Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 1

Mr. Zeman owns the mineral rights in a property in Grant County, Oklahoma. He

leases the property to Force Petroleum, reserving a 1/5 royalty. Force drills a successful

well and begins producing oil. Revenue from the first year of operations totaled $20,000

and costs of development and operation totaled $150,000. How much revenue will each

party receive? How much of the costs will each party pay?

leases the property to Force Petroleum, reserving a 1/5 royalty. Force drills a successful

well and begins producing oil. Revenue from the first year of operations totaled $20,000

and costs of development and operation totaled $150,000. How much revenue will each

party receive? How much of the costs will each party pay?

Explanation

Working interest and royalty interest

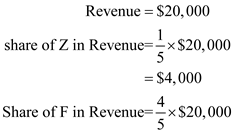

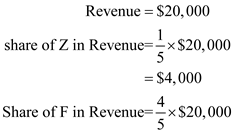

Consider this case, Z own mineral rights in G County. However he decided to lease the same to F petroleum ascertaining a royalty of 1/5. Since F started drilling and development of the well for producing the oil and incurred a cost of $150,000. Therefore the revenue being received by Z and F is shown below:

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to  and the share of F petroleum in the revenue amounts to

and the share of F petroleum in the revenue amounts to

Consider this case, Z own mineral rights in G County. However he decided to lease the same to F petroleum ascertaining a royalty of 1/5. Since F started drilling and development of the well for producing the oil and incurred a cost of $150,000. Therefore the revenue being received by Z and F is shown below:

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to  and the share of F petroleum in the revenue amounts to

and the share of F petroleum in the revenue amounts to

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255