The Economics of Money, Banking, and Financial Markets 10th Edition by Frederic Mishkin

Edition 10ISBN: 978-0132763646

The Economics of Money, Banking, and Financial Markets 10th Edition by Frederic Mishkin

Edition 10ISBN: 978-0132763646 Exercise 24

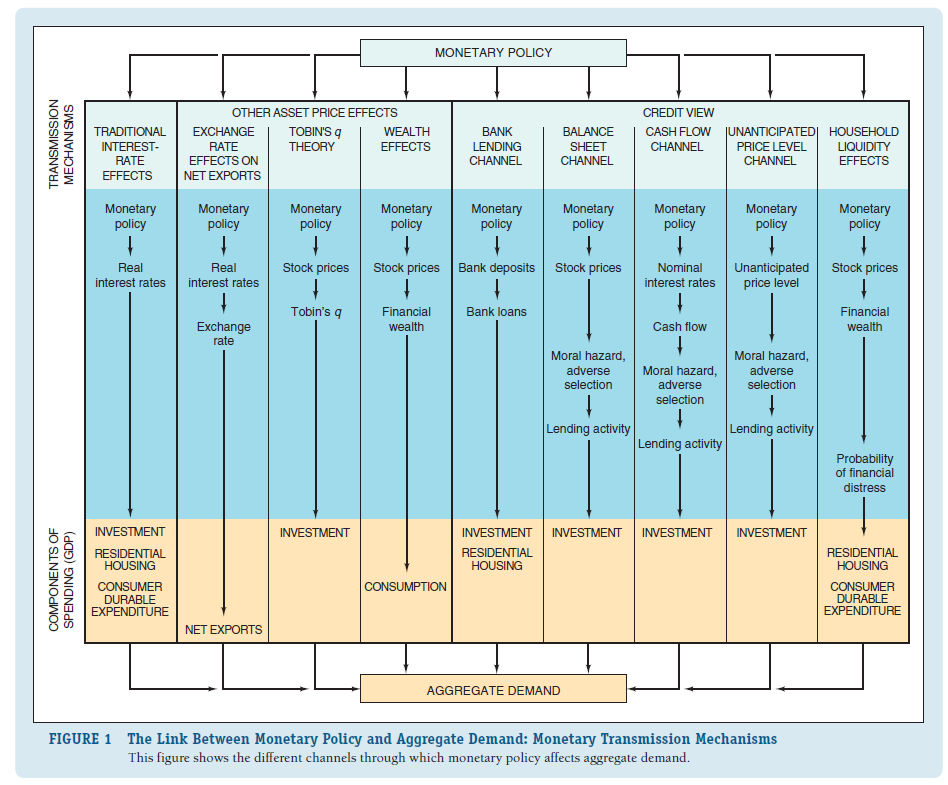

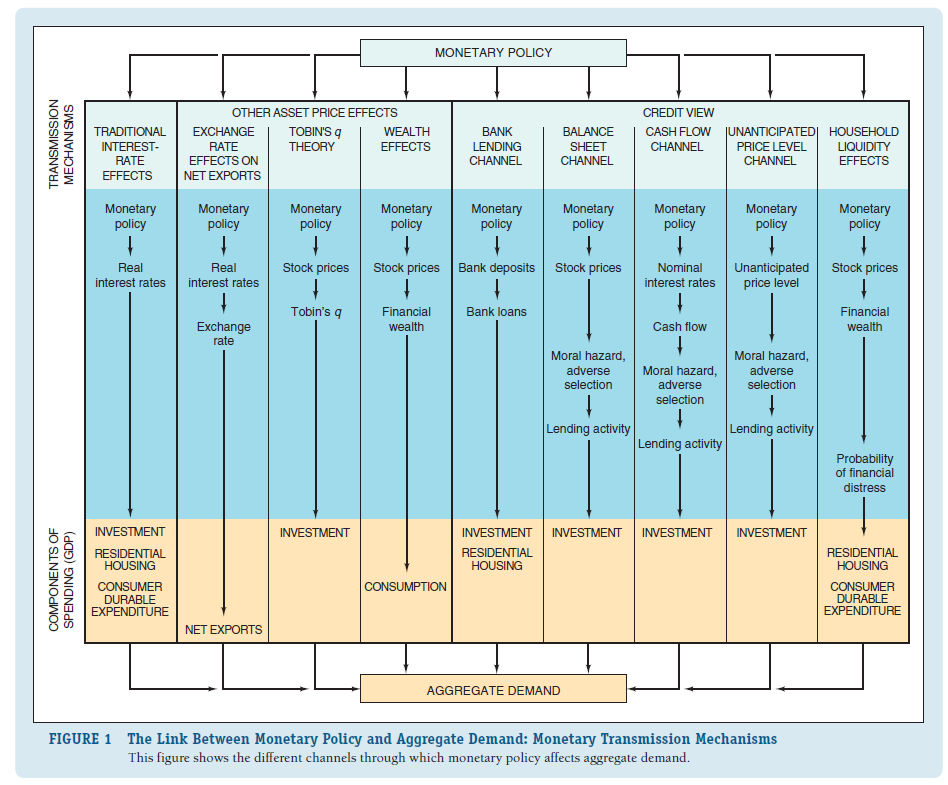

Figure 1 shows the relationship between estimated real interest rates and nominal interest rates. Go to www.martincapital.com/ and click on "U.S. Financial Data" and then "U.S. Financial Charts," then on "nominal versus real market rates" to find data showing real interest rates and nominal interest rates. When do the nominal and real interest rates give a very different picture about the tightness of monetary policy? How might this have led monetary policymakers to make mistakes if they focused entirely on nominal interest rates?

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

The Economics of Money, Banking, and Financial Markets 10th Edition by Frederic Mishkin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255