Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 11

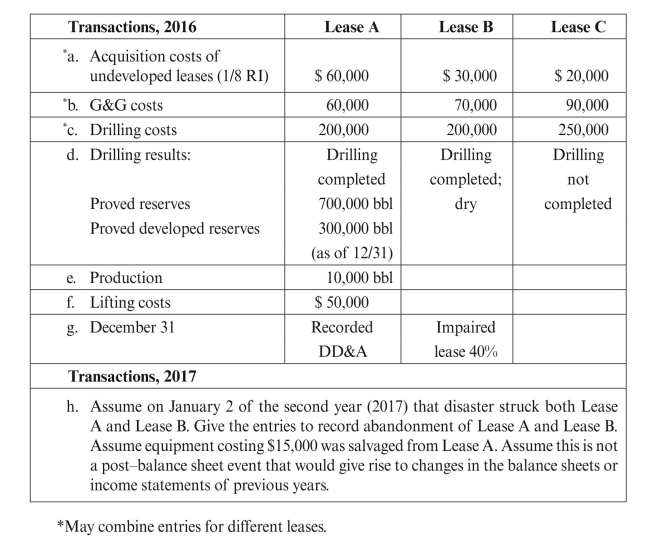

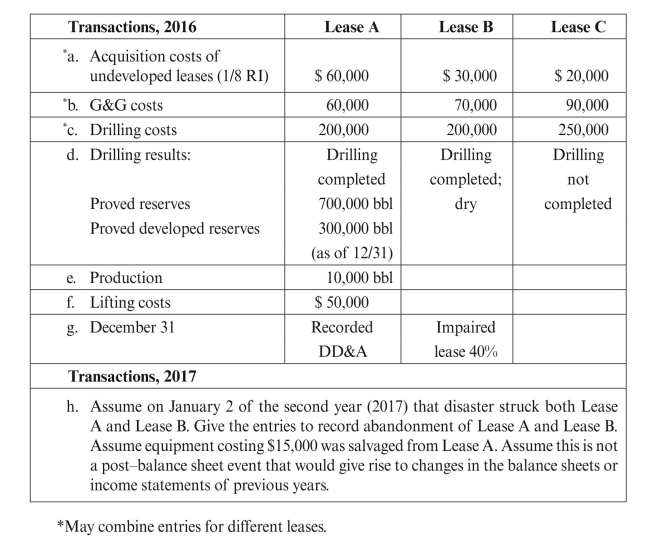

The following information as of 12/31/16 relates to the first year of operations for

Complex Oil Company. From the data, (1) prepare entries, and (2) prepare an income

statement for Complex Oil Company for 2016, assuming revenue to the company from

oil sales is $1,200,000. Expense lifting costs as lease operating expense.

Complex Oil Company. From the data, (1) prepare entries, and (2) prepare an income

statement for Complex Oil Company for 2016, assuming revenue to the company from

oil sales is $1,200,000. Expense lifting costs as lease operating expense.

Explanation

1.

Journal entry is given below: - Unp...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255