Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 7

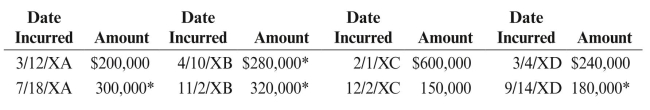

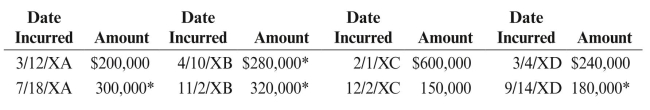

Sauer Oil Corporation, an integrated producer, incurs IDC costs in the following years

as indicated. The IDC amounts marked with an asterisk (*) relate to dry-hole IDC. REqUIRED: Compute the amount that may be deducted for IDC in the years 20XA,

REqUIRED: Compute the amount that may be deducted for IDC in the years 20XA,

20XB, 20XC, and 20XD.

as indicated. The IDC amounts marked with an asterisk (*) relate to dry-hole IDC.

REqUIRED: Compute the amount that may be deducted for IDC in the years 20XA,

REqUIRED: Compute the amount that may be deducted for IDC in the years 20XA,20XB, 20XC, and 20XD.

Explanation

Amount of ID deductible in each of the f...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255