Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 2

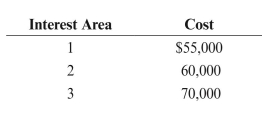

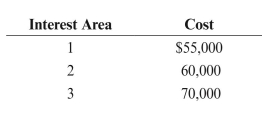

Big Tree Petroleum incurs G&G costs of $21,000 for Project Area 12. Three areas

of interest are identified. Detailed G&G is conducted on the areas of interest at the

following costs: As a result of the detailed G&G studies, the following leases were acquired:

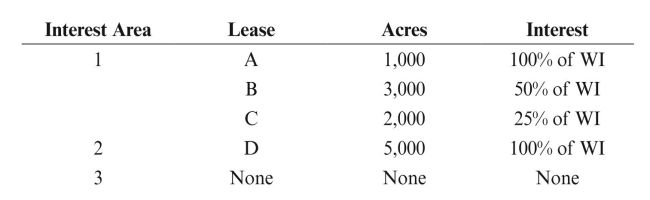

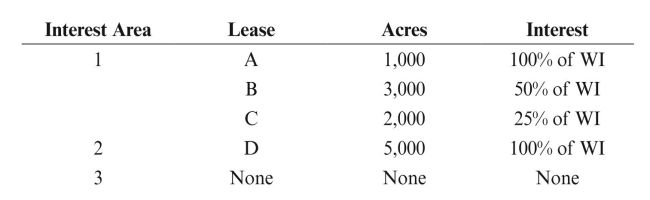

As a result of the detailed G&G studies, the following leases were acquired:  Determine the tax basis of any assets and the amount of any tax deductions.

Determine the tax basis of any assets and the amount of any tax deductions.

of interest are identified. Detailed G&G is conducted on the areas of interest at the

following costs:

As a result of the detailed G&G studies, the following leases were acquired:

As a result of the detailed G&G studies, the following leases were acquired:  Determine the tax basis of any assets and the amount of any tax deductions.

Determine the tax basis of any assets and the amount of any tax deductions.Explanation

Allocation of G G Cost in Determination ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255