Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 24

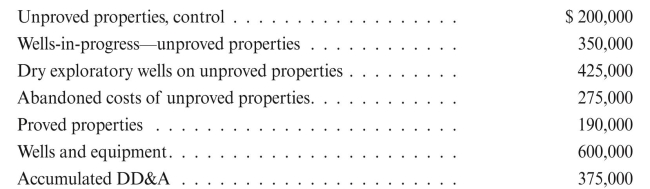

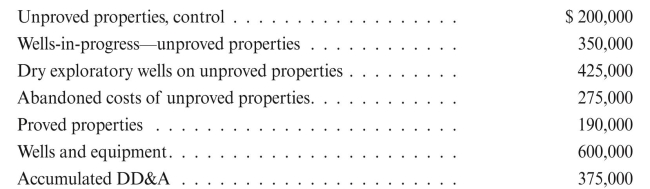

Data as of 12/31/15 for Dry Hole Oil Company's U.S. properties are as follows:

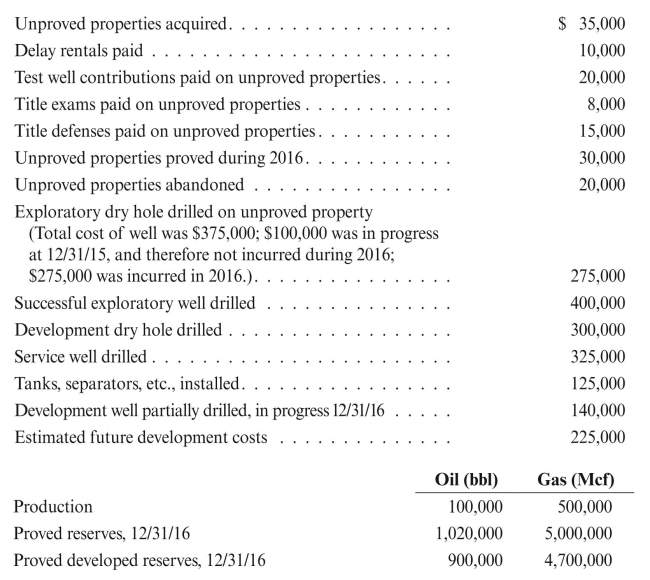

(This problem is similar to problem 14 in chapter 6.) Dry Hole's activities during 2016 were as follows:

Dry Hole's activities during 2016 were as follows:  a. Use T-accounts to accumulate costs.

a. Use T-accounts to accumulate costs.

b. Calculate DD&A for 2016, assuming no cost exclusions and using a common unit

of measure based on BOE.

c. Calculate DD&A for 2016, assuming all possible cost exclusions and using a common

unit of measure based on BOE. In addition, assume impairment for unproved

properties was $75,000 and the allowance for impairment was $25,000 at 12/31/16.

(This problem is similar to problem 14 in chapter 6.)

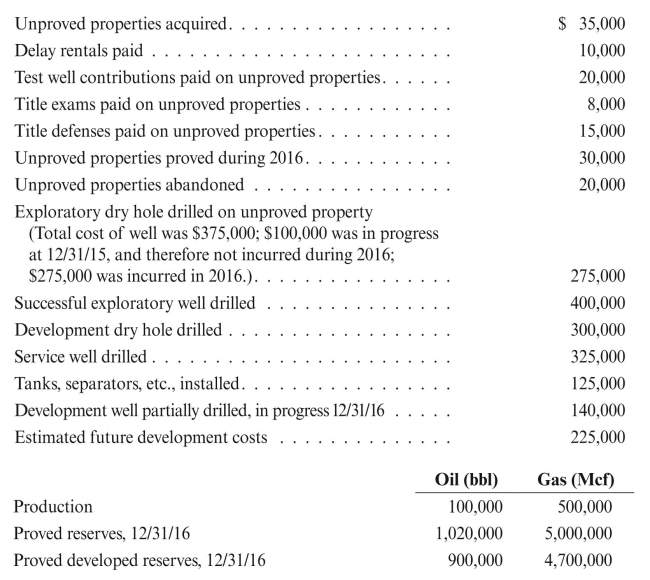

Dry Hole's activities during 2016 were as follows:

Dry Hole's activities during 2016 were as follows:  a. Use T-accounts to accumulate costs.

a. Use T-accounts to accumulate costs.b. Calculate DD&A for 2016, assuming no cost exclusions and using a common unit

of measure based on BOE.

c. Calculate DD&A for 2016, assuming all possible cost exclusions and using a common

unit of measure based on BOE. In addition, assume impairment for unproved

properties was $75,000 and the allowance for impairment was $25,000 at 12/31/16.

Explanation

D Oil Company's U.S. properties showing ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255