Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 2

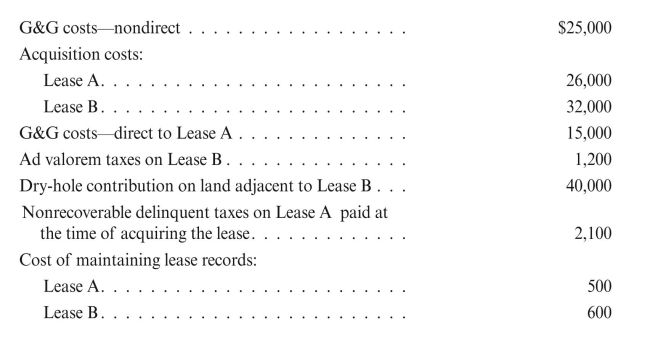

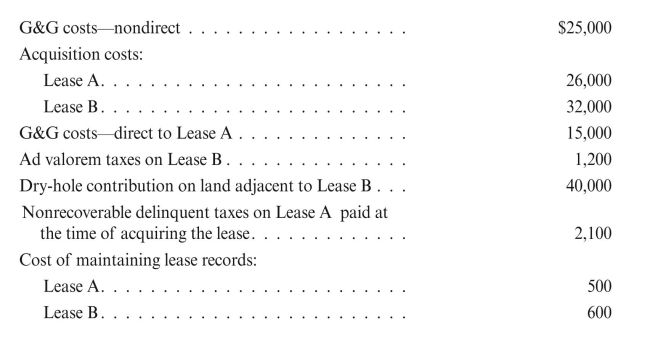

Virginia Oil Corporation, a full cost company, incurs the following costs during 2016:  During 2017, the following costs were incurred:

During 2017, the following costs were incurred:

Delay rentals were paid on Lease A, $2,000, and Lease B, $3,000.

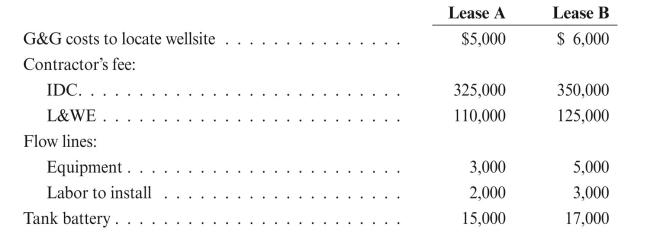

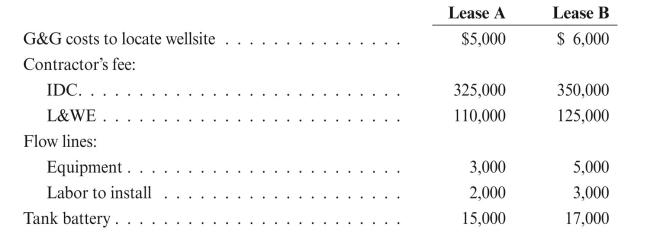

In the latter half of 2017, drilling operations were commenced on both leases, and costs

were incurred as follows: REqUIRED: Record the above transactions.

REqUIRED: Record the above transactions.

During 2017, the following costs were incurred:

During 2017, the following costs were incurred:Delay rentals were paid on Lease A, $2,000, and Lease B, $3,000.

In the latter half of 2017, drilling operations were commenced on both leases, and costs

were incurred as follows:

REqUIRED: Record the above transactions.

REqUIRED: Record the above transactions.Explanation

V Oil Corporation is following full cost...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255