Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 24

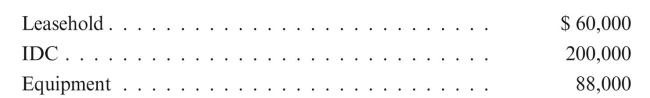

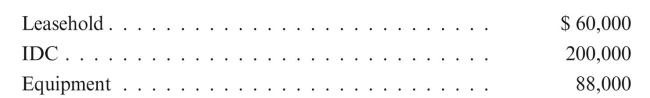

Greene Oil Company, a successful efforts company, owns 100% of the working interest

in a 320 acre proved property with the following net, unamortized costs: Greene Oil Company sells 100% of the working interest, including the wells and

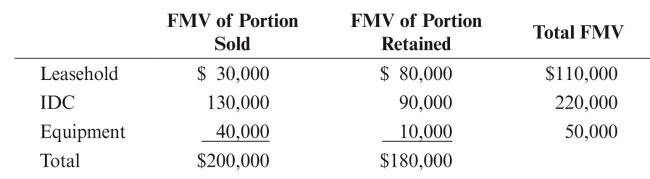

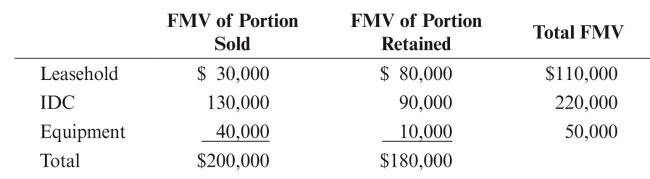

Greene Oil Company sells 100% of the working interest, including the wells and

equipment, on the western 160 acres of the property for $200,000. An appraisal is

performed with the following results: Give the entry to record the sale.

Give the entry to record the sale.

in a 320 acre proved property with the following net, unamortized costs:

Greene Oil Company sells 100% of the working interest, including the wells and

Greene Oil Company sells 100% of the working interest, including the wells andequipment, on the western 160 acres of the property for $200,000. An appraisal is

performed with the following results:

Give the entry to record the sale.

Give the entry to record the sale.Explanation

Successful efforts method

The corporati...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255