Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 10

Augusta Oil Corporation, an independent producer, began operations in June 20XA.

During the first 2½ years of operation, Augusta acquired only two U.S. properties,

which were noncontiguous. Costs incurred on those properties during those 2½ years

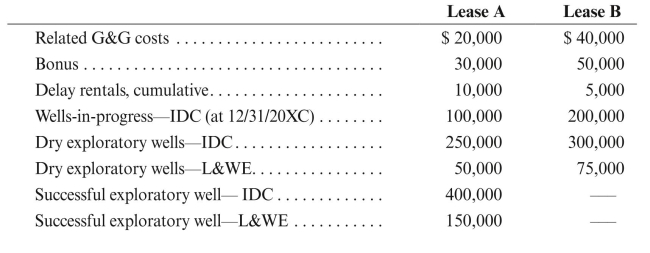

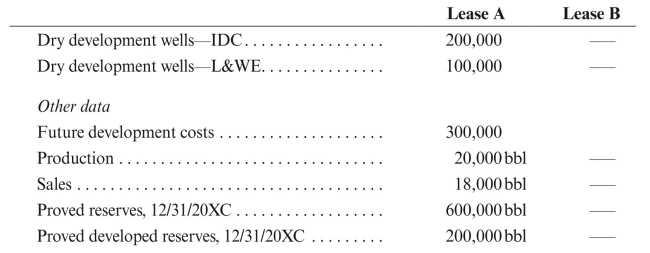

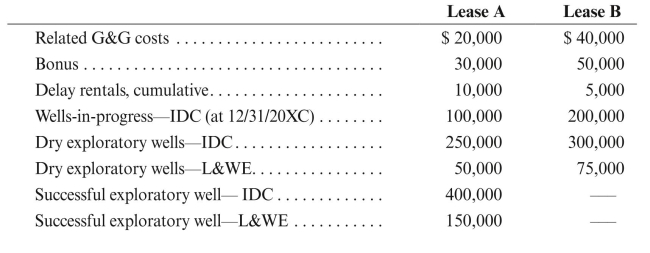

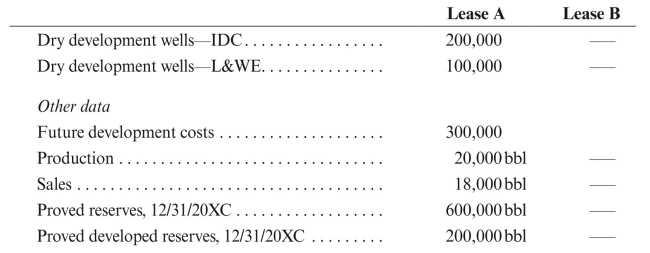

are given below, net of accumulated DD&A. Augusta drilled three dry holes and one

successful well. No equipment was salvaged from the dry holes. Production on the

successful well started on January 1, 20XB. During 20XC, Augusta incurred total IDC

of $100,000 on Lease A (in wells-in-progress-IDC at 12/31/20XC) and $200,000 on

Lease B (in wells-in-progress-IDC at 12/31/20XC). All 20XC IDC on both leases

was incurred early in May. All reserve, production, and sales data below apply only to

Augusta Oil Corporation.

Costs incurred 6/20XA through 12/20XC:

Augusta also placed in service on 1/1/20XB a building that cost $117,000 and has a

Augusta also placed in service on 1/1/20XB a building that cost $117,000 and has a

life of 25 years, with a salvage value of $7,000. The building houses the corporate

headquarters that supports oil and gas operations in the United States and non-oil

and gas operations in Mexico. The operations conducted in the building are general

in nature and are not directly attributable to any specific exploration, development, or

production activity. The building is not directly related to exploration, development,

or production and supports activities in more than one cost center. As such, it is

depreciated using straight-line depreciation for financial accounting.

a. Compute DD&A for 20XC for the following accounting methods assuming that

Augusta is an independent producer:

1) Successful efforts.

2) Full cost, assuming inclusion of all possible costs in the amortization base.

Ignore the revenue method."

During the first 2½ years of operation, Augusta acquired only two U.S. properties,

which were noncontiguous. Costs incurred on those properties during those 2½ years

are given below, net of accumulated DD&A. Augusta drilled three dry holes and one

successful well. No equipment was salvaged from the dry holes. Production on the

successful well started on January 1, 20XB. During 20XC, Augusta incurred total IDC

of $100,000 on Lease A (in wells-in-progress-IDC at 12/31/20XC) and $200,000 on

Lease B (in wells-in-progress-IDC at 12/31/20XC). All 20XC IDC on both leases

was incurred early in May. All reserve, production, and sales data below apply only to

Augusta Oil Corporation.

Costs incurred 6/20XA through 12/20XC:

Augusta also placed in service on 1/1/20XB a building that cost $117,000 and has a

Augusta also placed in service on 1/1/20XB a building that cost $117,000 and has alife of 25 years, with a salvage value of $7,000. The building houses the corporate

headquarters that supports oil and gas operations in the United States and non-oil

and gas operations in Mexico. The operations conducted in the building are general

in nature and are not directly attributable to any specific exploration, development, or

production activity. The building is not directly related to exploration, development,

or production and supports activities in more than one cost center. As such, it is

depreciated using straight-line depreciation for financial accounting.

a. Compute DD&A for 20XC for the following accounting methods assuming that

Augusta is an independent producer:

1) Successful efforts.

2) Full cost, assuming inclusion of all possible costs in the amortization base.

Ignore the revenue method."

Explanation

A Oil Corporation, an independent produc...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255