Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 13

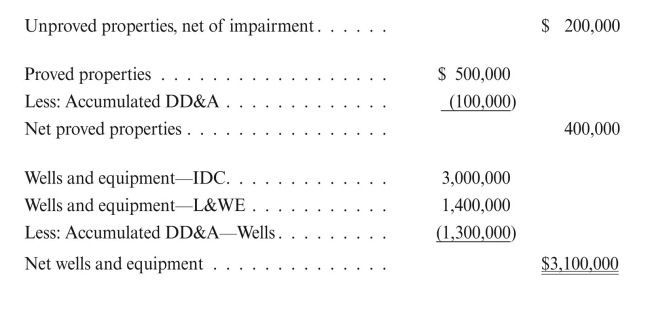

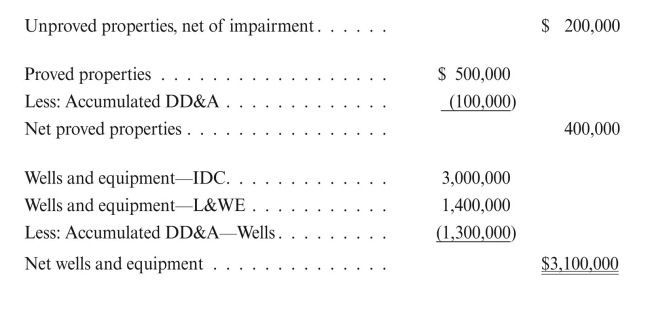

Dwight Oil Company computes DD&A on a fieldwide basis. Balance sheet data as of

12/31/15 for Dwight's Anadarko Basin field are as follows:

REqUIRED: Using BOE:

REqUIRED: Using BOE:

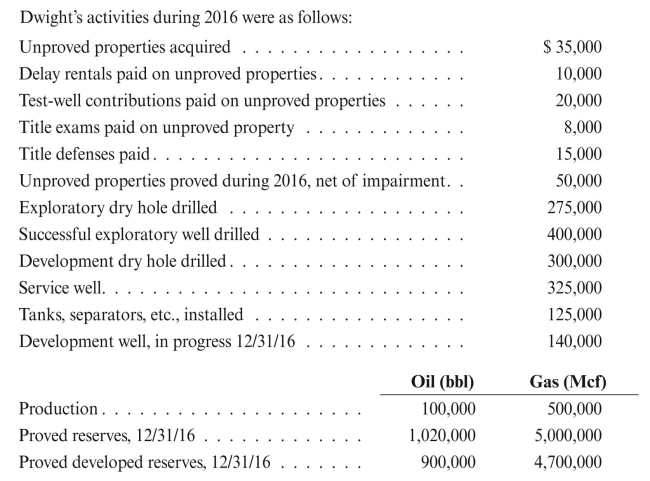

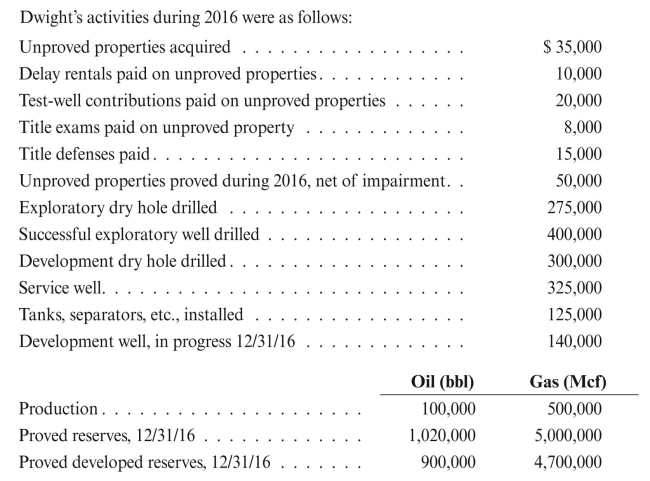

a. Calculate DD&A for 2016.

b. Calculate DD&A for 2016, assuming that part of the field, a proved property with

gross acquisition costs of $30,000, gross equipment cost of $70,000, and gross IDC

of $215,000, was abandoned during 2016.

12/31/15 for Dwight's Anadarko Basin field are as follows:

REqUIRED: Using BOE:

REqUIRED: Using BOE:a. Calculate DD&A for 2016.

b. Calculate DD&A for 2016, assuming that part of the field, a proved property with

gross acquisition costs of $30,000, gross equipment cost of $70,000, and gross IDC

of $215,000, was abandoned during 2016.

Explanation

Depreciation

DD and A stands for deprec...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255