Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 9

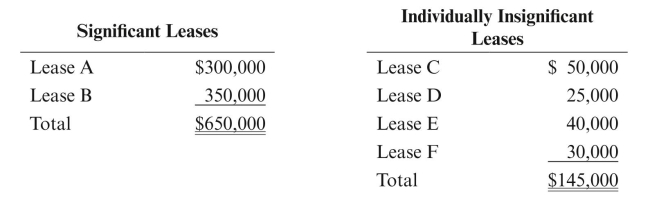

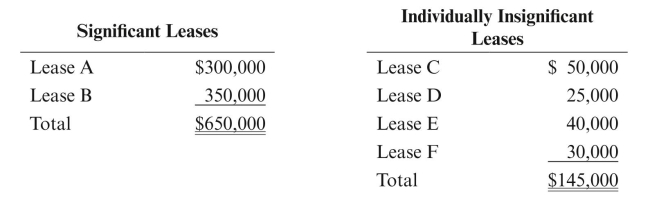

Railway Oil and Gas Company owned the following unproved property as of the end

of 2010: Although no activity took place on Lease A during the year, Railway decided that

Although no activity took place on Lease A during the year, Railway decided that

Lease A was not impaired, because there were still three years left in that lease's

primary term. Two dry holes were drilled on Lease B during the year; but because

Railway intended to drill one more well on Lease B in the coming year, it decided that

Lease B was only 40% impaired. With respect to the individually insignificant leases,

past experience indicates that 70% of all unproved properties assessed on a group basis

will eventually be abandoned. Railway's policy is to provide at year-end an allowance

equal to 70% of the gross cost of these properties. The allowance account had a

balance of $20,000 at year-end. Give the entries to record impairment.

of 2010:

Although no activity took place on Lease A during the year, Railway decided that

Although no activity took place on Lease A during the year, Railway decided thatLease A was not impaired, because there were still three years left in that lease's

primary term. Two dry holes were drilled on Lease B during the year; but because

Railway intended to drill one more well on Lease B in the coming year, it decided that

Lease B was only 40% impaired. With respect to the individually insignificant leases,

past experience indicates that 70% of all unproved properties assessed on a group basis

will eventually be abandoned. Railway's policy is to provide at year-end an allowance

equal to 70% of the gross cost of these properties. The allowance account had a

balance of $20,000 at year-end. Give the entries to record impairment.

Explanation

R Oil and Gas Company owned unproved pro...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255