Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 21

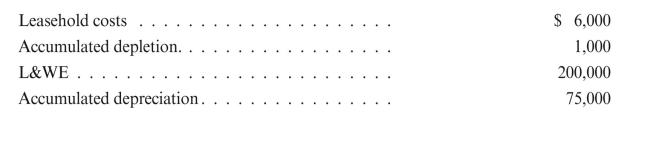

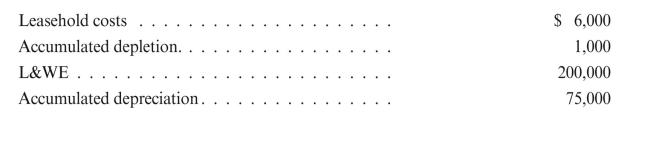

Tiger Energy has the following information:  The lease is subleased to Phil Oil Corporation for $300,000, and Tiger retains an 1/16

The lease is subleased to Phil Oil Corporation for $300,000, and Tiger retains an 1/16

ORI. At the date of the sublease, the FMV of the equipment is 180,000.

REqUIRED: Determine the tax basis of Tiger's and Phil's assets and the amount of

any tax revenue.

The lease is subleased to Phil Oil Corporation for $300,000, and Tiger retains an 1/16

The lease is subleased to Phil Oil Corporation for $300,000, and Tiger retains an 1/16ORI. At the date of the sublease, the FMV of the equipment is 180,000.

REqUIRED: Determine the tax basis of Tiger's and Phil's assets and the amount of

any tax revenue.

Explanation

Taxbasis of T's and P's assets-

Since ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255