Medical Insurance 7th Edition by Amy Blochowiak, Joanne Valerius, Nenna Bayes, Cynthia Newby

Edition 7ISBN: 978-1259683077

Medical Insurance 7th Edition by Amy Blochowiak, Joanne Valerius, Nenna Bayes, Cynthia Newby

Edition 7ISBN: 978-1259683077 Exercise 22

Calculating Insurance Math

A. A physician's usual fee for a routine eye examination is $80. Under the discounted fee-for-service arrangement the doctor has with Plan A, the fee is discounted 15 percent for Plan A members. This month, the doctor has seen five Plan A members for routine eye exams.

1. What is the physician's usual fee for the five patients?

2. What will the physician be paid for one Plan A member's exam?

3. What will the physician be paid for the five Plan A eye exams?

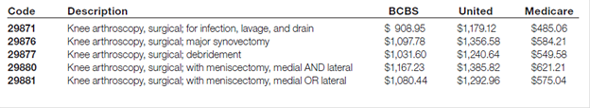

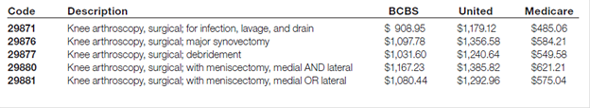

B. Using this fee schedule for three different payers for orthopedic procedures, complete the questions that follow.

1. A patient with BCBS PPO coverage had surgical knee arthroscopy with medial and lateral meniscectomy. The plan has an 80-20 coinsurance with no copayment for surgical procedures. The annual deductible has been met. What will the plan pay, and what amount does the patient owe?

2. A United patient has a high-deductible plan with a $1,200 deductible for this year that has not been met and 75-25 coinsurance. He has surgical knee arthroscopy with debridement. What will the plan pay, and what amount does the patient owe?

3. Another payer offers the practice a contract based on 115 percent of the Medicare Fee Schedule. What amounts are offered for the codes above?

A. A physician's usual fee for a routine eye examination is $80. Under the discounted fee-for-service arrangement the doctor has with Plan A, the fee is discounted 15 percent for Plan A members. This month, the doctor has seen five Plan A members for routine eye exams.

1. What is the physician's usual fee for the five patients?

2. What will the physician be paid for one Plan A member's exam?

3. What will the physician be paid for the five Plan A eye exams?

B. Using this fee schedule for three different payers for orthopedic procedures, complete the questions that follow.

1. A patient with BCBS PPO coverage had surgical knee arthroscopy with medial and lateral meniscectomy. The plan has an 80-20 coinsurance with no copayment for surgical procedures. The annual deductible has been met. What will the plan pay, and what amount does the patient owe?

2. A United patient has a high-deductible plan with a $1,200 deductible for this year that has not been met and 75-25 coinsurance. He has surgical knee arthroscopy with debridement. What will the plan pay, and what amount does the patient owe?

3. Another payer offers the practice a contract based on 115 percent of the Medicare Fee Schedule. What amounts are offered for the codes above?

Explanation

A. 1. $400

2. $68

3. $340

B. 1...

Medical Insurance 7th Edition by Amy Blochowiak, Joanne Valerius, Nenna Bayes, Cynthia Newby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255