Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 14

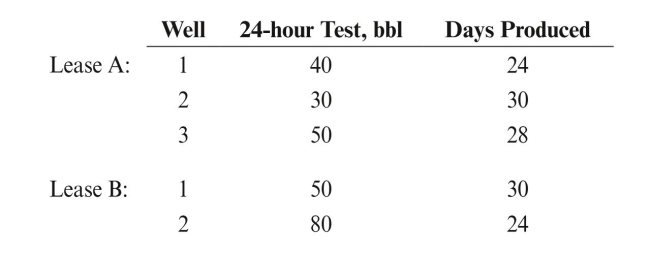

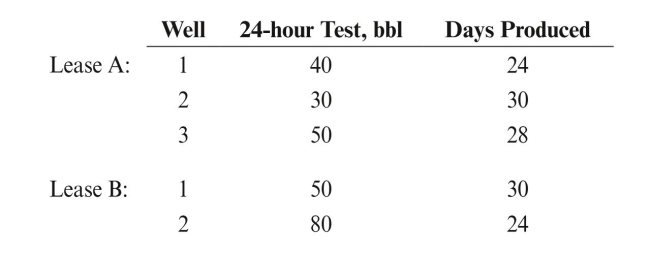

Jayhawk Oil Company's production for Lease A and Lease B is gathered into a

common system and sold. Total sales for the month are 6,562 barrels. Assume the

following data for Lease A and Lease B: Measured production is 3,300 barrels from Lease A and 3,500 barrels from Lease B.

Measured production is 3,300 barrels from Lease A and 3,500 barrels from Lease B.

REqUIRED:

a. Allocate production to each lease.

b. Allocate the amounts per lease determined in part a to the wells. Round the ratios

to four decimal places.

common system and sold. Total sales for the month are 6,562 barrels. Assume the

following data for Lease A and Lease B:

Measured production is 3,300 barrels from Lease A and 3,500 barrels from Lease B.

Measured production is 3,300 barrels from Lease A and 3,500 barrels from Lease B.REqUIRED:

a. Allocate production to each lease.

b. Allocate the amounts per lease determined in part a to the wells. Round the ratios

to four decimal places.

Explanation

JOC's production for Lease A a...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255