Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 1

Core Petroleum owns 60%, Dwight Corporation owns 30%, and Webb Company owns

10% of the working interest property number 2008. Core Petroleum is the operator and

bills Dwight and Webb monthly for their portion of costs incurred. During May 2016,

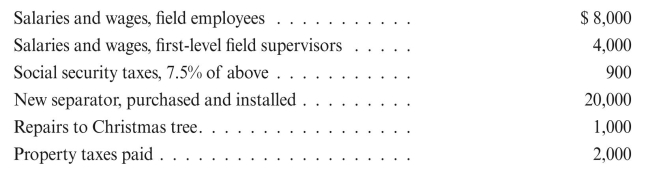

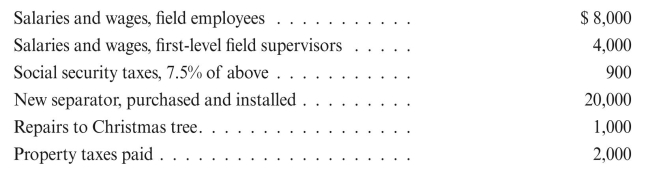

Core incurred costs as follows: Other Costs:

Other Costs:

Employee benefits-21% of salaries and wages

Transportation of material and employees, 1,500 miles at $0.25/mile

Overhead, 22% of all costs listed above

REqUIRED: Give the entries to record and distribute the costs, assuming regular

accounts are used.

10% of the working interest property number 2008. Core Petroleum is the operator and

bills Dwight and Webb monthly for their portion of costs incurred. During May 2016,

Core incurred costs as follows:

Other Costs:

Other Costs:Employee benefits-21% of salaries and wages

Transportation of material and employees, 1,500 miles at $0.25/mile

Overhead, 22% of all costs listed above

REqUIRED: Give the entries to record and distribute the costs, assuming regular

accounts are used.

Explanation

CP owns 60%, DC owns 30% and WC owns 10%...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255