Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 18

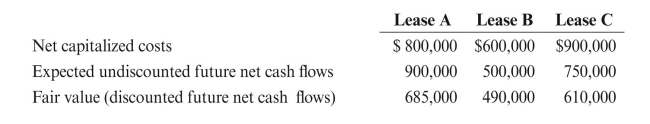

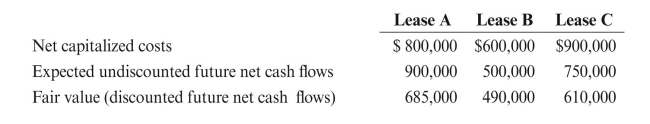

Payne Oil Corporation, a successful efforts company, has capitalized costs on three

leases as of 12/31/2013 as follows: Payne has no other capitalized costs. The leases are located in different counties

Payne has no other capitalized costs. The leases are located in different counties

in Oklahoma.

REqUIRED: If necessary, test the assets for impairment and make any necessary

journal entries assuming taxes tripled on all three leases.

leases as of 12/31/2013 as follows:

Payne has no other capitalized costs. The leases are located in different counties

Payne has no other capitalized costs. The leases are located in different countiesin Oklahoma.

REqUIRED: If necessary, test the assets for impairment and make any necessary

journal entries assuming taxes tripled on all three leases.

Explanation

If the expected undiscounted future net ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255