Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 7

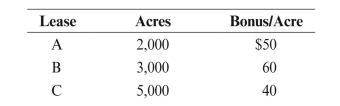

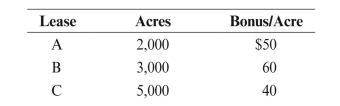

During 2015, Prosperity Oil Company acquired the following leases:  In acquiring and exploring these leases, Prosperity Oil Company incurred the following

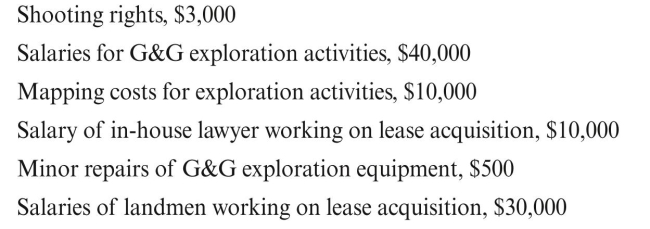

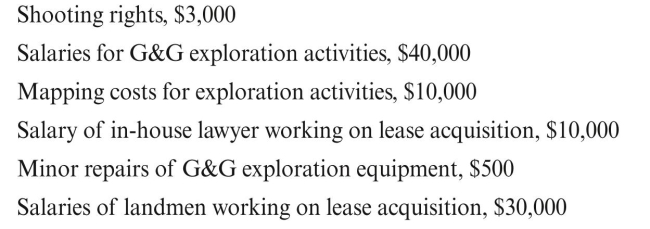

In acquiring and exploring these leases, Prosperity Oil Company incurred the following

additional costs: Prosperity Oil allocates internal costs relating to lease acquisition to specific leases.

Prosperity Oil allocates internal costs relating to lease acquisition to specific leases.

Assuming Lease A was abandoned at the end of the year, answer the following

questions:

a. What was the total nondrilling exploration expense for all three leases for the year?

b. What was the surrendered lease expense?

c. How much was capitalized as unproved property for Lease B?

Hint: Some of these costs must be allocated to the individual leases on some

reasonable basis.

In acquiring and exploring these leases, Prosperity Oil Company incurred the following

In acquiring and exploring these leases, Prosperity Oil Company incurred the followingadditional costs:

Prosperity Oil allocates internal costs relating to lease acquisition to specific leases.

Prosperity Oil allocates internal costs relating to lease acquisition to specific leases.Assuming Lease A was abandoned at the end of the year, answer the following

questions:

a. What was the total nondrilling exploration expense for all three leases for the year?

b. What was the surrendered lease expense?

c. How much was capitalized as unproved property for Lease B?

Hint: Some of these costs must be allocated to the individual leases on some

reasonable basis.

Explanation

P Oil Company acquired lease A B and C. ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255