Deck 7: Incremental Analysis for Short-Term Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

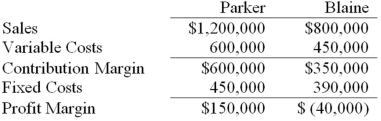

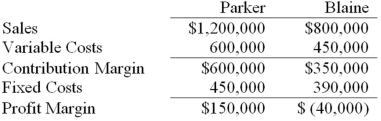

Question

Question

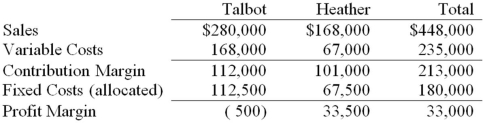

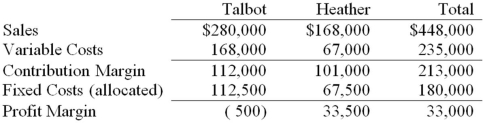

Question

Question

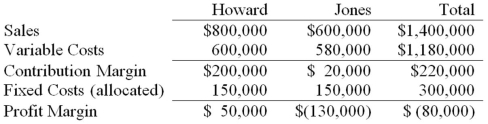

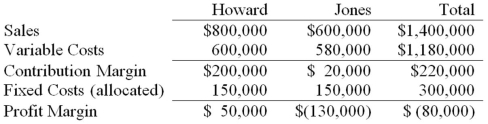

Question

Question

Question

Question

Question

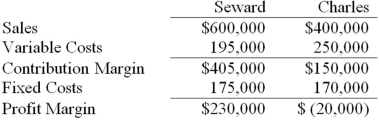

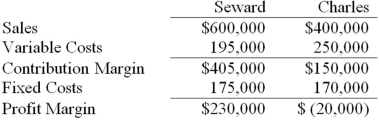

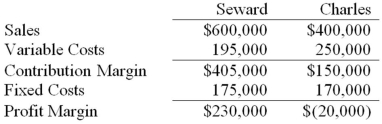

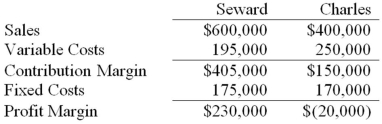

Question

Question

Question

Question

Question

Question

Question

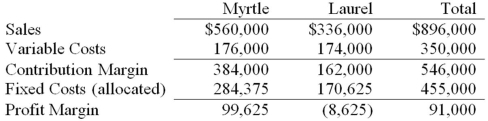

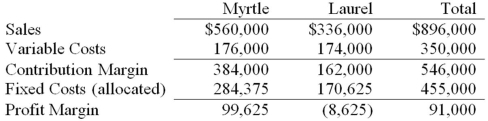

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 7: Incremental Analysis for Short-Term Decision Making

1

The quality of the goods in question is irrelevant to a make-or-buy decision.The quality of the goods in question is a qualitative factor that should be considered in a make-or-buy decision.

False

2

Another term for relevant cost is opportunity cost.Other terms for relevant costs include differential costs,incremental costs,and avoidable costs.Opportunity costs can be relevant,but the two are not synonymous.

False

3

The first step in the managerial decision making process is to identify the decision problem.The first step in the managerial decision making process is to identify the decision problem.

True

4

A sunk cost is never a relevant cost.Sunk costs cannot change depending on the alternative,so they are never relevant.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

A relevant cost is one that will not change depending upon which alternative is selected.A relevant cost will change depending on which alternative is selected.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

Opportunity costs are important in special-order and make-or-buy decisions,but not in keep-or-drop decisions.Any time business managers must choose one alternative over another,they will face opportunity costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

A special-order decision analysis cannot be used to make long-term pricing decisions.Prices must cover all costs if the company is to be profitable in the long run,and all costs are not considered in a special-order decision analysis.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

If a company has idle capacity,it means it has reached the limit on its resources.If a company has idle capacity,it means it has not yet reached the limit on its resources.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

A special-order decision analysis cannot be used if the firm is operating at full capacity.If the firm is operating at full capacity,the analysis must consider opportunity costs,but it can still be performed.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

When managers make a decision,they base it strictly on the numerical analysis performed in step three of the decision making process.Managers base decisions on the numerical analysis and a variety of other factors.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

Capacity is a measure of the limit placed on specific resources.This is the definition of capacity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

If machine hours are a constraining factor,the product with the highest contribution margin per machine hour should be prioritized in production.Managers should maximize the contribution margin earned per amount of constrained resource.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

A make-or-buy decision is the same as an insourcing versus outsourcing decision.Both terms are used for decisions about whether to perform an activity in-house or purchase it from an outside supplier.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

An avoidable cost is one that has already been spent.An avoidable cost is one a manager can avoid by choosing one alternative instead of another.A sunk cost is one that has already been spent.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Opportunity costs are not relevant when a company has idle capacity.If a company has idle capacity,it does not have to give up the opportunity to do something else.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

An opportunity cost is the foregone benefit of choosing to do one thing instead of another.This is the definition of opportunity cost.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

In deciding whether to eliminate a business segment,managers should consider which costs and benefits will change as a result of the decision.Costs and benefits that will not change will not be relevant to the decision.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

A product should be processed further if no additional fixed costs are incurred in its processing.If the increased revenue from processing further is enough to offset the incremental cost,the product should be processed further.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

The final step in the decision making process is to make the decision.The final step in the decision making process is to review the results of the decision-making process.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

The segment margin is the contribution margin of a particular segment.The segment margin is sales revenue less all costs that are directly attributable to the segment,including variable costs and direct fixed costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following costs is not relevant in a special-order decision?

A)Direct labor

B)Direct materials

C)Variable overhead

D)Fixed overhead

A)Direct labor

B)Direct materials

C)Variable overhead

D)Fixed overhead

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following steps in the managerial decision-making process involves differential analysis?

A)Identify the decision problem

B)Determine the decision alternatives

C)Evaluate the costs and benefits of the alternatives

D)Make the decision

A)Identify the decision problem

B)Determine the decision alternatives

C)Evaluate the costs and benefits of the alternatives

D)Make the decision

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

Costs that change across decision alternatives are

A)accounting costs.

B)activity-based costs.

C)differential costs.

D)capital costs.

A)accounting costs.

B)activity-based costs.

C)differential costs.

D)capital costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

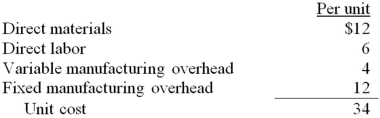

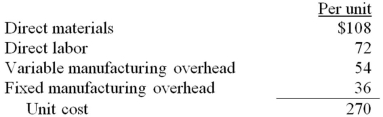

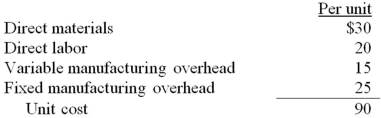

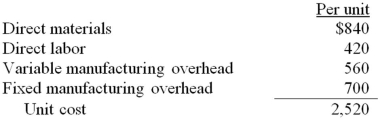

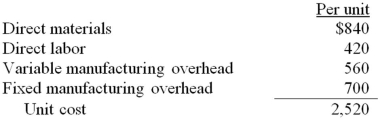

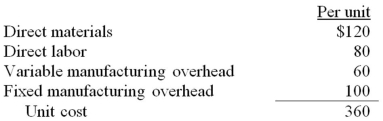

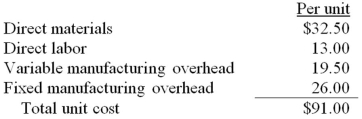

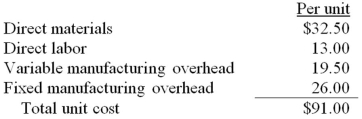

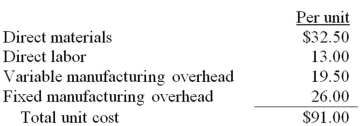

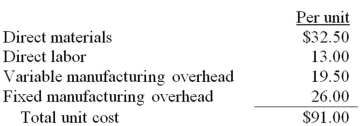

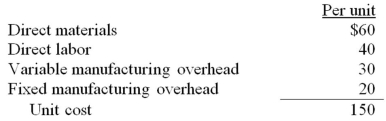

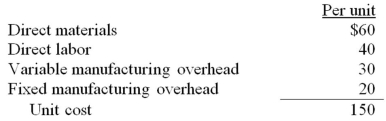

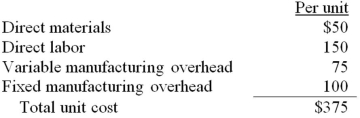

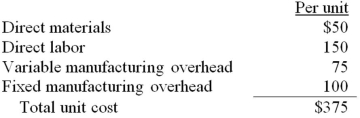

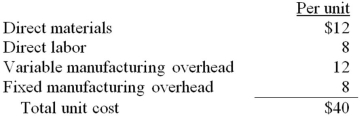

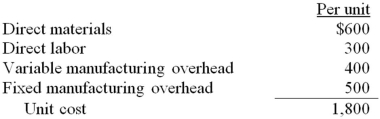

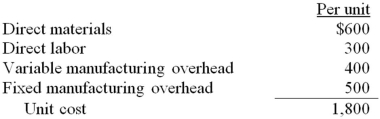

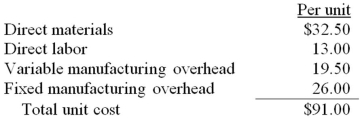

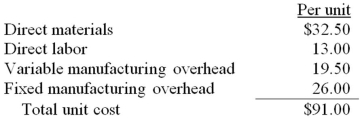

Ross has received a special order for 10,000 units of its product at a special price of $30.The product normally sells for $40 and has the following manufacturing costs: Assume that Ross has sufficient capacity to fill the order.If Ross accepts the order,what effect will the order have on the company's short-term profit?

A)$40,000 decrease

B)$180,000 increase

C)$60,000 decrease

D)$80,000 increase

A)$40,000 decrease

B)$180,000 increase

C)$60,000 decrease

D)$80,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

What are the decision alternatives in a special-order decision?

A)To make or buy the product.

B)To continue or discontinue the product.

C)To accept or reject the offer.

D)To sell-or-process further.

A)To make or buy the product.

B)To continue or discontinue the product.

C)To accept or reject the offer.

D)To sell-or-process further.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is not a step in the managerial decision-making process?

A)Identify the decision problem

B)Calculate the payback period

C)Determine the decision alternatives

D)Evaluate the costs and benefits of the alternatives

A)Identify the decision problem

B)Calculate the payback period

C)Determine the decision alternatives

D)Evaluate the costs and benefits of the alternatives

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is false?

A)Sunk costs are never relevant.

B)Sunk costs are costs that occurred in the past.

C)To be relevant,a cost must be an opportunity cost.

D)To be relevant,a cost must occur in the future.

A)Sunk costs are never relevant.

B)Sunk costs are costs that occurred in the past.

C)To be relevant,a cost must be an opportunity cost.

D)To be relevant,a cost must occur in the future.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

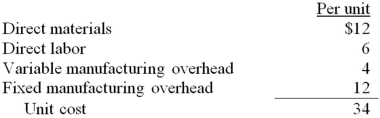

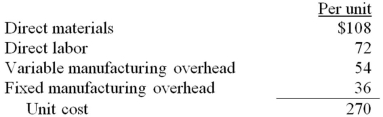

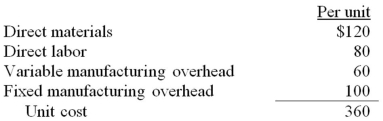

Walnut has received a special order for 2,000 units of its product at a special price of $270.The product normally sells for $360 and has the following manufacturing costs: Walnut is currently operating at full capacity and cannot fill the order without harming normal production and sales.If Walnut accepts the order,what effect will the order have on the company's short-term profit?

A)$108,000 decrease

B)$108,000 increase

C)$180,000 decrease

D)zero

A)$108,000 decrease

B)$108,000 increase

C)$180,000 decrease

D)zero

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

The manager of Hampton,Inc.is trying to decide whether to make or buy a component of the product it sells.Which of the following costs and benefits is not relevant to the decision?

A)Direct labor cost involved in making the component

B)The purchase price of the component if it is bought

C)Variable manufacturing overhead involved in making the component

D)The selling price of the product

A)Direct labor cost involved in making the component

B)The purchase price of the component if it is bought

C)Variable manufacturing overhead involved in making the component

D)The selling price of the product

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a step in the managerial decision-making process?

A)Identify the decision problem

B)Review the results of the decision-making process

C)Determine the decision alternatives

D)Forecast the potential sales

A)Identify the decision problem

B)Review the results of the decision-making process

C)Determine the decision alternatives

D)Forecast the potential sales

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is true of a firm that has reached the limit on its resources?

A)It has idle capacity

B)Opportunity costs are now relevant

C)It has no relevant costs

D)It has excess capacity

A)It has idle capacity

B)Opportunity costs are now relevant

C)It has no relevant costs

D)It has excess capacity

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following types of decisions involves deciding whether to accept or reject an order that is outside the scope of normal sales?

A)Special-order

B)Make-or-buy

C)Continue or discontinue

D)Sell-or-process further

A)Special-order

B)Make-or-buy

C)Continue or discontinue

D)Sell-or-process further

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not a step in the managerial decision-making process?

A)Identify the activity cost drivers.

B)Review the results of the decision-making process.

C)Determine the alternatives.

D)Evaluate the costs and benefits of the alternatives.

A)Identify the activity cost drivers.

B)Review the results of the decision-making process.

C)Determine the alternatives.

D)Evaluate the costs and benefits of the alternatives.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

The foregone benefit of choosing one alternative over another is measured by

A)opportunity costs.

B)activity-based costs.

C)differential costs.

D)capital costs.

A)opportunity costs.

B)activity-based costs.

C)differential costs.

D)capital costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

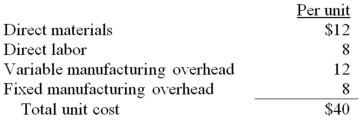

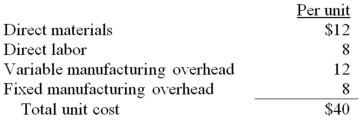

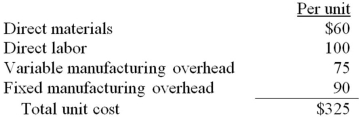

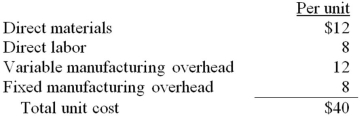

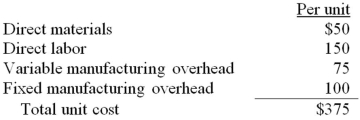

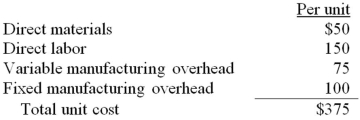

Pinto Co.has received a special order for 2,000 units of its product at a special price of $75.The product normally sells for $100 and has the following manufacturing costs: Assume that Pinto Co.has sufficient capacity to fill the order without harming normal production and sales.If Pinto Co.accepts the order,what effect will the order have on the company's short-term profit?

A)$30,000 decrease

B)$30,000 increase

C)$50,000 decrease

D)$20,000 increase

A)$30,000 decrease

B)$30,000 increase

C)$50,000 decrease

D)$20,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a step in the managerial decision-making process?

A)Identify the decision problem

B)Review the results of the decision-making process

C)Choose the appropriate hurdle rate

D)Evaluate the costs and benefits of the alternatives

A)Identify the decision problem

B)Review the results of the decision-making process

C)Choose the appropriate hurdle rate

D)Evaluate the costs and benefits of the alternatives

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

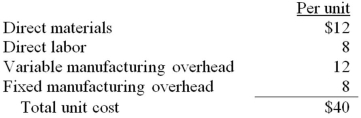

Potter has received a special order for 10,000 units of its product at a special price of $24.The product normally sells for $32 and has the following manufacturing costs: Potter is currently operating at full capacity and cannot fill the order without harming normal production and sales.If Potter accepts the order,what effect will the order have on the company's short-term profit?

A)$64,000 decrease

B)$64,000 increase

C)$80,000 decrease

D)$16,000 increase

A)$64,000 decrease

B)$64,000 increase

C)$80,000 decrease

D)$16,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

A relevant cost is

A)the foregone benefit of choosing to do one thing instead of another.

B)a cost that differs across decision alternatives.

C)a cost that has already been incurred.

D)a cost that is the same regardless of the alternative the manager chooses.

A)the foregone benefit of choosing to do one thing instead of another.

B)a cost that differs across decision alternatives.

C)a cost that has already been incurred.

D)a cost that is the same regardless of the alternative the manager chooses.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

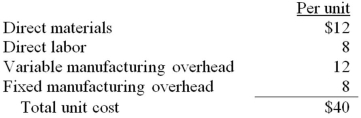

Cranberry has received a special order for 100 units of its product at a special price of $2,100.The product normally sells for $2,800 and has the following manufacturing costs: Assume that Cranberry has sufficient capacity to fill the order without harming normal production and sales.If Cranberry accepts the order,what effect will the order have on the company's short-term profit?

A)$42,000 decrease

B)$42,000 increase

C)$70,000 decrease

D)$28,000 increase

A)$42,000 decrease

B)$42,000 increase

C)$70,000 decrease

D)$28,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not another term for relevant costs?

A)differential costs

B)incremental costs

C)opportunity costs

D)avoidable costs

A)differential costs

B)incremental costs

C)opportunity costs

D)avoidable costs

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is irrelevant to the decision to eliminate an unprofitable segment?

A)The segment margin.

B)Direct fixed costs.

C)Common fixed costs.

D)Segment revenue.

A)The segment margin.

B)Direct fixed costs.

C)Common fixed costs.

D)Segment revenue.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

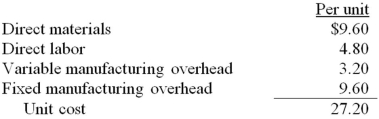

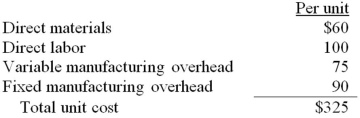

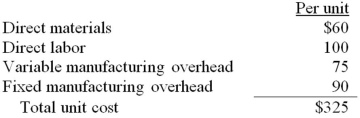

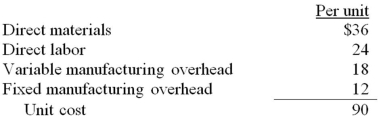

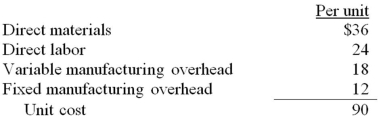

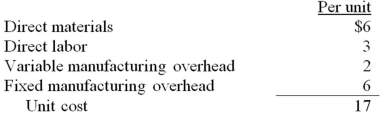

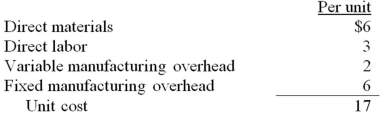

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.What is the maximum price Olive Corp should pay the outside supplier?

A)$32

B)$36

C)$40

D)$44

A)$32

B)$36

C)$40

D)$44

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

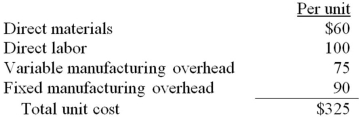

Avocado has received a special order for 2,000 units of its product at a special price.The product normally sells for $400 and has the following manufacturing costs: Assume that Avocado has sufficient capacity to fill the order.What special order price should Avocado charge to make a $20,000 incremental profit?

A)$400

B)$360

C)$270

D)$260

A)$400

B)$360

C)$270

D)$260

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

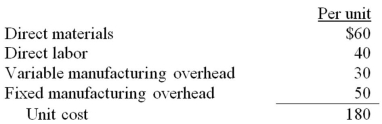

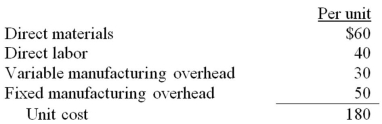

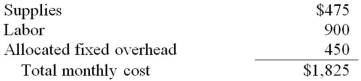

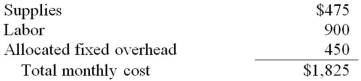

Chafford,Inc.currently manufactures 2,000 subcomponents in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Due to a labor strike,Chafford is considering purchasing the subcomponents from an outside supplier for $250 per unit.The union is demanding a 20% increase in pay for direct labor.Fixed overhead is not avoidable.How much could Chafford increase their pay before it would be more advantageous to purchase the subcomponents from the outside supplier?

A)5%

B)15%

C)50%

D)75%

Due to a labor strike,Chafford is considering purchasing the subcomponents from an outside supplier for $250 per unit.The union is demanding a 20% increase in pay for direct labor.Fixed overhead is not avoidable.How much could Chafford increase their pay before it would be more advantageous to purchase the subcomponents from the outside supplier?

A)5%

B)15%

C)50%

D)75%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.If Cotton Corp rejects the outside offer,what will be the effect on short-term profits?

A)$260,000 increase

B)$195,000 decrease

C)no change

D)$65,000 increase

A)$260,000 increase

B)$195,000 decrease

C)no change

D)$65,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following types of decisions involves deciding whether to perform a particular activity in-house or purchase it from an outside supplier?

A)Special-order

B)Make-or-buy

C)Continue or discontinue

D)Sell-or-process further

A)Special-order

B)Make-or-buy

C)Continue or discontinue

D)Sell-or-process further

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Clifford,Inc.currently manufactures 2,000 subcomponents in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Due to a labor strike,Clifford is considering purchasing the subcomponents from an outside supplier for $250 per unit rather than paying the 10% increase in direct labor costs demanded by the union.Fixed overhead is not avoidable.If Clifford purchases the subcomponent from the outside supplier,how much will profit differ from what it would be if it manufactured the subcomponents with the increase in direct labor cost?

A)$30,000 less

B)$20,000 less

C)$10,000 less

D)$20,000 more

Due to a labor strike,Clifford is considering purchasing the subcomponents from an outside supplier for $250 per unit rather than paying the 10% increase in direct labor costs demanded by the union.Fixed overhead is not avoidable.If Clifford purchases the subcomponent from the outside supplier,how much will profit differ from what it would be if it manufactured the subcomponents with the increase in direct labor cost?

A)$30,000 less

B)$20,000 less

C)$10,000 less

D)$20,000 more

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.If Cotton Corp accepts the outside offer,what will be the effect on short-term profits?

A)$260,000 increase

B)$195,000 decrease

C)no change

D)$65,000 increase

A)$260,000 increase

B)$195,000 decrease

C)no change

D)$65,000 increase

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

Dot has received a special order for 2,000 units of its product at a special price.The product normally sells for $200 and has the following manufacturing costs: Assume that Dot has sufficient capacity to fill the order without harming normal production and sales.What minimum price should Dot charge to achieve a $50,000 incremental profit?

A)$225

B)$155

C)$168

D)$180

A)$225

B)$155

C)$168

D)$180

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Crystal has received a special order for 2,000 units of its product.The product normally sells for $200 and has the following manufacturing costs: Crystal is currently operating at full capacity and cannot fill the order without harming normal production and sales.What minimum price should Crystal charge to earn an incremental profit of $50,000?

A)$175

B)$200

C)$225

D)$155

A)$175

B)$200

C)$225

D)$155

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

Almond has received a special order for 6,000 units of its product at a special price of $90.The product normally sells for $120 and has the following manufacturing costs: Assume that Almond has sufficient capacity to fill the order.If Almond accepts the order,what effect will the order have on the company's short-term profit?

A)$72,000 increase

B)$180,000 increase

C)$252,000 decrease

D)zero

A)$72,000 increase

B)$180,000 increase

C)$252,000 decrease

D)zero

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Manor,Inc.currently manufactures 1,000 subcomponents per month in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Manor is considering purchasing the subcomponents from an outside supplier,who normally charges $300 per unit.The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join,but whose members can purchase the subcomponents for $250 per unit.Fixed overhead is not avoidable.If Manor chose to purchase the subcomponents using the cheaper of the two buying options,what would be the effect on profit?

A)Decrease $25,000

B)Decrease $5,000

C)Increase $20,000

D)Increase $75,000

Manor is considering purchasing the subcomponents from an outside supplier,who normally charges $300 per unit.The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join,but whose members can purchase the subcomponents for $250 per unit.Fixed overhead is not avoidable.If Manor chose to purchase the subcomponents using the cheaper of the two buying options,what would be the effect on profit?

A)Decrease $25,000

B)Decrease $5,000

C)Increase $20,000

D)Increase $75,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Moss,Inc.currently processes payroll in its accounting department,which costs the following per month: Moss could use a payroll processing firm instead,which would cost $1,350 per month,but the firm would provide all supplies.If Moss used the outside firm,the accountants who currently process payroll would be reassigned to other accounting tasks.How much would monthly costs be affected if Moss switched to the payroll processing firm?

A)Increase $875

B)Decrease $475

C)Increase $225

D)Decrease $225

A)Increase $875

B)Decrease $475

C)Increase $225

D)Decrease $225

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp accepts the outside offer,what will be the effect on short-term profits?

A)$160,000 decrease

B)$320,000 increase

C)$160,000 increase

D)$80,000 decrease

A)$160,000 decrease

B)$320,000 increase

C)$160,000 increase

D)$80,000 decrease

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following types of decisions involves deciding whether to eliminate a particular division or segment of the business?

A)Special-order

B)Make-or-buy

C)Continue-or-discontinue

D)Sell-or-process further

A)Special-order

B)Make-or-buy

C)Continue-or-discontinue

D)Sell-or-process further

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp rejects the outside offer,what will be the effect on short-term profits?

A)$80,000 increase

B)no change

C)$160,000 decrease

D)$80,000 decrease

A)$80,000 increase

B)no change

C)$160,000 decrease

D)$80,000 decrease

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

Violet has received a special order for 100 units of its product.The product normally sells for $2,000 and has the following manufacturing costs: Assume that Violet has sufficient capacity to fill the order without harming normal production and sales.What minimum price should Violet charge to achieve a $25,000 incremental profit?

A)$1,300

B)$1,550

C)$1,680

D)$1,800

A)$1,300

B)$1,550

C)$1,680

D)$1,800

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

Manor,Inc.currently manufactures 1,000 subcomponents per month in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Manor is considering purchasing the subcomponents from an outside supplier,who normally charges $300 per unit.The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join,but whose members can purchase the subcomponents for $250 per unit.Fixed overhead is not avoidable.How many units would Manor need to order per month to make it worth it to join the "Exclusive Buyer's Club"?

A)800

B)1,000

C)1,200

D)1,500

Manor is considering purchasing the subcomponents from an outside supplier,who normally charges $300 per unit.The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join,but whose members can purchase the subcomponents for $250 per unit.Fixed overhead is not avoidable.How many units would Manor need to order per month to make it worth it to join the "Exclusive Buyer's Club"?

A)800

B)1,000

C)1,200

D)1,500

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.What is the maximum price Cotton Corp should pay the outside supplier?

A)$65.00

B)$84.50

C)$91.00

D)$58.50

A)$65.00

B)$84.50

C)$91.00

D)$58.50

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

Peach has received a special order for 10,000 units of its product.The product normally sells for $20 and has the following manufacturing costs: Assume that Peach has sufficient capacity to fill the order.What price should Peach charge to make a $10,000 incremental profit?

A)$20

B)$17

C)$12

D)$15

A)$20

B)$17

C)$12

D)$15

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

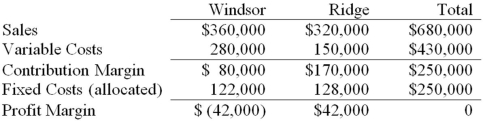

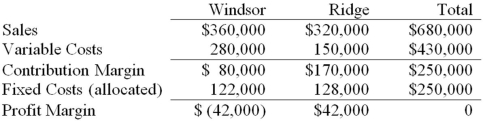

Power Inc.has two divisions,Windsor and Ridge.Following is the income statement for the past month: What would Power's profit margin be if the Windsor division was dropped and all fixed costs are unavoidable?

A)$0

B)$80,000 loss

C)$42,00 profit

D)$80,000 profit

A)$0

B)$80,000 loss

C)$42,00 profit

D)$80,000 profit

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

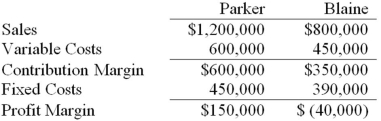

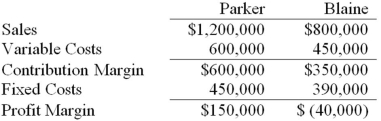

Hamilton,Inc.has two divisions,Parker and Blaine.Following is the income statement for the previous year: Of the total fixed costs,$600,000 are common fixed costs that are allocated equally between the divisions.What is Parker's segment margin?

A)$150,000

B)$450,000

C)$600,000

D)$1,200,000

A)$150,000

B)$450,000

C)$600,000

D)$1,200,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

The law firm of Regal and Porter is examining its client base to determine how profitable its regular clients are.Its analysis indicates that Hawthorne,Inc.paid $179,200 in fees last year,but cost the firm $208,600 ($168,000 in billable labor,supplies,and copying,and $40,600 in allocated common fixed costs).If Regal and Porter dropped Hawthorne,Inc.as a client,and all fixed costs are unavoidable,how would profit be affected?

A)$0

B)Increase $29,400

C)Decrease $11,200

D)Decrease $179,200

A)$0

B)Increase $29,400

C)Decrease $11,200

D)Decrease $179,200

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Market Inc.has two divisions,Talbot and Heather.Following is the income statement for the past month: What would Market's profit margin be if the Talbot division was dropped and all fixed costs are unavoidable?

A)$500 loss

B)$79,000 loss

C)$33,500 profit

D)$213,000 profit

A)$500 loss

B)$79,000 loss

C)$33,500 profit

D)$213,000 profit

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not relevant to a sell-or-process further decision?

A)The cost of processing the product "as is"

B)The cost of processing the product further

C)The opportunity cost of spending resources processing the product further

D)The incremental revenue from processing the product further

A)The cost of processing the product "as is"

B)The cost of processing the product further

C)The opportunity cost of spending resources processing the product further

D)The incremental revenue from processing the product further

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

Davenport Inc.has two divisions,Howard and Jones.Following is the income statement for the past month: What would Davenport's profit margin be if the Jones division was dropped?

A)$80,000 loss

B)$100,000 loss

C)$50,000 profit

D)$70,000 profit

A)$80,000 loss

B)$100,000 loss

C)$50,000 profit

D)$70,000 profit

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

It costs Glenwood,Inc.$70 per unit to manufacture 1,000 units per month of a product that it can sell for $100 each.Alternatively,Glenwood could process the units further into a more complex product,which would cost an additional $40 per unit.Glenwood could sell the more complex product for $145 each.How would processing the product further affect Glenwood's profit?

A)Profit would increase by $5,000.

B)Profit would increase by $45,000.

C)Profit would decrease by $5,000.

D)Profit would decrease by $45,000.

A)Profit would increase by $5,000.

B)Profit would increase by $45,000.

C)Profit would decrease by $5,000.

D)Profit would decrease by $45,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

It costs Elmwood,Inc.$78 per unit to manufacture 1,000 units per month of a product that it can sell for $90 each.Alternatively,Elmwood could sell the units at an earlier stage of processing,which would save $36 per unit.Elmwood could sell the simpler product for $60 each.How would selling the simpler product affect Elmwood's profit?

A)Profit would increase by $6,000.

B)Profit would increase by $30,000.

C)Profit would decrease by $6,000.

D)Profit would decrease by $30,000.

A)Profit would increase by $6,000.

B)Profit would increase by $30,000.

C)Profit would decrease by $6,000.

D)Profit would decrease by $30,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following types of decisions involves deciding whether to sell a product as is or continue to refine it so that it can be sold at a higher price?

A)Special-order

B)Make-or-buy

C)Continue-or-discontinue

D)Sell-or-process further

A)Special-order

B)Make-or-buy

C)Continue-or-discontinue

D)Sell-or-process further

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Henry Sweet currently makes 6" candy sticks that it sells for $.20 each.Henry can make 12" candy sticks out of two 6" candy sticks by melting them together,which costs an additional $.03 per 12" stick.Henry can sell the 12" sticks for $.45.Henry has enough capacity to make 10,000 6" candy sticks per month,and enough demand to sell all the candy sticks it can manufacture,whether 6" or 12".Should Henry sell 6" or 12" candy sticks,and how much additional profit will their decision bring in per month?

A)Sell 6" sticks,additional $100

B)Sell 6" sticks,additional $250

C)Sell 12" sticks,additional $100

D)Sell 12" sticks,additional $250

A)Sell 6" sticks,additional $100

B)Sell 6" sticks,additional $250

C)Sell 12" sticks,additional $100

D)Sell 12" sticks,additional $250

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

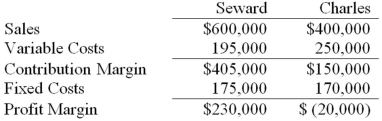

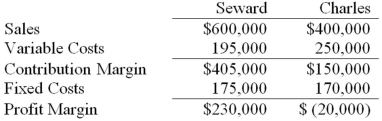

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.How much did the Charles division incur in direct fixed costs?

A)$20,000

B)$150,000

C)$170,000

D)$300,000

A)$20,000

B)$150,000

C)$170,000

D)$300,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Hamilton,Inc.has two divisions,Parker and Blaine.Following is the income statement for the previous year: Of the total fixed costs,$600,000 are common fixed costs that are allocated equally between the divisions.What would Hamilton's profit margin be if Blaine were dropped?

A)$(240,000)

B)$(150,000)

C)$110,000

D)$150,000

A)$(240,000)

B)$(150,000)

C)$110,000

D)$150,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

It costs Camp,Inc.$35 per unit to manufacture 1,000 units per month of a product that it can sell for $50 each.Alternatively,Camp could process the units further into a more complex product,which would cost an additional $30 per unit.Camp could sell the more complex product for $75 each.How would processing the product further affect Camp's profit?

A)Profit would increase by $5,000.

B)Profit would increase by $25,000.

C)Profit would decrease by $5,000.

D)Profit would decrease by $25,000.

A)Profit would increase by $5,000.

B)Profit would increase by $25,000.

C)Profit would decrease by $5,000.

D)Profit would decrease by $25,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

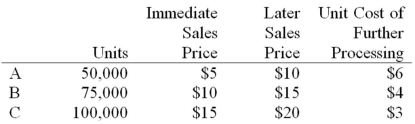

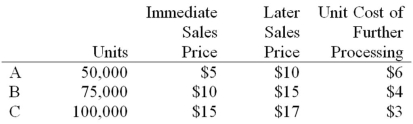

Dundee Company currently produces three products from a joint process.The joint process has total costs of $250,000 per month.All three products,A,B & C,are immediately saleable as they come out of the joint process.Alternatively,any of the products could continue on with additional processing and be sold as a more complete product.The following information is available: Which of the products should be sold after further processing?

A)Product A only

B)Products B and C

C)Products A and C

D)Product B only

A)Product A only

B)Products B and C

C)Products A and C

D)Product B only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

The accounting firm of Pie and Lowell is examining its client base to determine how profitable its regular clients are.Its analysis indicates that Chico,Inc.paid $116,000 in fees last year,but cost the firm $124,000 ($106,000 in billable labor,supplies,and copying,and $18,000 in allocated common fixed costs).If Pie and Lowell dropped Chico,Inc.as a client,and all fixed costs are unavoidable,how would profit be affected?

A)$0

B)Increase $8,000

C)Decrease $10,000

D)Decrease $116,000

A)$0

B)Increase $8,000

C)Decrease $10,000

D)Decrease $116,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

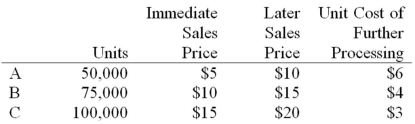

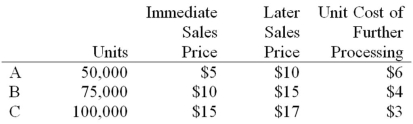

Dardon Company currently produces three products from a joint process.The joint process has total costs of $250,000 per month.All three products,A,B & C,are immediately saleable as they come out of the joint process.Alternatively,any of the products could continue on with additional processing and be sold as a more complete product.The following information is available: Which of the products should be sold immediately without further processing?

A)Product A only

B)Products B and C

C)Products A and C

D)Product B only

A)Product A only

B)Products B and C

C)Products A and C

D)Product B only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.What is Seward's segment margin?

A)$230,000

B)$380,000

C)$405,000

D)$600,000

A)$230,000

B)$380,000

C)$405,000

D)$600,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

Clay Inc.has two divisions,Myrtle and Laurel.Following is the income statement for the previous year: What would Clay's profit margin be if the Laurel division was dropped and all fixed costs are unavoidable?

A)$99,625 profit

B)$91,000 profit

C)$384,000 profit

D)$71,000 loss

A)$99,625 profit

B)$91,000 profit

C)$384,000 profit

D)$71,000 loss

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.What would Franklin's profit margin be if Charles were dropped?

A)$60,000

B)$80,000

C)$100,000

D)$230,000

A)$60,000

B)$80,000

C)$100,000

D)$230,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

A ______________ is one that can be attributed to a specific segment of the business.

A)common fixed cost

B)direct fixed cost

C)variable fixed cost

D)fixed variable cost

A)common fixed cost

B)direct fixed cost

C)variable fixed cost

D)fixed variable cost

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck