Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 8

During 20XA, Core Petroleum incurred G&G costs of $20,000 for Project Area 15.

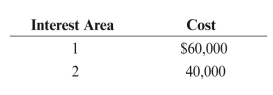

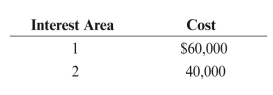

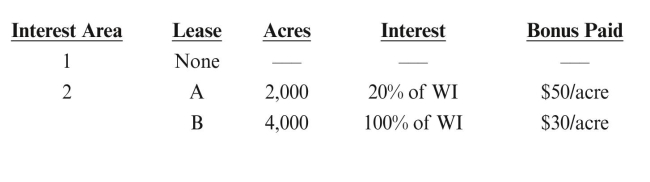

Two areas of interest were identified. Detailed seismic studies were conducted on the

areas of interests at the following costs: As a result of the detailed seismic studies, the following leases were obtained:

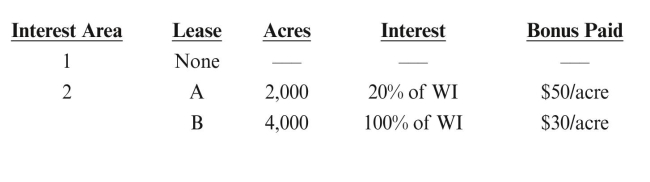

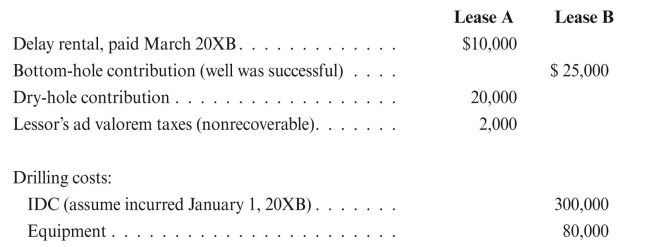

As a result of the detailed seismic studies, the following leases were obtained:  During 20XB, Core Petroleum made the following payments:

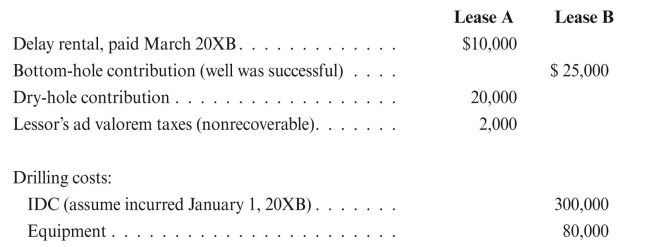

During 20XB, Core Petroleum made the following payments:  The well on Lease B was completed early in January 20XC and was successful. Core

The well on Lease B was completed early in January 20XC and was successful. Core

Petroleum's share of production from the well was 10,000 barrels of oil. All 10,000

barrels of oil were sold during 20XC. Core's share of estimated reserves at year-end was

300,000 barrels. The selling price of the oil was $60/bbl, and lifting costs were $200,000.

Lease A was abandoned in March 20XC, and Lease B was abandoned early in January

20XD. No oil was produced during 20XD.

a. Determine the tax effects for the above transactions in each year, assuming Core is

an independent producer. Ignore percentage depletion, but remember DD&A.

b. Determine any tax effects that would be different if Core were an integrated

producer rather than an independent producer.

Two areas of interest were identified. Detailed seismic studies were conducted on the

areas of interests at the following costs:

As a result of the detailed seismic studies, the following leases were obtained:

As a result of the detailed seismic studies, the following leases were obtained:  During 20XB, Core Petroleum made the following payments:

During 20XB, Core Petroleum made the following payments:  The well on Lease B was completed early in January 20XC and was successful. Core

The well on Lease B was completed early in January 20XC and was successful. CorePetroleum's share of production from the well was 10,000 barrels of oil. All 10,000

barrels of oil were sold during 20XC. Core's share of estimated reserves at year-end was

300,000 barrels. The selling price of the oil was $60/bbl, and lifting costs were $200,000.

Lease A was abandoned in March 20XC, and Lease B was abandoned early in January

20XD. No oil was produced during 20XD.

a. Determine the tax effects for the above transactions in each year, assuming Core is

an independent producer. Ignore percentage depletion, but remember DD&A.

b. Determine any tax effects that would be different if Core were an integrated

producer rather than an independent producer.

Explanation

Tax effects of transactions occurring du...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255