Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 15

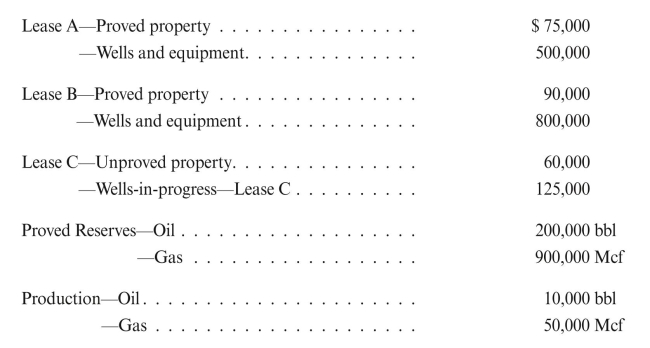

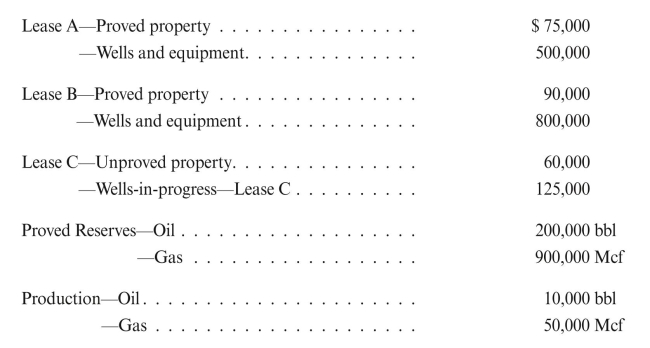

Complex Corporation started operations on 1/1/15. At 12/31/15, the company owned

the following leases in Canada: The production was sold at $70/bbl and $5.50/Mcf. Current prices at 12/31/15 are $75/

The production was sold at $70/bbl and $5.50/Mcf. Current prices at 12/31/15 are $75/

bbl and $6.00/Mcf.

Compute DD&A for Canada, assuming the following:

a. No exclusions from the amortization base, and using unit-of-production converted

to a common unit of measure based on energy (equivalent Mcf).

b. No exclusions from the amortization base, and using unit-of-revenue method.

c. All possible costs are excluded from amortization, and using a common unit of

measure based on energy (equivalent Mcf).

d. All possible costs are excluded from amortization, and using

unit-of-revenue method.

the following leases in Canada:

The production was sold at $70/bbl and $5.50/Mcf. Current prices at 12/31/15 are $75/

The production was sold at $70/bbl and $5.50/Mcf. Current prices at 12/31/15 are $75/bbl and $6.00/Mcf.

Compute DD&A for Canada, assuming the following:

a. No exclusions from the amortization base, and using unit-of-production converted

to a common unit of measure based on energy (equivalent Mcf).

b. No exclusions from the amortization base, and using unit-of-revenue method.

c. All possible costs are excluded from amortization, and using a common unit of

measure based on energy (equivalent Mcf).

d. All possible costs are excluded from amortization, and using

unit-of-revenue method.

Explanation

C Corporation started operation on 01-01...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255