individual was approved. The key explanatory variable is white, a dummy variable equal to one if the applicant was white. The other applicants in the data set are black and Hispanic.

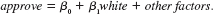

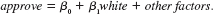

To test for discrimination in the mortgage loan market, a linear probability model can be used:

(i) If there is discrimination against minorities, and the appropriate factors have been controlled for, what is the sign of 1

(ii) Regress approve on white and report the results in the usual form. Interpret the coefficient on white. Is it statistically significant Is it practically large

(iii) As controls, add the variables hrat, obrat, loanprc, unem, male, married, dep, sch, cosign, chist, pubrec, mortlat1, mortlat2, and vr. What happens to the coefficient on white Is there still evidence of discrimination against nonwhites

(iv) Now, allow the effect of race to interact with the variable measuring other obligations as a percentage of income (obrat). Is the interaction term significant

(v) Using the model from part (iv), what is the effect of being white on the probability of approval when obrat = 32, which is roughly the mean value in the sample Obtain a 95% confidence interval for this effect.

(i) Estimate the equation in part (iii) of Computer Exercise, computing the heteroskedasticity-robust standard errors. Compare the 95% confidence interval on white with the nonrobust confidence interval.

(ii) Obtain the fitted values from the regression in part (i). Are any of them less than zero Are any of them greater than one What does this mean about applying weighted least squares

Use the data in LOANAPP.RAW for this exercise. The binary variable to be explained is approve, which is equal to one if a mortgage loan to an individual was approved. The key explanatory variable is white, a dummy variable equal to one if the applicant was white. The other applicants in the data set are black and Hispanic.

To test for discrimination in the mortgage loan market, a linear probability model can be used:

(i) If there is discrimination against minorities, and the appropriate factors have been controlled for, what is the sign of 1

(ii) Regress approve on white and report the results in the usual form. Interpret the coefficient on white. Is it statistically significant Is it practically large

(iii) As controls, add the variables hrat, obrat, loanprc, unem, male, married, dep, sch, cosign, chist, pubrec, mortlat1, mortlat2, and vr. What happens to the coefficient on white Is there still evidence of discrimination against nonwhites

(iv) Now, allow the effect of race to interact with the variable measuring other obligations as a percentage of income (obrat). Is the interaction term significant

(v) Using the model from part (iv), what is the effect of being white on the probability of approval when obrat = 32, which is roughly the mean value in the sample Obtain a 95% confidence interval for this effect.

Explanation

(i)

Estimate the model where is regress...

Introductory Econometrics 4th Edition by Jeffrey Wooldridge

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255