BASIC MARKETING 18th Edition by Jerome McCarthy William Perreault, Joseph Cannon

Edition 18ISBN: 978-0077577193

BASIC MARKETING 18th Edition by Jerome McCarthy William Perreault, Joseph Cannon

Edition 18ISBN: 978-0077577193 Exercise 22

Allen Lynch (A L)

The partners of Allen Lynch are having a serious discussion about what the firm should do in the near future.

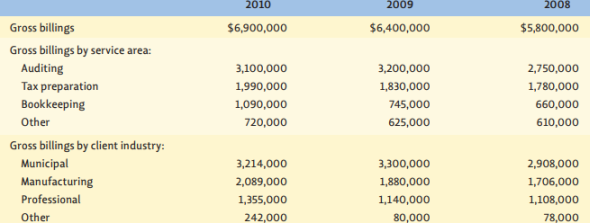

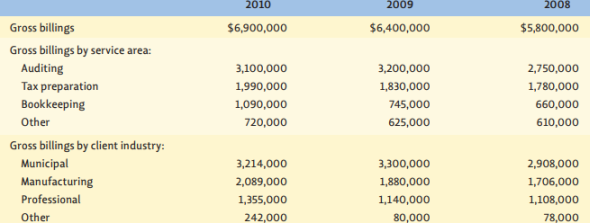

Allen Lynch (A L) is a medium-size regional certified public accounting firm based in Grand Rapids, Michigan, with branch offices in Lansing and Detroit. Allen Lynch has nine partners and a professional staff of approximately 105 accountants. Gross service billings for the fiscal year ending June 30, 2010, were $6.9 million. Financial data for 2010, 2009, and 2008 are presented in Table 1.

A L's professional services include auditing, tax preparation, bookkeeping, and some general management consulting. Its client base includes municipal governments (cities, villages, and townships), manufacturing companies, professional organizations (attorneys, doctors, and dentists), and various other small businesses. A good share of revenue comes from the firm's municipal practice. Table 1 gives A L's gross revenue by service area and client industry for 2010, 2009, and 2008.

At the monthly partners' meeting held in July 2010, Robert Allen, the firm's managing partner (CEO), expressed concern about the future of the firm's municipal practice. Robert's presentation to his partners follows:

Although our firm is considered to be a leader in municipal auditing in our geographic area, I am concerned that as municipals attempt to cut their operating costs, they will solicit competitive bids from other public accounting firms to perform their annual audits. Three of the four largest accounting firms in the world have local offices in our area. Because they concentrate their practice in the manufacturing industry-which typically has December 31 fiscal year-ends-they have "available" staff during the summer months.

Therefore, they can afford to low-ball competitive bids to keep their staffs busy and benefit from on-the-job training provided by municipal clientele. I am concerned that we may begin to lose clients in our most established and profitable practice area.*

*Organizations with December fiscal year-ends require audit work to be performed during the fall and in January and February. Those with June 30 fiscal year-ends require auditing during the summer months.

Sherry Lynch, a senior partner in the firm and the partner in charge of the firm's municipal practice, was the first to respond to Robert's concern.

Table 1 Fiscal Year Ending June 30

Robert, we all recognize the potential threat of being underbid for our municipal work by our large accounting competitors. However, A L is a leader in municipal auditing in Michigan, and we have much more local experience than our competitors. Furthermore, it is a fact that we offer a superior level of service to our clients-which goes beyond the services normally expected during an audit to include consulting on financial and other operating issues. Many of our less sophisticated clients depend on our nonaudit consulting assistance. Therefore, I believe, we have been successful in differentiating our services from our competitors. In many recent situations, A L was selected over a field of as many as 10 competitors even though our proposed prices were much higher than those of our competitors.

The partners at the meeting agreed with Sherry's comments. However, even though A L had many success stories regarding their ability to retain their municipal clients-despite being underbid-they had lost three large municipal clients during the past year. Sherry was asked to comment on the loss of those clients. She explained that the lost clients are larger municipalities with a lot of in-house financial expertise and therefore less dependent on A L's consulting assistance. As a result, A L's service differentiation went largely unnoticed. Sherry explained that the larger, more sophisticated municipals regard audits as a necessary evil and usually select the low-cost reputable bidder. Robert then requested ideas and discussion from the other partners at the meeting. One partner, Rosa Basilio, suggested that A L should protect itself by diversifying. Specifically, she felt a substantial practice development effort should be directed toward manufacturing. She reasoned that since manufacturing work would occur during A L's off-season, A L could afford to price very low to gain new manufacturing clients. This strategy would also help to counter (and possibly discourage) low-ball pricing for municipals by the three large accounting firms mentioned earlier.

Another partner, Wade Huntoon, suggested that "if we have consulting skills, we ought to promote them more, instead of hoping that the clients will notice and come to appreciate us. Further, maybe we ought to be more aggressive in calling on smaller potential clients."

Another partner, Stan Walsh, agreed with Wade, but wanted to go further. He suggested that they recognize that there are at least two types of municipal customers and that two (at least) different strategies be implemented, including lower prices for auditing only for larger municipal customers and/or higher prices for smaller customers who are buying consulting too. This caused a big uproar from some who said this would lead to price cutting of professional services, and A L didn't want to be price cutters: "One price for all is the professional way."

However, another partner, Isabel Ventura, agreed with Stan and suggested they go even further-pricing consulting services separately. In fact, she suggested that the partners consider setting up a separate department for consulting- like the large accounting firms have done. This can be a very profitable business. But it is a different kind of business and eventually may require different kinds of people and a different organization. For now, however, it may be desirable to appoint a manager for consulting services-with a budget- to be sure it gets proper attention. This suggestion too caused serious disagreement. Partners pointed out that having a separate consulting arm had led to major conflicts, especially in some larger accounting firms. The initial problems were internal. The consultants often brought in more profit than the auditors, but the auditors controlled the partnership and the successful consultants didn't always feel that they got their share of the rewards. But there had also been serious external problems and charges of unethical behavior based on the concern that big accounting firms had a conflict of interest when they did audits on publicly traded companies that they in turn relied on for consulting income. Because of problems in this area, the Securities Exchange Commission created new guidelines that have changed how the big four accounting firms handle consulting. On the other hand, several partners argued that this was really an opportunity for A L because their firm handled very few companies listed with the SEC, and the conflict of interest issues didn't even apply with municipal clients.

Robert thanked everyone for their comments and encouraged them to debate these issues in smaller groups and to share ideas by e-mail before coming to a one-day retreat (in two weeks) to continue this discussion and come to some conclusions.

Evaluate A L's situation. What strategy(ies) should the partners select? Why?

The partners of Allen Lynch are having a serious discussion about what the firm should do in the near future.

Allen Lynch (A L) is a medium-size regional certified public accounting firm based in Grand Rapids, Michigan, with branch offices in Lansing and Detroit. Allen Lynch has nine partners and a professional staff of approximately 105 accountants. Gross service billings for the fiscal year ending June 30, 2010, were $6.9 million. Financial data for 2010, 2009, and 2008 are presented in Table 1.

A L's professional services include auditing, tax preparation, bookkeeping, and some general management consulting. Its client base includes municipal governments (cities, villages, and townships), manufacturing companies, professional organizations (attorneys, doctors, and dentists), and various other small businesses. A good share of revenue comes from the firm's municipal practice. Table 1 gives A L's gross revenue by service area and client industry for 2010, 2009, and 2008.

At the monthly partners' meeting held in July 2010, Robert Allen, the firm's managing partner (CEO), expressed concern about the future of the firm's municipal practice. Robert's presentation to his partners follows:

Although our firm is considered to be a leader in municipal auditing in our geographic area, I am concerned that as municipals attempt to cut their operating costs, they will solicit competitive bids from other public accounting firms to perform their annual audits. Three of the four largest accounting firms in the world have local offices in our area. Because they concentrate their practice in the manufacturing industry-which typically has December 31 fiscal year-ends-they have "available" staff during the summer months.

Therefore, they can afford to low-ball competitive bids to keep their staffs busy and benefit from on-the-job training provided by municipal clientele. I am concerned that we may begin to lose clients in our most established and profitable practice area.*

*Organizations with December fiscal year-ends require audit work to be performed during the fall and in January and February. Those with June 30 fiscal year-ends require auditing during the summer months.

Sherry Lynch, a senior partner in the firm and the partner in charge of the firm's municipal practice, was the first to respond to Robert's concern.

Table 1 Fiscal Year Ending June 30

Robert, we all recognize the potential threat of being underbid for our municipal work by our large accounting competitors. However, A L is a leader in municipal auditing in Michigan, and we have much more local experience than our competitors. Furthermore, it is a fact that we offer a superior level of service to our clients-which goes beyond the services normally expected during an audit to include consulting on financial and other operating issues. Many of our less sophisticated clients depend on our nonaudit consulting assistance. Therefore, I believe, we have been successful in differentiating our services from our competitors. In many recent situations, A L was selected over a field of as many as 10 competitors even though our proposed prices were much higher than those of our competitors.

The partners at the meeting agreed with Sherry's comments. However, even though A L had many success stories regarding their ability to retain their municipal clients-despite being underbid-they had lost three large municipal clients during the past year. Sherry was asked to comment on the loss of those clients. She explained that the lost clients are larger municipalities with a lot of in-house financial expertise and therefore less dependent on A L's consulting assistance. As a result, A L's service differentiation went largely unnoticed. Sherry explained that the larger, more sophisticated municipals regard audits as a necessary evil and usually select the low-cost reputable bidder. Robert then requested ideas and discussion from the other partners at the meeting. One partner, Rosa Basilio, suggested that A L should protect itself by diversifying. Specifically, she felt a substantial practice development effort should be directed toward manufacturing. She reasoned that since manufacturing work would occur during A L's off-season, A L could afford to price very low to gain new manufacturing clients. This strategy would also help to counter (and possibly discourage) low-ball pricing for municipals by the three large accounting firms mentioned earlier.

Another partner, Wade Huntoon, suggested that "if we have consulting skills, we ought to promote them more, instead of hoping that the clients will notice and come to appreciate us. Further, maybe we ought to be more aggressive in calling on smaller potential clients."

Another partner, Stan Walsh, agreed with Wade, but wanted to go further. He suggested that they recognize that there are at least two types of municipal customers and that two (at least) different strategies be implemented, including lower prices for auditing only for larger municipal customers and/or higher prices for smaller customers who are buying consulting too. This caused a big uproar from some who said this would lead to price cutting of professional services, and A L didn't want to be price cutters: "One price for all is the professional way."

However, another partner, Isabel Ventura, agreed with Stan and suggested they go even further-pricing consulting services separately. In fact, she suggested that the partners consider setting up a separate department for consulting- like the large accounting firms have done. This can be a very profitable business. But it is a different kind of business and eventually may require different kinds of people and a different organization. For now, however, it may be desirable to appoint a manager for consulting services-with a budget- to be sure it gets proper attention. This suggestion too caused serious disagreement. Partners pointed out that having a separate consulting arm had led to major conflicts, especially in some larger accounting firms. The initial problems were internal. The consultants often brought in more profit than the auditors, but the auditors controlled the partnership and the successful consultants didn't always feel that they got their share of the rewards. But there had also been serious external problems and charges of unethical behavior based on the concern that big accounting firms had a conflict of interest when they did audits on publicly traded companies that they in turn relied on for consulting income. Because of problems in this area, the Securities Exchange Commission created new guidelines that have changed how the big four accounting firms handle consulting. On the other hand, several partners argued that this was really an opportunity for A L because their firm handled very few companies listed with the SEC, and the conflict of interest issues didn't even apply with municipal clients.

Robert thanked everyone for their comments and encouraged them to debate these issues in smaller groups and to share ideas by e-mail before coming to a one-day retreat (in two weeks) to continue this discussion and come to some conclusions.

Evaluate A L's situation. What strategy(ies) should the partners select? Why?

Explanation

AL is a public accounting firm. The comp...

BASIC MARKETING 18th Edition by Jerome McCarthy William Perreault, Joseph Cannon

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255