Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 14

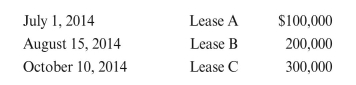

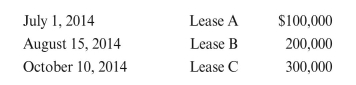

Critic Oil Company purchased three leases as follows:  All the leases are classified as individually significant.

All the leases are classified as individually significant.

a. On December 31, 2014, Lease A is determined to be 25% impaired. Lease B and

Lease C are not impaired.

b. On December 31, 2015, Lease A is determined to be impaired a total of 75%, and

Lease C, 60%. Lease B is not impaired.

c. On December 31, 2016, Lease A is considered to be 100% impaired and is

abandoned. Lease B is 30% impaired, and a well on Lease C found proved reserves.

Prepare journal entries for all of the transactions except the initial purchase.

All the leases are classified as individually significant.

All the leases are classified as individually significant.a. On December 31, 2014, Lease A is determined to be 25% impaired. Lease B and

Lease C are not impaired.

b. On December 31, 2015, Lease A is determined to be impaired a total of 75%, and

Lease C, 60%. Lease B is not impaired.

c. On December 31, 2016, Lease A is considered to be 100% impaired and is

abandoned. Lease B is 30% impaired, and a well on Lease C found proved reserves.

Prepare journal entries for all of the transactions except the initial purchase.

Explanation

a.Lease A determined to be impaired by 2...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255