Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 26

Wolfforth Company sold its 100% WI in a proved property for $600,000 and retained

an ORI. Wolfforth's net cost basis in the property was $500,000. The fair market value

of the entire original working interest was $700,000.

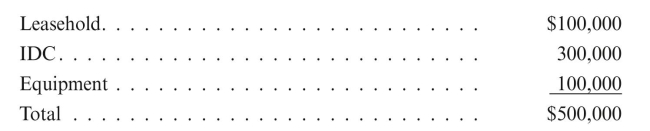

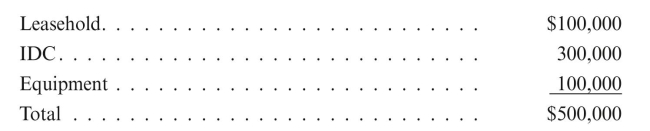

Wolfforth had the following net investment in its accounts: Prepare Wolfforth Company's entry to record the sale, assuming Wolfforth is a

Prepare Wolfforth Company's entry to record the sale, assuming Wolfforth is a

successful efforts company.

an ORI. Wolfforth's net cost basis in the property was $500,000. The fair market value

of the entire original working interest was $700,000.

Wolfforth had the following net investment in its accounts:

Prepare Wolfforth Company's entry to record the sale, assuming Wolfforth is a

Prepare Wolfforth Company's entry to record the sale, assuming Wolfforth is asuccessful efforts company.

Explanation

Applicable paragraph No 47K

Since the F...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255