Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 16

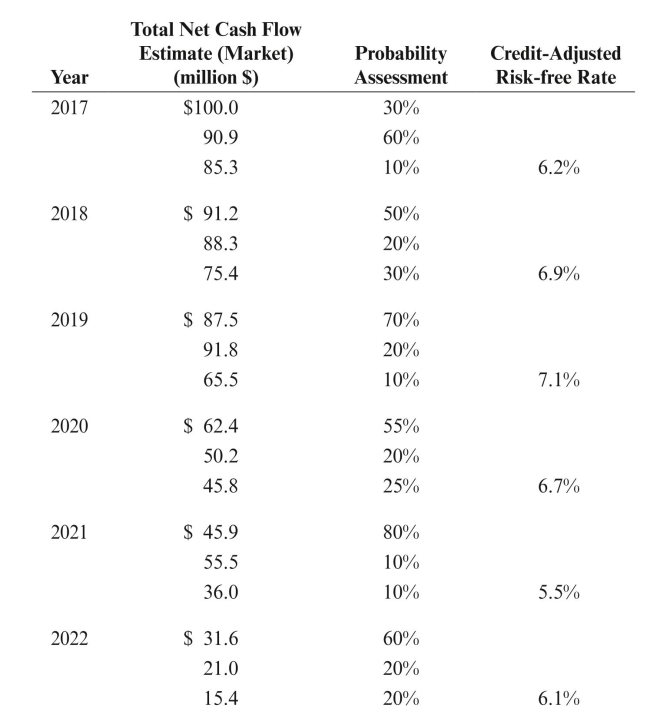

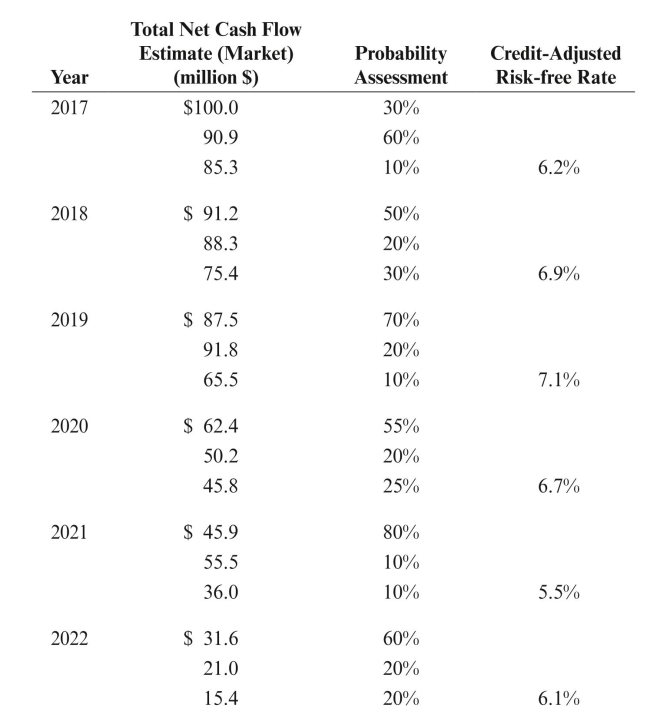

Ellis Company, a successful efforts company, has 100% of the working interest in a field

in Texas. The field constitutes a cost center and is also an asset group for purposes of

testing for impairment. In 2016, the price of oil dropped significantly; therefore, Ellis

must test for impairment. The table below reflects Ellis's latest expected cash flows and

risk-free rates for the remainder of the life of the field. REqUIRED:

REqUIRED:

a. Assume that Ellis's carrying value for the field is $300 million. Determine whether

Ellis must book impairment and, if so, record the necessary journal entry. Round

the present value factors to four decimal places.

b. Assume that Ellis's carrying value for the field is $400 million. Determine whether

Ellis must book impairment and, if so, record the necessary journal entry. Round

the present value factors to four decimal places.

in Texas. The field constitutes a cost center and is also an asset group for purposes of

testing for impairment. In 2016, the price of oil dropped significantly; therefore, Ellis

must test for impairment. The table below reflects Ellis's latest expected cash flows and

risk-free rates for the remainder of the life of the field.

REqUIRED:

REqUIRED:a. Assume that Ellis's carrying value for the field is $300 million. Determine whether

Ellis must book impairment and, if so, record the necessary journal entry. Round

the present value factors to four decimal places.

b. Assume that Ellis's carrying value for the field is $400 million. Determine whether

Ellis must book impairment and, if so, record the necessary journal entry. Round

the present value factors to four decimal places.

Explanation

(a)If the expected undiscounted future n...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255