Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Edition 5ISBN: 9781630181031 Exercise 4

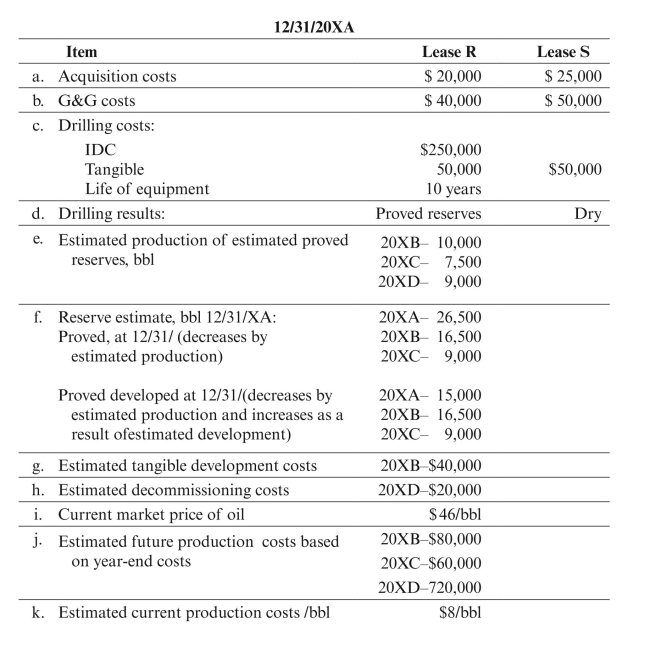

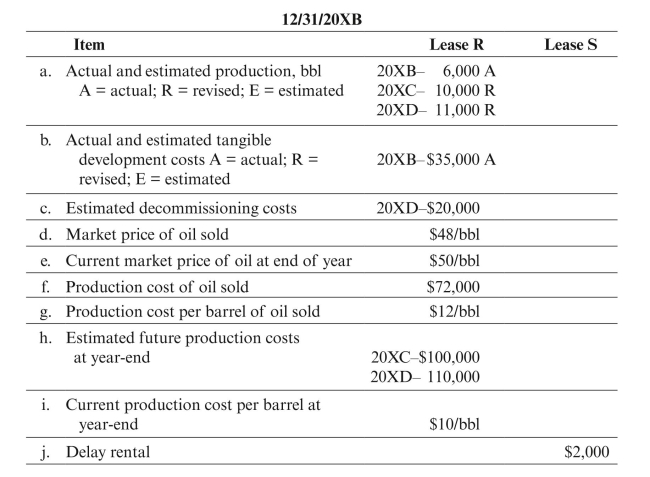

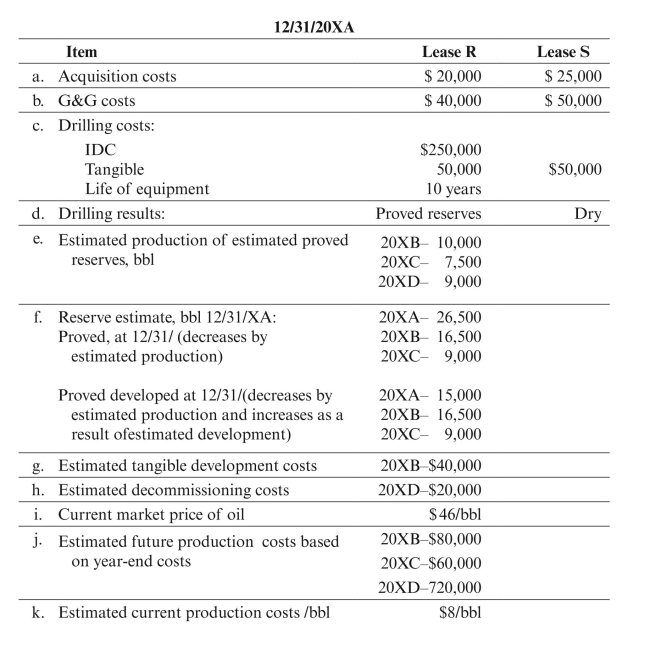

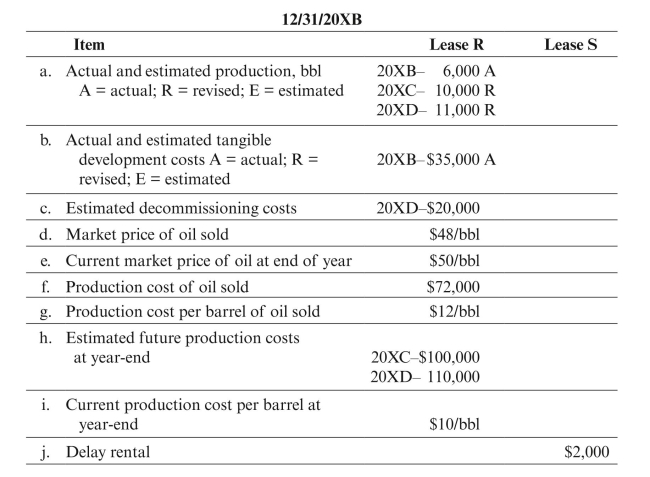

Casing Oil, a successful efforts company, began operations on January 1, 20XA.

Assume the following facts about Casing's first two years of operations. All reserve

and production quantities apply only to Casing Oil's interest. Prepare the required

disclosures under SFAS No. 69.

Assume a tax rate of 40%, and that Casing Oil does not qualify for percentage

Assume a tax rate of 40%, and that Casing Oil does not qualify for percentage

depletion because it is an integrated producer. For purposes of the required

capitalization and amortization of 30% of IDC, assume nine months of amortization

in 20XA. Because of the short life of Lease R, also assume Casing elects to use the

unit-of-production method for calculating depreciation. Use proved reserves for

depletion and proved developed reserves for depreciation. Ignore the alternative

minimum tax and deferred taxes. (What is the significance of no estimated future

development costs on Lease R as of 12/31/XB?)

Assume the following facts about Casing's first two years of operations. All reserve

and production quantities apply only to Casing Oil's interest. Prepare the required

disclosures under SFAS No. 69.

Assume a tax rate of 40%, and that Casing Oil does not qualify for percentage

Assume a tax rate of 40%, and that Casing Oil does not qualify for percentagedepletion because it is an integrated producer. For purposes of the required

capitalization and amortization of 30% of IDC, assume nine months of amortization

in 20XA. Because of the short life of Lease R, also assume Casing elects to use the

unit-of-production method for calculating depreciation. Use proved reserves for

depletion and proved developed reserves for depreciation. Ignore the alternative

minimum tax and deferred taxes. (What is the significance of no estimated future

development costs on Lease R as of 12/31/XB?)

Explanation

C Oil follows successful efforts method,...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255