Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Edition 1ISBN: 978-1285187273

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Edition 1ISBN: 978-1285187273 Exercise 2

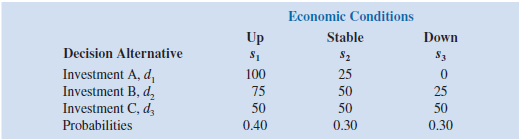

A firm has three investment alternatives. Payoffs are in thousands of dollars.

a. Using the expected value approach, which decision is preferred

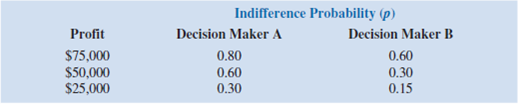

b. For the lottery having a payoff of $100,000 with probability p and $0 with probability (1 p ), two decision makers expressed the following indifference probabilities. Find the most preferred decision for each decision maker using the expected utility approach.

c. Why don't decision makers A and B select the same decision alternative

a. Using the expected value approach, which decision is preferred

b. For the lottery having a payoff of $100,000 with probability p and $0 with probability (1 p ), two decision makers expressed the following indifference probabilities. Find the most preferred decision for each decision maker using the expected utility approach.

c. Why don't decision makers A and B select the same decision alternative

Explanation

a. Since probabilities are available wit...

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255