Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 19

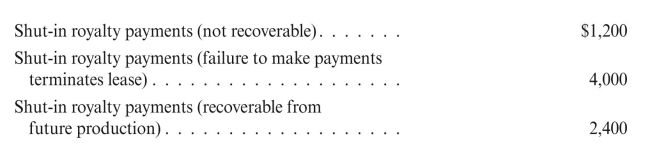

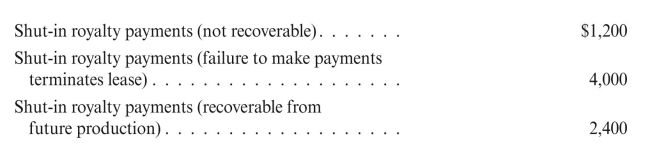

Harper Oil Corporation paid the following amounts in 20XD:  Determine the tax basis of any assets and the amount of any tax deductions.

Determine the tax basis of any assets and the amount of any tax deductions.

Determine the tax basis of any assets and the amount of any tax deductions.

Determine the tax basis of any assets and the amount of any tax deductions.Explanation

Income tax treatment of transactions:

O...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255