Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 25

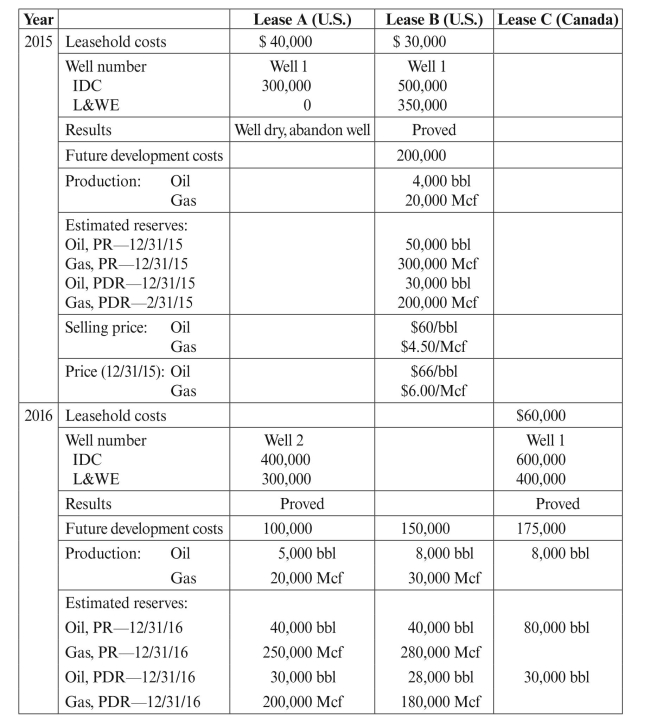

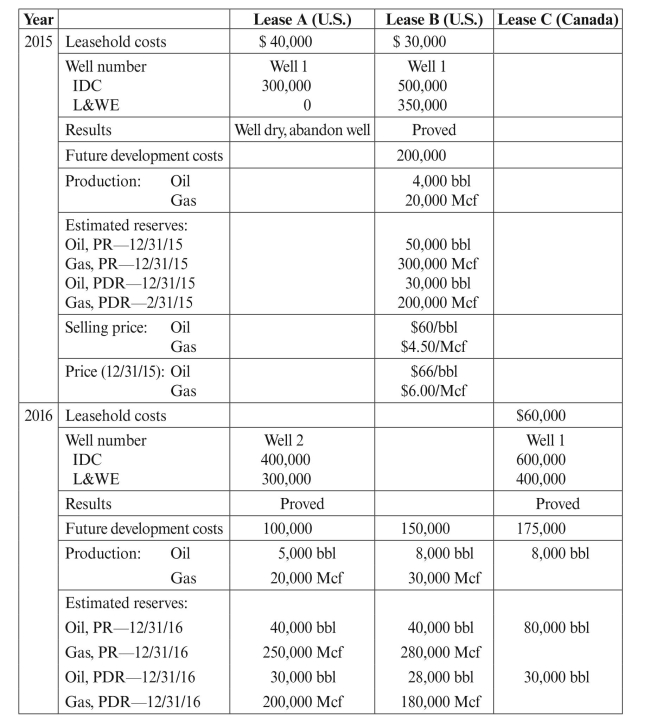

Core Petroleum started its oil and gas exploration and production business in 2015.

During the years 2015 and 2016, the company provided the following information

relating to leases located both in the United States and in Canada: a. Record the above information for both years. Ignore revenue entries.

a. Record the above information for both years. Ignore revenue entries.

b. Compute and record DD&A for both years. Assume the revenue method may

be ignored in the second year. If there is not a significant difference between the

revenue basis and energy basis in the first year (less than $150,000), use the energy

basis (equivalent Mcf). Assume that all possible costs are included in DD&A.

c. Compute DD&A using a common unit of measure based on Mcf, assuming Core

Oil Company used successful efforts accounting instead of full cost accounting.

During the years 2015 and 2016, the company provided the following information

relating to leases located both in the United States and in Canada:

a. Record the above information for both years. Ignore revenue entries.

a. Record the above information for both years. Ignore revenue entries.b. Compute and record DD&A for both years. Assume the revenue method may

be ignored in the second year. If there is not a significant difference between the

revenue basis and energy basis in the first year (less than $150,000), use the energy

basis (equivalent Mcf). Assume that all possible costs are included in DD&A.

c. Compute DD&A using a common unit of measure based on Mcf, assuming Core

Oil Company used successful efforts accounting instead of full cost accounting.

Explanation

C Petroleum started oil and gas explorat...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255