Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 6

Session Gas Company owns a 33.3% working interest in a lease in West Texas. Roger

Williams, a local farmer, owns a 1/8 royalty interest in the lease. Session is the operator,

and its partners, Rocky Energy and Asteroid Petroleum, each own 33.3% of the

working interest. Session analyzed the prospects for the lease and proposed drilling a

gas well. Asteroid agreed, but Rocky decided to go nonconsent. Session and Asteroid

both agreed to proportionately carry Rocky's working interest. The joint operating

agreement stipulates that a 150% drilling and completion cost penalty will be assessed

on any partner choosing not to participate in drilling the well.

On July 1, 2014, the Gusher No. 2 was drilled and completed at a total cost of

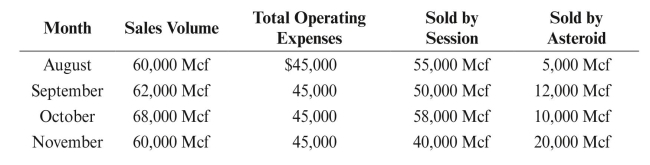

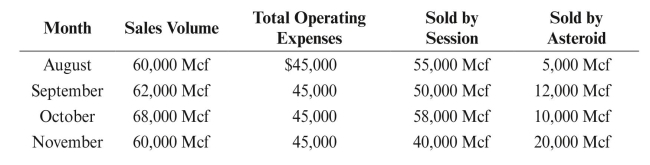

$300,000. The following information is available concerning production and sales.

Assume each company contracts to sell its gas for $6.00/Mcf. REqUIRED: Ignoring severance tax:

REqUIRED: Ignoring severance tax:

a. Determine when Rocky will reach payout if payout is calculated based on the

quantity actually sold. Hint: Session and Asteroid would have to compute

payout separately.

b. Determine when Rocky will reach payout if payout is calculated using the amount

to which each partner is entitled.

Williams, a local farmer, owns a 1/8 royalty interest in the lease. Session is the operator,

and its partners, Rocky Energy and Asteroid Petroleum, each own 33.3% of the

working interest. Session analyzed the prospects for the lease and proposed drilling a

gas well. Asteroid agreed, but Rocky decided to go nonconsent. Session and Asteroid

both agreed to proportionately carry Rocky's working interest. The joint operating

agreement stipulates that a 150% drilling and completion cost penalty will be assessed

on any partner choosing not to participate in drilling the well.

On July 1, 2014, the Gusher No. 2 was drilled and completed at a total cost of

$300,000. The following information is available concerning production and sales.

Assume each company contracts to sell its gas for $6.00/Mcf.

REqUIRED: Ignoring severance tax:

REqUIRED: Ignoring severance tax:a. Determine when Rocky will reach payout if payout is calculated based on the

quantity actually sold. Hint: Session and Asteroid would have to compute

payout separately.

b. Determine when Rocky will reach payout if payout is calculated using the amount

to which each partner is entitled.

Explanation

S Comp and A Comp's proportionate share ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255