Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 13

Problem 10 is the same as problem 9 with respect to initial measurement of the ARO

liability. Now assume that Ameritec's credit standing improves over time, causing the

credit-adjusted risk-free rate to decrease by 1% to 9% at December 31, 2016.

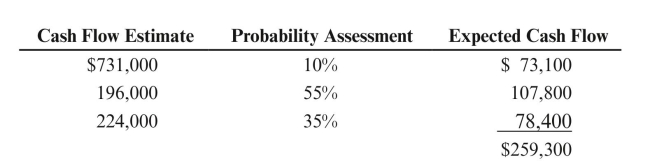

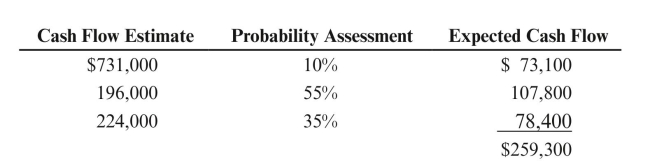

On December 31, 2016, Ameritec revises its estimate of labor costs and revised the

probability assessments related to those labor costs. The change in labor costs results

in an upward revision to the undiscounted cash flows. Consequently, the incremental

cash flows are discounted at the current rate of 9%. All other assumptions remain

unchanged. The revised estimate of expected cash flows for labor costs is as follows: REqUIRED:

REqUIRED:

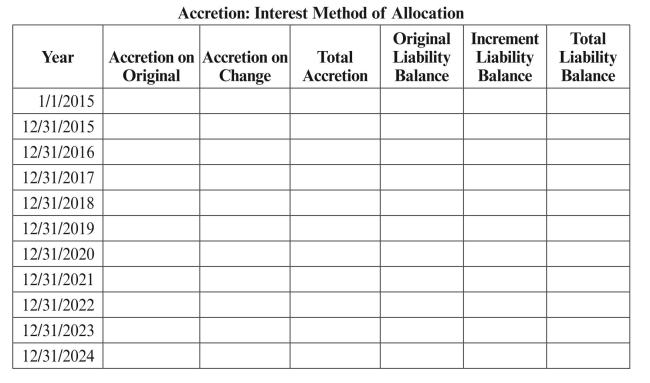

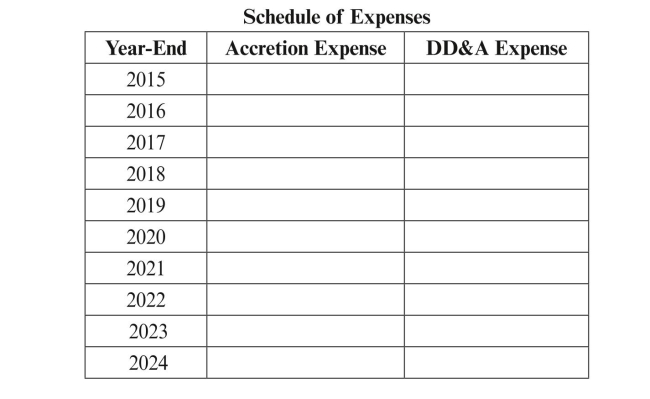

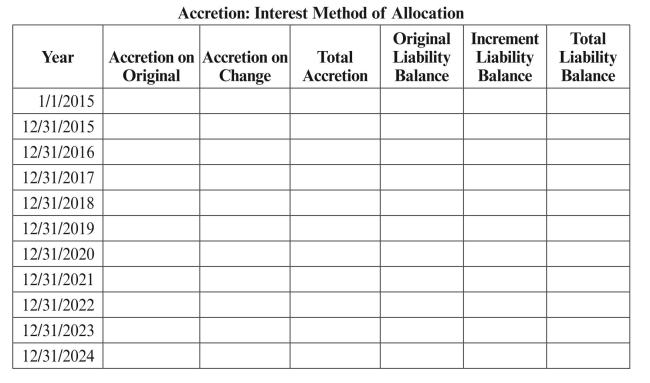

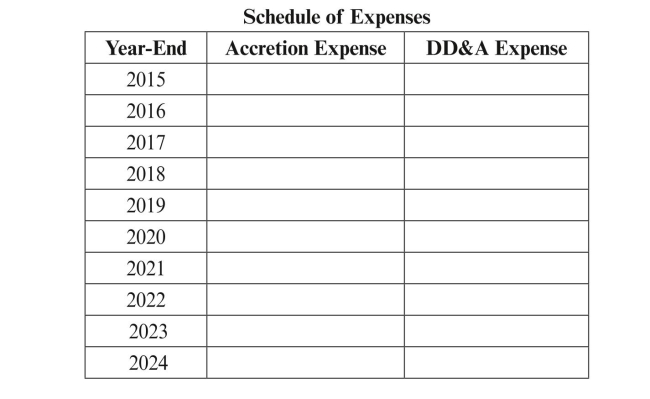

a. Complete the following tables:

b. Prepare the journal entry that would be made on January 1, 2015 to record the asset

b. Prepare the journal entry that would be made on January 1, 2015 to record the asset

retirement obligation.

c. Prepare the journal entries that would be made on December 31, 2015 and December

31, 2016 to record the accretion expense and the DD&A expense related to the ARO.

d. Prepare the journal entries that would be required at December 31, 2016 to record

the revision in the asset retirement obligation.

e. Prepare the journal entries that would be made from December 31, 2017 to

December 31, 2024 to record the accretion expense and the DD&A expense.

f. On December 31, 2024, Ameritec settles its asset retirement obligation by using

an outside contractor. It incurs costs of $800,000. Prepare the journal entries

that would be made on December 31, 2024 to record the settlement of the asset

retirement obligation.

liability. Now assume that Ameritec's credit standing improves over time, causing the

credit-adjusted risk-free rate to decrease by 1% to 9% at December 31, 2016.

On December 31, 2016, Ameritec revises its estimate of labor costs and revised the

probability assessments related to those labor costs. The change in labor costs results

in an upward revision to the undiscounted cash flows. Consequently, the incremental

cash flows are discounted at the current rate of 9%. All other assumptions remain

unchanged. The revised estimate of expected cash flows for labor costs is as follows:

REqUIRED:

REqUIRED:a. Complete the following tables:

b. Prepare the journal entry that would be made on January 1, 2015 to record the asset

b. Prepare the journal entry that would be made on January 1, 2015 to record the assetretirement obligation.

c. Prepare the journal entries that would be made on December 31, 2015 and December

31, 2016 to record the accretion expense and the DD&A expense related to the ARO.

d. Prepare the journal entries that would be required at December 31, 2016 to record

the revision in the asset retirement obligation.

e. Prepare the journal entries that would be made from December 31, 2017 to

December 31, 2024 to record the accretion expense and the DD&A expense.

f. On December 31, 2024, Ameritec settles its asset retirement obligation by using

an outside contractor. It incurs costs of $800,000. Prepare the journal entries

that would be made on December 31, 2024 to record the settlement of the asset

retirement obligation.

Explanation

Interpreting of Cash flows:-

The balanc...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255