Business 10th Edition by Ferrell,Geoffrey Hirt,Linda Ferrell

Edition 10ISBN: 978-1259179396

Business 10th Edition by Ferrell,Geoffrey Hirt,Linda Ferrell

Edition 10ISBN: 978-1259179396 Exercise 15

Financial Analysis

Background

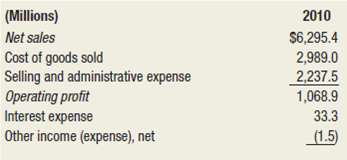

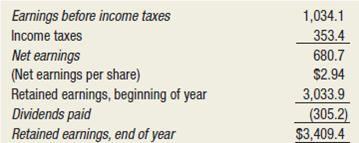

The income statement for Western Grain Company, a producer of agricultural products for industrial as well as consumer markets, is shown below. Western Grain's total assets are $4,237.1 million, and its equity is $1,713.4 million. Consolidated Earnings and Retained Earnings Year Ended December 31

Task

Calculate the following profitability ratios: profit margin, return on assets, and return on equity. Assume that the industry averages for these ratios are as follows: profit margin, 12 percent; return on assets, 18 percent; and return on equity, 25 percent. Evaluate Western Grain's profitability relative to the industry averages. Why is this information useful?

Background

The income statement for Western Grain Company, a producer of agricultural products for industrial as well as consumer markets, is shown below. Western Grain's total assets are $4,237.1 million, and its equity is $1,713.4 million. Consolidated Earnings and Retained Earnings Year Ended December 31

Task

Calculate the following profitability ratios: profit margin, return on assets, and return on equity. Assume that the industry averages for these ratios are as follows: profit margin, 12 percent; return on assets, 18 percent; and return on equity, 25 percent. Evaluate Western Grain's profitability relative to the industry averages. Why is this information useful?

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Business 10th Edition by Ferrell,Geoffrey Hirt,Linda Ferrell

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255