Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 10

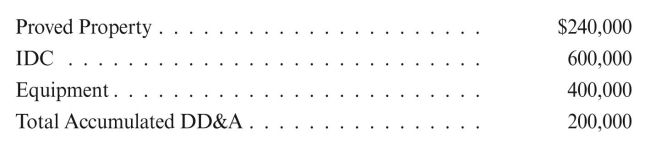

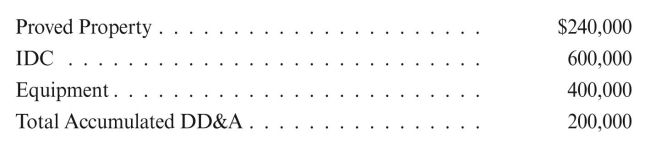

Hein Oil Company, a successful efforts company, owns 100% of the working interest in

a proved property that has the following capitalized costs: A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

for $1,200,000 and retains a production payment interest of $300,000. The production

payment interest is payable from the proceeds from 30% of the working interest

share of production. The fair market value of the entire original working interest is

$1,500,000.

Prepare the journal entry by Hein to record the above transaction, assuming that

payment of the production payment interest is not reasonably assured.

a proved property that has the following capitalized costs:

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interestfor $1,200,000 and retains a production payment interest of $300,000. The production

payment interest is payable from the proceeds from 30% of the working interest

share of production. The fair market value of the entire original working interest is

$1,500,000.

Prepare the journal entry by Hein to record the above transaction, assuming that

payment of the production payment interest is not reasonably assured.

Explanation

Successful efforts method

The corporati...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255