Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 15

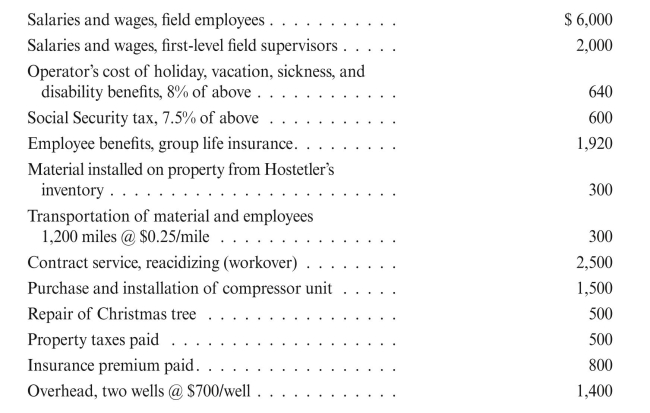

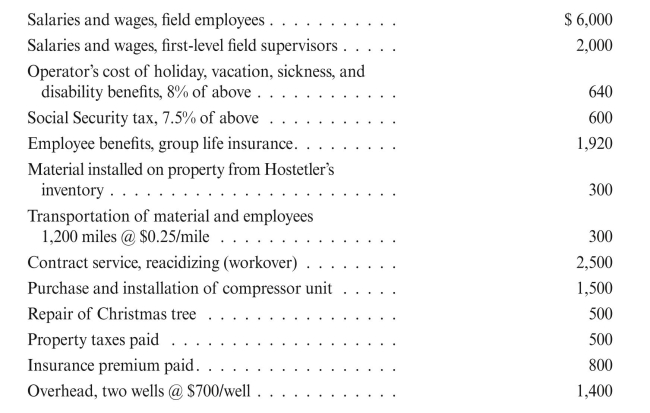

Hostetler Energy owns 70%, Challenger Company owns 20%, and Hill Oil Company

owns 10% of the working interest property 1004. Assume Hostetler Energy is the

operator and incurs the following costs during the month of September 2013, in

connection with the property: REqUIRED: Give the entries to record and distribute the costs, assuming regular

REqUIRED: Give the entries to record and distribute the costs, assuming regular

accounts are used.

owns 10% of the working interest property 1004. Assume Hostetler Energy is the

operator and incurs the following costs during the month of September 2013, in

connection with the property:

REqUIRED: Give the entries to record and distribute the costs, assuming regular

REqUIRED: Give the entries to record and distribute the costs, assuming regularaccounts are used.

Explanation

H energy is the operator and incurs the ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255