Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 5

The Raupe Lease has the following working interest owners: Reed Corporation 50%,

League Energy 25%, and Sunshine Oil Company 25%. There is a 1/8 royalty on the

lease. On April 1, 2011, Reed Corporation, the operator, receives notice that League

Energy is going nonconsent on the drilling of the Gusher No. 2. Reed Corporation and

Sunshine Oil Company agree to carry League's share proportionately. The nonconsent

penalty is 300%. On August 1, the Gusher No. 2, which was drilled and completed at a

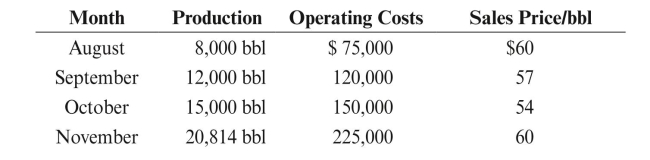

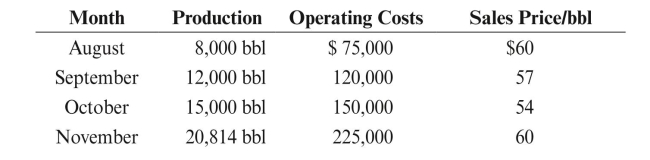

cost of $750,000, goes on production. The production and operating information for

the next few months is as follows: REqUIRED: Assuming severance tax is ignored:

REqUIRED: Assuming severance tax is ignored:

a. Determine Reed Corporation's and Sunshine Oil Company's proportionate shares

of drilling and equipping costs.

b. Prepare a table determining when League Energy will reach payout.

c. Prepare the journal entry that Reed Corporation will make during August to book

its share of production revenue.

League Energy 25%, and Sunshine Oil Company 25%. There is a 1/8 royalty on the

lease. On April 1, 2011, Reed Corporation, the operator, receives notice that League

Energy is going nonconsent on the drilling of the Gusher No. 2. Reed Corporation and

Sunshine Oil Company agree to carry League's share proportionately. The nonconsent

penalty is 300%. On August 1, the Gusher No. 2, which was drilled and completed at a

cost of $750,000, goes on production. The production and operating information for

the next few months is as follows:

REqUIRED: Assuming severance tax is ignored:

REqUIRED: Assuming severance tax is ignored:a. Determine Reed Corporation's and Sunshine Oil Company's proportionate shares

of drilling and equipping costs.

b. Prepare a table determining when League Energy will reach payout.

c. Prepare the journal entry that Reed Corporation will make during August to book

its share of production revenue.

Explanation

a.The R Corp and S Corp's proportionate ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255