Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 17

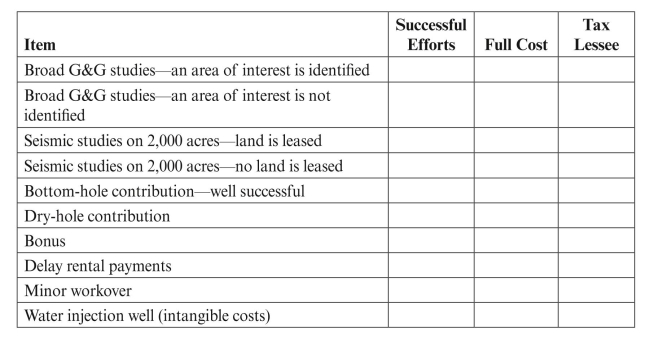

Indicate which items are to be capitalized (C), expensed (E), and part capitalized and

part expensed (C/E) for successful efforts, full cost, and tax accounting. Assume the

maximum tax deductions are taken. Successful tax

Successful tax

Item Efforts Full Cost Lessee

Option to lease

Water disposal well (intangible costs)

Wells-in-progress-proved property

a. Intangible costs

b. Tangible costs

Wells-in-progress-unproved property

a. Intangible costs

b. Tangible costs

Successful exploratory drilling

a. Intangible costs

b. Tangible costs

Exploratory drilling-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Successful development drilling

a. Intangible costs

b. Tangible costs

Development drilling-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Deepening a development well to unexplored

depths-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Abandonment of well on producing lease (well had

been depreciated separately for tax purposes)

Abandonment of lease (no other nearby leases)

Production costs

Water supply well (intangible costs)

a.Water to be used for development drilling

b. Water to be used for secondary recovery

Exploratory stratigraphic test well-dry

(intangible costs)

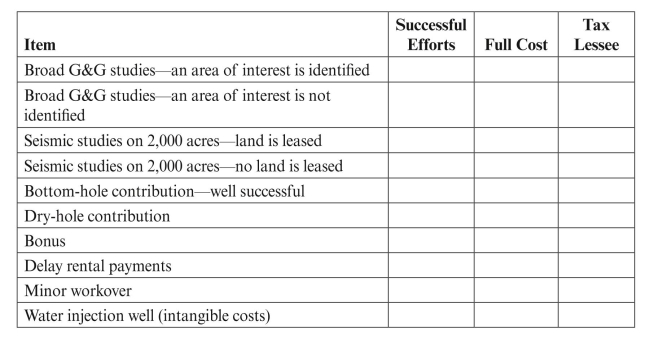

part expensed (C/E) for successful efforts, full cost, and tax accounting. Assume the

maximum tax deductions are taken.

Successful tax

Successful taxItem Efforts Full Cost Lessee

Option to lease

Water disposal well (intangible costs)

Wells-in-progress-proved property

a. Intangible costs

b. Tangible costs

Wells-in-progress-unproved property

a. Intangible costs

b. Tangible costs

Successful exploratory drilling

a. Intangible costs

b. Tangible costs

Exploratory drilling-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Successful development drilling

a. Intangible costs

b. Tangible costs

Development drilling-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Deepening a development well to unexplored

depths-dry hole

a. Intangible costs

b. Tangible costs (net of salvage)

Abandonment of well on producing lease (well had

been depreciated separately for tax purposes)

Abandonment of lease (no other nearby leases)

Production costs

Water supply well (intangible costs)

a.Water to be used for development drilling

b. Water to be used for secondary recovery

Exploratory stratigraphic test well-dry

(intangible costs)

Explanation

The items to be capitalized (C) , expens...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255