Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 2

During 2015, O'Neal Corporation incurred the following costs in connection with the

Batch lease:

a. Acquired the 800 acre Batch lease at a lease bonus of $70 per acre and other

acquisition costs of $10,000.

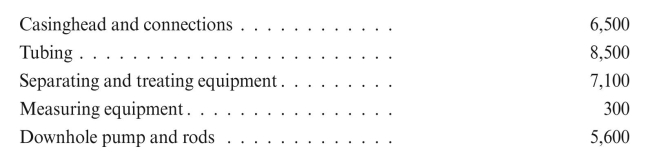

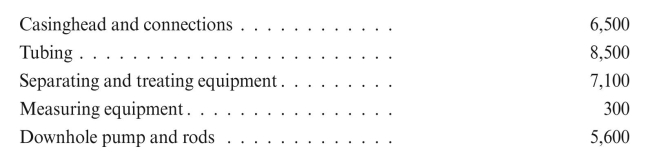

b. Incurred the following costs in connection with Batch #1:

Record the above transactions. Hint: The type of equipment installed when the well

Record the above transactions. Hint: The type of equipment installed when the well

reached target depth indicates whether the well was successful or dry.

Batch lease:

a. Acquired the 800 acre Batch lease at a lease bonus of $70 per acre and other

acquisition costs of $10,000.

b. Incurred the following costs in connection with Batch #1:

Record the above transactions. Hint: The type of equipment installed when the well

Record the above transactions. Hint: The type of equipment installed when the wellreached target depth indicates whether the well was successful or dry.

Explanation

During year 2015, O'Neal Corporation inc...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255