Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 15

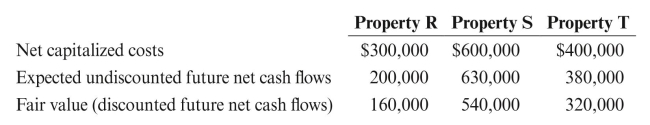

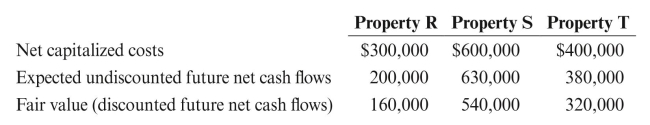

Duncan Oil Company, a successful efforts company, has capitalized costs on Property

R, Property S, and Property T as of 12/31/2017 as follows: Duncan has no other capitalized costs. The properties are located in different regions

Duncan has no other capitalized costs. The properties are located in different regions

in Venezuela.

REqUIRED: If necessary, test the assets for impairment and make any necessary

journal entries, assuming production costs tripled late in the year on all three properties

and that production costs are not expected to decrease.

R, Property S, and Property T as of 12/31/2017 as follows:

Duncan has no other capitalized costs. The properties are located in different regions

Duncan has no other capitalized costs. The properties are located in different regionsin Venezuela.

REqUIRED: If necessary, test the assets for impairment and make any necessary

journal entries, assuming production costs tripled late in the year on all three properties

and that production costs are not expected to decrease.

Explanation

If the expected undiscounted future net ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255