Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 2

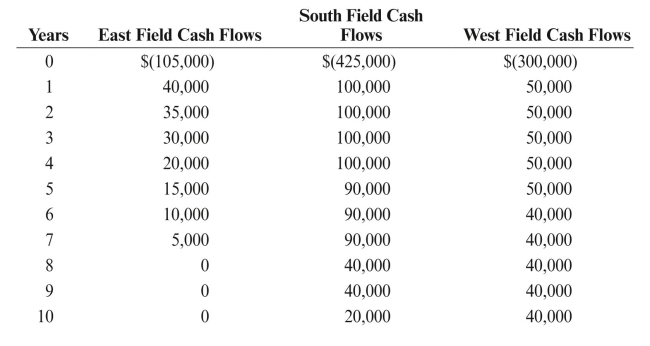

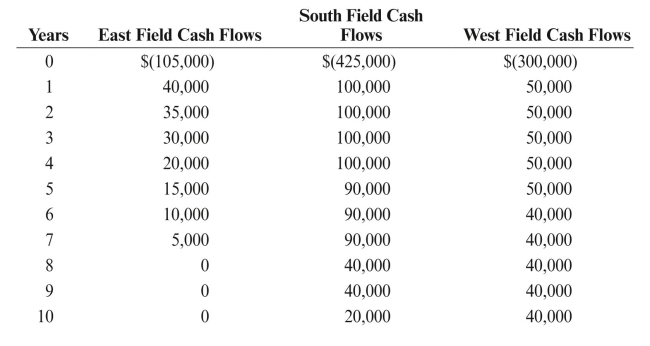

Polecat Corporation is considering beginning drilling operations in three separate fields.

Polecat decides to analyze these fields using a 13% discount rate. The estimated cash

flows for each field are as follows: REqUIRED:

REqUIRED:

a. Calculate the net present value of each field

b. Calculate the profitability index of each field.

c. Determine the internal rate of return of each field.

d. Rank the fields from best investment to worst investment.

Polecat decides to analyze these fields using a 13% discount rate. The estimated cash

flows for each field are as follows:

REqUIRED:

REqUIRED:a. Calculate the net present value of each field

b. Calculate the profitability index of each field.

c. Determine the internal rate of return of each field.

d. Rank the fields from best investment to worst investment.

Explanation

a.The NPV of each field -

b.The profi...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255