Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

Edition 4ISBN: 978-0078112898

Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

Edition 4ISBN: 978-0078112898 Exercise 6

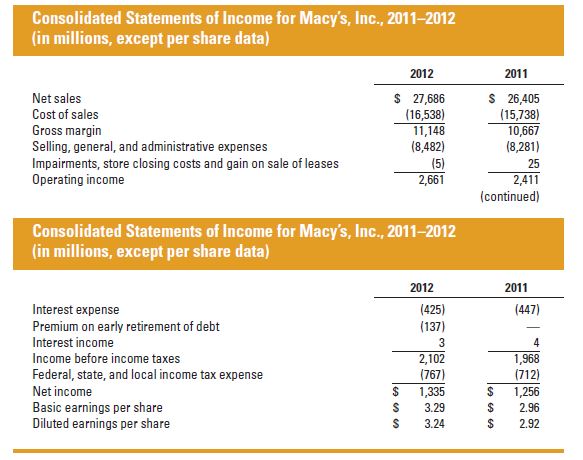

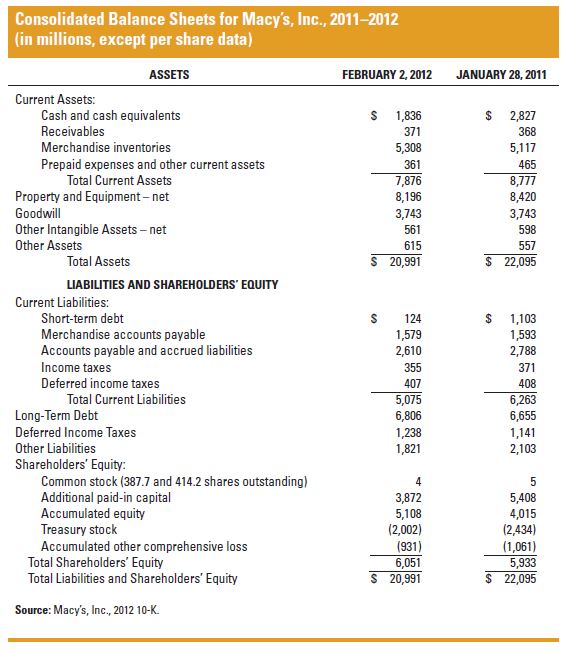

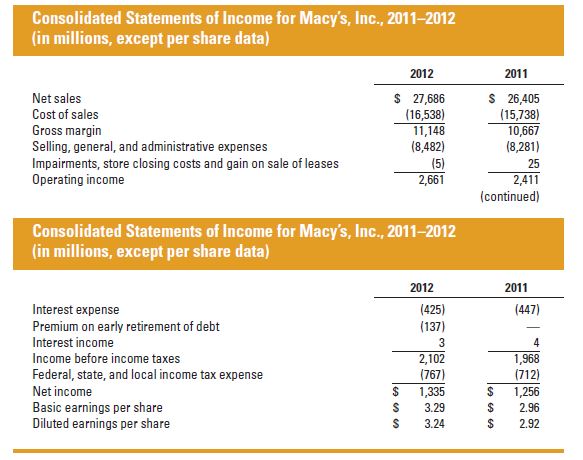

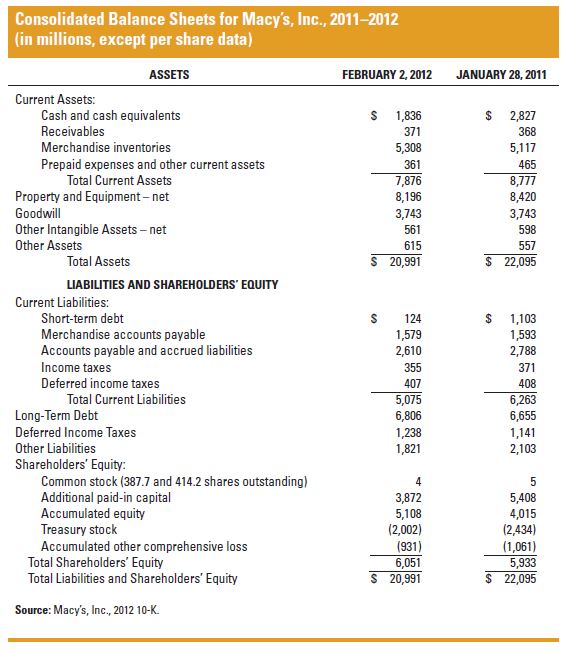

Using the financial ratios provided in the Appendix and the financial statement information for Macy's, Inc., below, calculate the following ratios for Macy's for both 2011 and 2012.

a. Gross profit margin.

b. Operating profit margin.

c. Net profit margin.

d. Times interest earned coverage.

e. Return on shareholders' equity.

f. Return on assets.

g. Debt-to-equity ratio.

h. Days of inventory.

i. Inventory turnover ratio.

j. Average collection period.

Based on these ratios, did Macy's financial performance improve, weaken, or remain about the same from 2011 to 2012?

a. Gross profit margin.

b. Operating profit margin.

c. Net profit margin.

d. Times interest earned coverage.

e. Return on shareholders' equity.

f. Return on assets.

g. Debt-to-equity ratio.

h. Days of inventory.

i. Inventory turnover ratio.

j. Average collection period.

Based on these ratios, did Macy's financial performance improve, weaken, or remain about the same from 2011 to 2012?

Explanation

The financial soundness of a company can...

Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255