Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 25

Optimistic Oil Company incurred the following costs during the years 2016 and 2017:

2016

a. Contracted and paid $50,000 for G&G surveys during the year.

b. Leased acreage in four areas as follows:

1) Williams lease-500 acres @ $50 per acre bonus; other acquisition costs, $2,000

2) Van Dolah lease-800 acres @ $100 per acre bonus; other acquisition costs,

$3,000"

3) Sauer lease-200 acres @ $60 per acre bonus; other acquisition costs, $500

4) Raupe lease-600 acres @ $30 per acre bonus; other acquisition costs, $800

Each lease had a delay rental clause requiring payment of $2 per acre if drilling

was not commenced by the end of one year. Also, each of the above leases was

considered individually significant.

c. The company also leased 10 individual tracts for a total consideration of

$60,000. The tracts are considered to be individually insignificant and are the first

insignificant unproved properties acquired by Optimistic.

d. The company incurred $1,000 in costs to maintain lease and land records in 2016.

Also, costs of $8,000 were incurred to successfully defend a title suit concerning the

Williams lease.

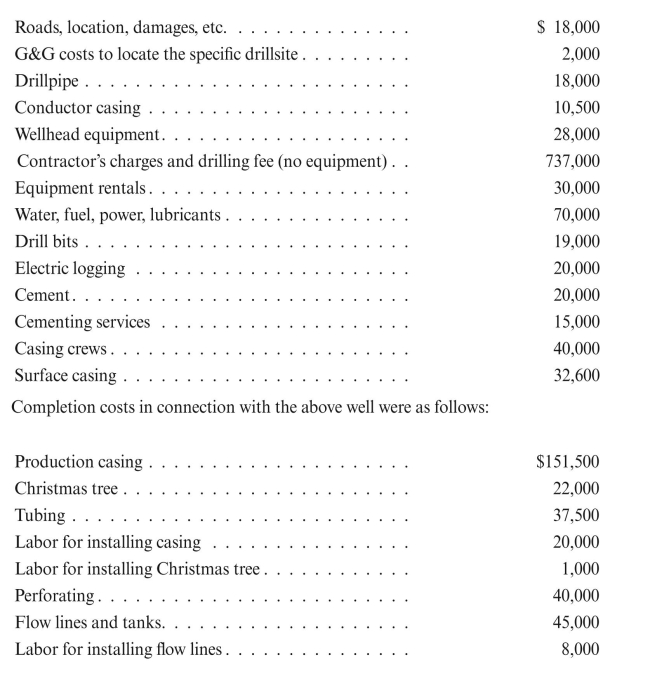

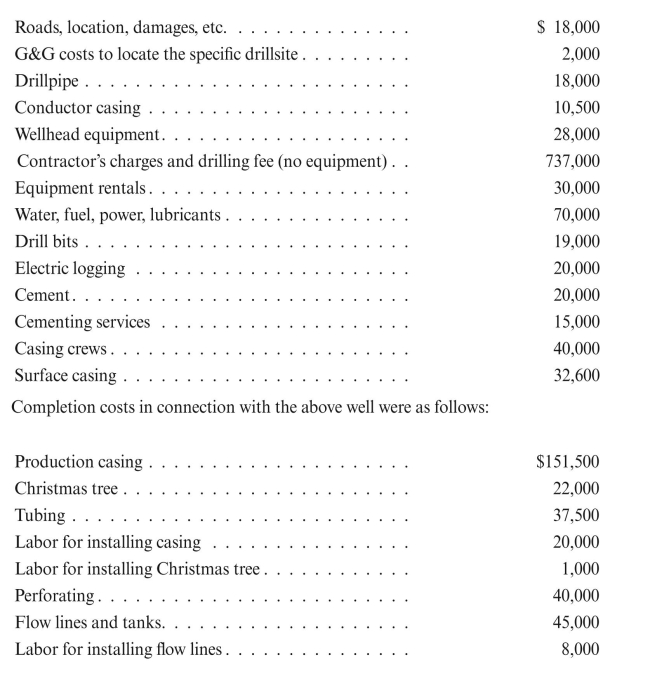

e. During 2016, the company incurred the following costs in connection with the

Williams lease when drilling an exploratory well: f. An exploratory well was drilled on the Van Dolah lease in 2016 on a turnkey basis

f. An exploratory well was drilled on the Van Dolah lease in 2016 on a turnkey basis

to 9,000 feet. The contractor's charge was $300,000, which included $40,000 for

casing. At the end of 2016, a decision had not been made to complete or abandon

the well. Both criteria for delaying classification of the well were met.

g. At the end of 2016, the Raupe lease was impaired by 40%, and the Sauer lease by

20%. The company has a policy of maintaining an allowance for impairment equal

to 60% of individually insignificant leases.

2017

a. Delay rentals were paid on the Sauer and Raupe leases.

b. Late in 2017, the company abandoned the Sauer lease and two of the individually

insignificant leases, which cost a total of $8,000 when acquired. The Raupe lease is

now considered to be a very valuable lease, because a large producer was found on

adjacent property.

c. At year-end, the company still could not decide whether to complete or abandon

the well on the Van Dolah lease, and both criteria for delaying classification of the

well were no longer met.

Prepare journal entries for the Optimistic Oil Company's transactions."

2016

a. Contracted and paid $50,000 for G&G surveys during the year.

b. Leased acreage in four areas as follows:

1) Williams lease-500 acres @ $50 per acre bonus; other acquisition costs, $2,000

2) Van Dolah lease-800 acres @ $100 per acre bonus; other acquisition costs,

$3,000"

3) Sauer lease-200 acres @ $60 per acre bonus; other acquisition costs, $500

4) Raupe lease-600 acres @ $30 per acre bonus; other acquisition costs, $800

Each lease had a delay rental clause requiring payment of $2 per acre if drilling

was not commenced by the end of one year. Also, each of the above leases was

considered individually significant.

c. The company also leased 10 individual tracts for a total consideration of

$60,000. The tracts are considered to be individually insignificant and are the first

insignificant unproved properties acquired by Optimistic.

d. The company incurred $1,000 in costs to maintain lease and land records in 2016.

Also, costs of $8,000 were incurred to successfully defend a title suit concerning the

Williams lease.

e. During 2016, the company incurred the following costs in connection with the

Williams lease when drilling an exploratory well:

f. An exploratory well was drilled on the Van Dolah lease in 2016 on a turnkey basis

f. An exploratory well was drilled on the Van Dolah lease in 2016 on a turnkey basisto 9,000 feet. The contractor's charge was $300,000, which included $40,000 for

casing. At the end of 2016, a decision had not been made to complete or abandon

the well. Both criteria for delaying classification of the well were met.

g. At the end of 2016, the Raupe lease was impaired by 40%, and the Sauer lease by

20%. The company has a policy of maintaining an allowance for impairment equal

to 60% of individually insignificant leases.

2017

a. Delay rentals were paid on the Sauer and Raupe leases.

b. Late in 2017, the company abandoned the Sauer lease and two of the individually

insignificant leases, which cost a total of $8,000 when acquired. The Raupe lease is

now considered to be a very valuable lease, because a large producer was found on

adjacent property.

c. At year-end, the company still could not decide whether to complete or abandon

the well on the Van Dolah lease, and both criteria for delaying classification of the

well were no longer met.

Prepare journal entries for the Optimistic Oil Company's transactions."

Explanation

O Oil Company incurred following costs d...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255