Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 20

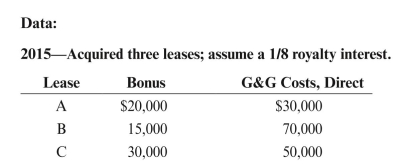

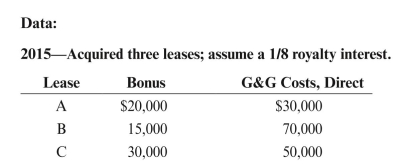

Ernest Petroleum began operations January 1, 2015. Transactions for the first three

years include the data below. Using that data:

a. Prepare journal entries assuming full cost (ignore revenue entries and assume no

exclusions from the amortization base).

b. Prepare income statements under full cost and successful efforts for all three years,

again assuming no exclusions from the full cost amortization base. Ignore severance

tax. Assume a 1/8 royalty interest.

c. Recalculate DD&A assuming Ernest is a full cost company and that Ernest

excludes all possible costs from the amortization base.

d. Which of the journal entries given in part a above would have been different if

Ernest had been excluding all possible costs from the amortization base rather than

including all costs? 2016

2016

1) A delay rental of $2,000 is paid for Lease B.

2) A delay rental of $4,000 is paid for Lease A.

3) Drilling costs of $120,000 are paid on Lease C. Proved reserves are found and

estimated to be 200,000 total gross barrels, and proved developed reserves are

estimated to be 70,000 total gross barrels as of December 31, 2016. During 2016,

20,000 total gross barrels of oil are produced and sold. Lifting costs are $15/bbl,

and the selling price is $65/bbl. (Expense lifting costs as lease operating expense.)

Future development costs are estimated to be $100,000.

2017"

1) Lease B is surrendered.

2) A dry hole is drilled on Lease A at a cost of $250,000. As a result, Ernest feels that

Lease A is worth only 1/4 of the amount capitalized as unproved property. (Note:

successful efforts and full cost impairment amounts will be different.)"

3) An additional well (development) is drilled on Lease C at a cost of $300,000.

Proved reserves at 12/31/17 are estimated to be 230,000 total gross barrels, and

proved developed reserves are estimated to be 90,000 total gross barrels.

During 2017, 25,000 total gross barrels of oil are produced and sold for $70/bbl. Lifting

costs are $14/bbl. Future development costs are estimated to be $150,000."

years include the data below. Using that data:

a. Prepare journal entries assuming full cost (ignore revenue entries and assume no

exclusions from the amortization base).

b. Prepare income statements under full cost and successful efforts for all three years,

again assuming no exclusions from the full cost amortization base. Ignore severance

tax. Assume a 1/8 royalty interest.

c. Recalculate DD&A assuming Ernest is a full cost company and that Ernest

excludes all possible costs from the amortization base.

d. Which of the journal entries given in part a above would have been different if

Ernest had been excluding all possible costs from the amortization base rather than

including all costs?

2016

20161) A delay rental of $2,000 is paid for Lease B.

2) A delay rental of $4,000 is paid for Lease A.

3) Drilling costs of $120,000 are paid on Lease C. Proved reserves are found and

estimated to be 200,000 total gross barrels, and proved developed reserves are

estimated to be 70,000 total gross barrels as of December 31, 2016. During 2016,

20,000 total gross barrels of oil are produced and sold. Lifting costs are $15/bbl,

and the selling price is $65/bbl. (Expense lifting costs as lease operating expense.)

Future development costs are estimated to be $100,000.

2017"

1) Lease B is surrendered.

2) A dry hole is drilled on Lease A at a cost of $250,000. As a result, Ernest feels that

Lease A is worth only 1/4 of the amount capitalized as unproved property. (Note:

successful efforts and full cost impairment amounts will be different.)"

3) An additional well (development) is drilled on Lease C at a cost of $300,000.

Proved reserves at 12/31/17 are estimated to be 230,000 total gross barrels, and

proved developed reserves are estimated to be 90,000 total gross barrels.

During 2017, 25,000 total gross barrels of oil are produced and sold for $70/bbl. Lifting

costs are $14/bbl. Future development costs are estimated to be $150,000."

Explanation

E Petroleum began operation in January 1...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255