Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 14

Tadpole Oil Company has the working interest in a fully developed lease located in

Texas. As of 12/31/17, the lease had proved developed reserves of 1,200,000 barrels

and unrecovered costs of $12,000,000. During the third quarter of 2018, a new reserve

study was received that estimated proved developed reserves of 1,500,000 barrels as of

August 1, 2018.

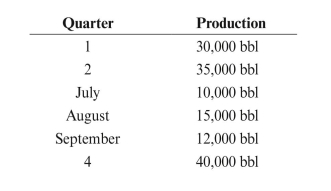

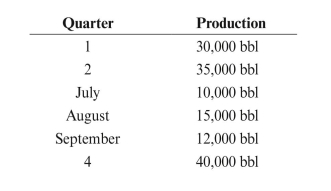

Calculate DD&A for each quarter, assuming the following production and using the

first method illustrated in the chapter.

Texas. As of 12/31/17, the lease had proved developed reserves of 1,200,000 barrels

and unrecovered costs of $12,000,000. During the third quarter of 2018, a new reserve

study was received that estimated proved developed reserves of 1,500,000 barrels as of

August 1, 2018.

Calculate DD&A for each quarter, assuming the following production and using the

first method illustrated in the chapter.

Explanation

Compute the DD A:

Reserve estimate as o...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255