Deck 9: Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 9: Liabilities

1

The Discount on Bonds Payable account is shown on the balance sheet as:

A) an asset.

B) an expense.

C) a contra-liability.

D) as a reduction in equity for the discount provided.

A) an asset.

B) an expense.

C) a contra-liability.

D) as a reduction in equity for the discount provided.

C

2

Which of the following would most likely be classified as a current liability?

A) Two-year notes payable

B) Bonds payable

C) Mortgage payable

D) Portion of long-term debt due within one year

A) Two-year notes payable

B) Bonds payable

C) Mortgage payable

D) Portion of long-term debt due within one year

D

3

The journal entry to record the issuance of a note for the purpose of borrowing funds is:

A) debit Accounts Payable; credit Notes Payable.

B) debit Cash; credit Notes Payable.

C) debit Notes Payable; credit Cash.

D) debit Cash and Interest Expense; credit Notes Payable.

A) debit Accounts Payable; credit Notes Payable.

B) debit Cash; credit Notes Payable.

C) debit Notes Payable; credit Cash.

D) debit Cash and Interest Expense; credit Notes Payable.

B

4

When bonds are sold for less than the face amount, this means that the:

A) maturity value will be less than the face amount.

B) maturity value will be greater than the face amount.

C) bonds are sold at a premium.

D) stated rate of interest is less than the market rate of interest.

A) maturity value will be less than the face amount.

B) maturity value will be greater than the face amount.

C) bonds are sold at a premium.

D) stated rate of interest is less than the market rate of interest.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

Jensen Company

Jensen Company has the following information for the pay period of December 15 - 31, 2012:

-

Refer to the information provided for Jensen Company. Salaries are paid on December 31, 2012. On December 31st, Cash would be recorded for:

A) $8,500.

B) $10,000.

C) $6,735.

D) $7,300.

Jensen Company has the following information for the pay period of December 15 - 31, 2012:

-

Refer to the information provided for Jensen Company. Salaries are paid on December 31, 2012. On December 31st, Cash would be recorded for:

A) $8,500.

B) $10,000.

C) $6,735.

D) $7,300.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

Jensen Company

Jensen Company has the following information for the pay period of December 15 - 31, 2012:

-

Refer to the information provided for Jensen Company. Salaries are paid on December 31, 2012. On December 31st, Salaries Expense would be recorded for:

A) $10,000.

B) $8,500.

C) $6,735.

D) $7,750.

Jensen Company has the following information for the pay period of December 15 - 31, 2012:

-

Refer to the information provided for Jensen Company. Salaries are paid on December 31, 2012. On December 31st, Salaries Expense would be recorded for:

A) $10,000.

B) $8,500.

C) $6,735.

D) $7,750.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

Bonds are sold at a premium if the:

A) issuing company has a better reputation than other companies in the same business.

B) market rate of interest was less than the stated rate at the time of issue.

C) market rate of interest was more than the stated rate at the time of issue.

D) market rate of interest was same as the stated rate at the time of issue.

A) issuing company has a better reputation than other companies in the same business.

B) market rate of interest was less than the stated rate at the time of issue.

C) market rate of interest was more than the stated rate at the time of issue.

D) market rate of interest was same as the stated rate at the time of issue.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

The journal entry to record the payment of an ordinary note is:

A) debit Cash; credit Notes Payable.

B) debit Cash; credit Accounts Payable.

C) debit Notes Payable and Interest Expense; credit Cash.

D) debit Notes Payable and Interest Receivable; credit Cash.

A) debit Cash; credit Notes Payable.

B) debit Cash; credit Accounts Payable.

C) debit Notes Payable and Interest Expense; credit Cash.

D) debit Notes Payable and Interest Receivable; credit Cash.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

The amount of federal income taxes withheld from an employee's gross pay is recorded as a:

A) payroll expense.

B) contra account.

C) current asset.

D) current liability.

A) payroll expense.

B) contra account.

C) current asset.

D) current liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

Moore Company has the following information for the pay period of December 15 - 31, 2012:

-

Salaries are paid on December 31, 2012. On December 31st, Cash would be recorded for:

A) $18,000.

B) $13,140.

C) $12,123.

D) $15,300.

-

Salaries are paid on December 31, 2012. On December 31st, Cash would be recorded for:

A) $18,000.

B) $13,140.

C) $12,123.

D) $15,300.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

The Premium on Bonds Payable account is shown on the balance sheet as:

A) a contra asset.

B) a reduction of an expense.

C) as an increase in equity for the premium provided.

D) an addition to a long-term liability.

A) a contra asset.

B) a reduction of an expense.

C) as an increase in equity for the premium provided.

D) an addition to a long-term liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

When will bonds sell at a discount?

A) The credit standing of the issuing company is not as good as other companies in a similar line of business.

B) The stated rate of interest is less than the market rate of interest at the time of issue.

C) The stated rate of interest is more than the market rate of interest at the time of issue.

D) The stated rate of interest is same as the market rate of interest at the time of issue.

A) The credit standing of the issuing company is not as good as other companies in a similar line of business.

B) The stated rate of interest is less than the market rate of interest at the time of issue.

C) The stated rate of interest is more than the market rate of interest at the time of issue.

D) The stated rate of interest is same as the market rate of interest at the time of issue.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

When bonds are issued by a company, the accounting entry shows an:

A) increase in liabilities and a decrease in equity.

B) increase in liabilities and an increase in equity.

C) increase in assets and an increase in liabilities.

D) increase in assets and an increase in equity.

A) increase in liabilities and a decrease in equity.

B) increase in liabilities and an increase in equity.

C) increase in assets and an increase in liabilities.

D) increase in assets and an increase in equity.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

Current liabilities are:

A) due, but not receivable for more than one year.

B) due, but not payable for more than one year.

C) due and receivable within one year.

D) due and payable within one year.

A) due, but not receivable for more than one year.

B) due, but not payable for more than one year.

C) due and receivable within one year.

D) due and payable within one year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

Paris Company issued bonds in the amount of $500,000 with a stated interest rate of 8%. If the interest is paid semiannually and the bonds are due in 10 years, what would be the total amount of interest paid over the life of the bonds?

A) $500,000

B) $200,000

C) $400,000

D) $ 40,000

A) $500,000

B) $200,000

C) $400,000

D) $ 40,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

The portion of long-term debt due within one year should:

A) be classified as a long-term liability.

B) not be separated from the long-term portion of debt.

C) be paid immediately.

D) be reclassified as a current liability.

A) be classified as a long-term liability.

B) not be separated from the long-term portion of debt.

C) be paid immediately.

D) be reclassified as a current liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Long-term liabilities generally include:

A) liabilities related to long-term assets.

B) accounts payable, because they are interest-bearing.

C) obligations that extend beyond one year.

D) accrued expenses.

A) liabilities related to long-term assets.

B) accounts payable, because they are interest-bearing.

C) obligations that extend beyond one year.

D) accrued expenses.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

Moore Company has the following information for the pay period of December 15 - 31, 2012.

-

Salaries are paid on December 31, 2012. On December 31st, Salaries Expense would be recorded for:

A) $18,000.

B) $12,123.

C) $15,300.

D) $13,140.

-

Salaries are paid on December 31, 2012. On December 31st, Salaries Expense would be recorded for:

A) $18,000.

B) $12,123.

C) $15,300.

D) $13,140.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

Grayson Bank agrees to lend the Trust Company $100,000 on January 1. Trust Company signs a $100,000, 12%, 9-month note. What entry will Trust Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

The interest charged by the bank, at the rate of 9%, on a 3-month, discounted note payable for $100,000 is:

A) $9,000.

B) $2,250.

C) $750.

D) $1,000.

A) $9,000.

B) $2,250.

C) $750.

D) $1,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

When determining the amount of interest to be paid on a bond, which of the following information is necessary?

A) The market value of the bonds after one year.

B) The selling price of the bonds.

C) The stated rate of interest on the bonds.

D) The effective rate of interest on the bonds.

A) The market value of the bonds after one year.

B) The selling price of the bonds.

C) The stated rate of interest on the bonds.

D) The effective rate of interest on the bonds.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

The Collins Company sold $200,000 of 10-year bonds for $190,000. The stated rate on the bonds was 8% and interest is paid annually on December 31. What entry would be made on December 31 when the interest is paid? (Numbers are omitted.)

A) IInterest Expense

Cash

B) Interest Expense

Discount on Bonds Payable

Cash

C) Interest Expense

Discount on Bonds Payable

Cash

D)Interest Expense

Bonds Payable

Cash

A) IInterest Expense

Cash

B) Interest Expense

Discount on Bonds Payable

Cash

C) Interest Expense

Discount on Bonds Payable

Cash

D)Interest Expense

Bonds Payable

Cash

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following lease conditions would result in a capital lease to the lessee?

A) The lessee will return the property to the lessor at the end of the lease term.

B) The lessee obtains enough rights to use the asset and is in substance the owner.

C) The leased asset is not capitalized on the balance sheet.

D) The lease term is 70% of the property's economic life.

A) The lessee will return the property to the lessor at the end of the lease term.

B) The lessee obtains enough rights to use the asset and is in substance the owner.

C) The leased asset is not capitalized on the balance sheet.

D) The lease term is 70% of the property's economic life.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

On the issuance date, the Bonds Payable account had a balance of $80,000,000 and Premium on Bonds Payable had a balance of $5,000,000. What was the issue price of the bonds?

A) $80,000,000

B) $79,000,000

C) $85,000,000

D) $75,000,000

A) $80,000,000

B) $79,000,000

C) $85,000,000

D) $75,000,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements regarding amortization is true?

A) Amortization of the premium causes the Premium on Bonds Payable account to increase.

B) Amortization of the premium causes the amount of interest expense to increase.

C) Cash interest payments on bonds equals interest expense on the income statement when there is amortization of bond premium.

D) Amortization of a premium continues over the life of the bond until the balance in the account is reduced to zero.

A) Amortization of the premium causes the Premium on Bonds Payable account to increase.

B) Amortization of the premium causes the amount of interest expense to increase.

C) Cash interest payments on bonds equals interest expense on the income statement when there is amortization of bond premium.

D) Amortization of a premium continues over the life of the bond until the balance in the account is reduced to zero.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

On January 2, 2012, Tech Metals Co. leased a mining machine from BX Leasing Corporation. The lease qualifies as an operating lease. The annual payments are $50,000 at the end of each year, and the life of the lease is 10 years. What entry would Tech Metals Co. make when the machine is delivered by BX Leasing Corporation.?

A)

B)

C) Rent Expense 50,000

Cash 50,000

D) No entry is necessary.

A)

B)

C) Rent Expense 50,000

Cash 50,000

D) No entry is necessary.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

If a company's bonds are callable:

A) the bondholder has the right to sell an option on the bond.

B) the issuing company is likely to retire the bonds before maturity if the bonds are paying 8% interest while the market rate of interest is 4%.

C) the bonds are never allowed to remain outstanding until the maturity date.

D) the investor never knows what the redemption price will be until the bonds are actually called.

A) the bondholder has the right to sell an option on the bond.

B) the issuing company is likely to retire the bonds before maturity if the bonds are paying 8% interest while the market rate of interest is 4%.

C) the bonds are never allowed to remain outstanding until the maturity date.

D) the investor never knows what the redemption price will be until the bonds are actually called.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

Victor Corporation issues $1,000,000, 10-year, 8% bonds at 96. The journal entry to record the issuance will show a:

A) debit to Cash of $1,000,000.

B) credit to Discount on Bonds Payable for $40,000.

C) credit to Bonds Payable for $960,000.

D) debit to Cash for $960,000.

A) debit to Cash of $1,000,000.

B) credit to Discount on Bonds Payable for $40,000.

C) credit to Bonds Payable for $960,000.

D) debit to Cash for $960,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

Bonds with a face amount $1,000,000, are sold at 98. The entry to record the issuance is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements regarding contingent liabilities is true?

A) If they are probable and estimable, then they must be recorded even before the outcome of the future event.

B) If they are probable and estimable, then they should be disclosed in the notes to the financial statements.

C) The accounting principle that determines whether a contingent liability is to be recorded is that of historical cost.

D) Contingencies that are not estimable should not be recorded or disclosed in the financial statements even if they are probable.

A) If they are probable and estimable, then they must be recorded even before the outcome of the future event.

B) If they are probable and estimable, then they should be disclosed in the notes to the financial statements.

C) The accounting principle that determines whether a contingent liability is to be recorded is that of historical cost.

D) Contingencies that are not estimable should not be recorded or disclosed in the financial statements even if they are probable.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

Barnes Company issued $500,000 of bonds for $498,351. Interest is paid semiannually. The bond markets and the financial press are likely to report the bond issue price as:

A) 498.35.

B) 100.00.

C) 99.67.

D) 49.84.

A) 498.35.

B) 100.00.

C) 99.67.

D) 49.84.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

If bonds are issued at 101.25, this means that:

A) a $1,000 bond sold for $101.25.

B) the bonds sold at a discount.

C) a $1,000 bond sold for $1,012.50.

D) the bond rate of interest is 10.125% of the market rate of interest.

A) a $1,000 bond sold for $101.25.

B) the bonds sold at a discount.

C) a $1,000 bond sold for $1,012.50.

D) the bond rate of interest is 10.125% of the market rate of interest.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

The Miracle Corporation issues $1,000,000, 10-year, 8% bonds at 96. The journal entry to record the issuance will show a:

A) debit to Discount on Bonds Payable for $40,000.

B) debit to Cash of $1,000,000.

C) credit to Bonds Payable for $960,000.

D) credit to Cash for $960,000.

A) debit to Discount on Bonds Payable for $40,000.

B) debit to Cash of $1,000,000.

C) credit to Bonds Payable for $960,000.

D) credit to Cash for $960,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

If the market rate of interest is 10%, a $10,000, 12%, 10-year bond that pays interest semiannually would sell at an amount:

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) that cannot be determined.

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) that cannot be determined.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

On January 2, 2012, Senate Inc. issued $10,000,000 of 10-year, 9% bonds at 87. How much of the discount will be amortized in the first year under the straight-line method?

A) $ 870,000

B) $ 130,000

C) $1,300,000

D) $ 600,000

A) $ 870,000

B) $ 130,000

C) $1,300,000

D) $ 600,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

If bonds were initially issued at a premium, the carrying value of the bonds on the issuer's books will:

A) decrease as the bonds approach their maturity date.

B) increase as the bonds approach their maturity date.

C) remain constant throughout the bonds' life.

D) fluctuate throughout the bonds' life.

A) decrease as the bonds approach their maturity date.

B) increase as the bonds approach their maturity date.

C) remain constant throughout the bonds' life.

D) fluctuate throughout the bonds' life.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would describe a callable bond?

A) Borrower has the right to pay off the bonds prior to due date.

B) Borrower has the right to issue more bonds prior to due date.

C) Borrower has the right to call off the interest payments on the bonds.

D) Investor has the right to call off the interest payments on the bonds.

A) Borrower has the right to pay off the bonds prior to due date.

B) Borrower has the right to issue more bonds prior to due date.

C) Borrower has the right to call off the interest payments on the bonds.

D) Investor has the right to call off the interest payments on the bonds.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following accounts would not appear on the balance sheet of a lessee company recording a capital lease?

A) Accumulated depreciation on the leased asset.

B) Capital lease liability in the current liability section.

C) Capital lease liability in the long-term liability section.

D) Rent expense on the leased asset.

A) Accumulated depreciation on the leased asset.

B) Capital lease liability in the current liability section.

C) Capital lease liability in the long-term liability section.

D) Rent expense on the leased asset.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

On January 1, 2012, Action Inc. issued $1,000,000 of 10% bonds at face value. These bonds are due in 10 years with interest payable semi-annually on June 30 and December 31. What is the amount of interest paid in 2012?

A) $ 10,000

B) $100,000

C) $ 25,000

D) $ 50,000

A) $ 10,000

B) $100,000

C) $ 25,000

D) $ 50,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

Bonds with a face amount $1,000,000, are sold at 106. The entry to record the issuance is:

A)

B)

C)

.

D)

A)

B)

C)

.

D)

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

International Corporation leased a building from Domestic Company. The 10-year lease is recorded as a capital lease. The annual payments are $10,000 and the recorded cost of the asset is $67,100. The straight-line method is used to calculate depreciation. Which of the following statements is true?

A) Depreciation expense of $6,710 will be recorded each year by International Corporation.

B) Depreciation expense of $10,000 will be recorded each year by International Corporation.

C) No depreciation expense will be recorded by International Corporation.

D) No rent expense will be recorded by International Corporation.

A) Depreciation expense of $6,710 will be recorded each year by International Corporation.

B) Depreciation expense of $10,000 will be recorded each year by International Corporation.

C) No depreciation expense will be recorded by International Corporation.

D) No rent expense will be recorded by International Corporation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

Time Value of Money Tables

Use the information provided in the time value of money tables in the text to answer the question(s) that follow.

-

Refer to the Time Value of Money Tables. Homestead Company issued $1,000,000, 7-year, 8%, bonds with interest payable semiannually. The market rate was 6%. The issuance price of the bonds is:

A) $1,111,560.

B) $1,000,000.

C) $1,151,480.

D) $1,112,944.

Use the information provided in the time value of money tables in the text to answer the question(s) that follow.

-

Refer to the Time Value of Money Tables. Homestead Company issued $1,000,000, 7-year, 8%, bonds with interest payable semiannually. The market rate was 6%. The issuance price of the bonds is:

A) $1,111,560.

B) $1,000,000.

C) $1,151,480.

D) $1,112,944.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

IBD Corporation has Current Assets of $200,000, Long Term Assets of $300,000, Current Liabilities of $100,000, Long Term Liabilities of $200,000, Paid in Capital of $150,000, and Retained Earnings of $50,000. Calculate IBD's debt to assets ratio?

A) .40

B) .60

C) .20

D) .90

A) .40

B) .60

C) .20

D) .90

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

Faultless, Inc.

Selected data from Faultless' financial statements are provided below:

-If current assets amount to $150, total assets are $350, current liabilities are $65, and total liabilities are $100, then the current ratio is:

A) 3.50.

B) 3.03.

C) 2.31.

D) 2.12.

Selected data from Faultless' financial statements are provided below:

-If current assets amount to $150, total assets are $350, current liabilities are $65, and total liabilities are $100, then the current ratio is:

A) 3.50.

B) 3.03.

C) 2.31.

D) 2.12.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

Under the effective interest method, the cash paid on each interest payment date will:

A) decrease if bonds are issued at a premium.

B) increase if bonds are issued at a premium.

C) remain constant regardless of the issuance price.

D) increase if bonds are issued at a discount.

A) decrease if bonds are issued at a premium.

B) increase if bonds are issued at a premium.

C) remain constant regardless of the issuance price.

D) increase if bonds are issued at a discount.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

Tyson Construction Inc.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. The interest expense on the bonds at June 30, 2012 is:

A) $50,000.00.

B) $45,436.60.

C) $57,135.75.

D) $90,873.20.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. The interest expense on the bonds at June 30, 2012 is:

A) $50,000.00.

B) $45,436.60.

C) $57,135.75.

D) $90,873.20.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

Britt Company

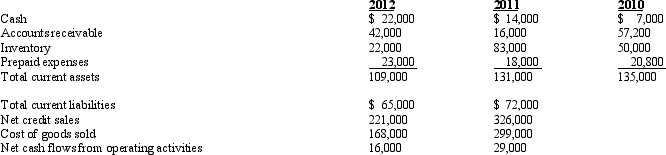

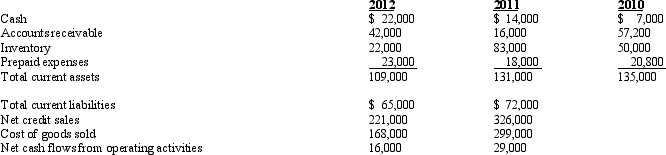

Selected data from Britt Company's financial statements are provided below:

- Refer to the selected financial data for Britt Company. Britt's current ratio for 2012 is:

A) 0.60.

B) 0.99.

C) 1.34.

D) 1.68.

Selected data from Britt Company's financial statements are provided below:

- Refer to the selected financial data for Britt Company. Britt's current ratio for 2012 is:

A) 0.60.

B) 0.99.

C) 1.34.

D) 1.68.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

Faultless, Inc.

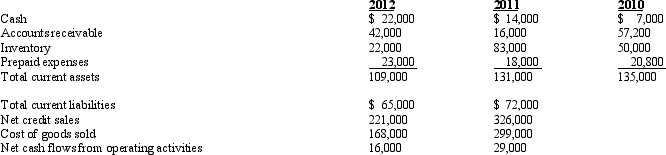

Selected data from Faultless' financial statements are provided below:

- Refer to the financial information presented for Faultless, Inc. What is the debt to assets ratio for Faultless in the year 2011 and 2012?

A) 0.692 in 2011 and 0.429 in 2012.

B) 0.429 in 2011 and 0.692 in 2012.

C) 2.250 in 2011 and 0.750 in 2012.

D) 0.750 in 2011 and 2.250 in 2012.

Selected data from Faultless' financial statements are provided below:

- Refer to the financial information presented for Faultless, Inc. What is the debt to assets ratio for Faultless in the year 2011 and 2012?

A) 0.692 in 2011 and 0.429 in 2012.

B) 0.429 in 2011 and 0.692 in 2012.

C) 2.250 in 2011 and 0.750 in 2012.

D) 0.750 in 2011 and 2.250 in 2012.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

The bond issue price is determined by calculating the:

A) present value of the stream of interest payments and the future value of the maturity amount.

B) future value of the stream of interest payments and the future value of the maturity amount.

C) future value of the stream of interest payments and the present value of the maturity amount.

D) present value of the stream of interest payments and the present value of the maturity amount.

A) present value of the stream of interest payments and the future value of the maturity amount.

B) future value of the stream of interest payments and the future value of the maturity amount.

C) future value of the stream of interest payments and the present value of the maturity amount.

D) present value of the stream of interest payments and the present value of the maturity amount.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

Max's Tire Center

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's balance sheet?

A) Total liabilities increased 8.7% during 2012.

B) Total liabilities increased 7.8% during 2012.

C) Total liabilities is 30% of total assets in 2012.

D) The total of liabilities & equity is $500,000 in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's balance sheet?

A) Total liabilities increased 8.7% during 2012.

B) Total liabilities increased 7.8% during 2012.

C) Total liabilities is 30% of total assets in 2012.

D) The total of liabilities & equity is $500,000 in 2012.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

Banister Company wishes to issue $600,000 of 10-year, 7% bonds, with interest paid annually at the end of the year. The market rate of interest is currently 5%. What information is needed in order to determine the issue price of the bond?

A) The market rate of interest, the stated rate of interest, the bond rating, and the bond life.

B) The face value of the bonds, the stated rate of interest, the market rate of interest, and the bond life.

C) The life of the bonds, the market rate of interest, the bond rating, and the face value of the bonds.

D) The face value of the bonds, the market rate of interest, the purpose of the issue, and the bond life.

A) The market rate of interest, the stated rate of interest, the bond rating, and the bond life.

B) The face value of the bonds, the stated rate of interest, the market rate of interest, and the bond life.

C) The life of the bonds, the market rate of interest, the bond rating, and the face value of the bonds.

D) The face value of the bonds, the market rate of interest, the purpose of the issue, and the bond life.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Pointe Corporation's balance sheet showed the following amounts for its liability accounts: Notes payable, $130,000; Bonds Payable, $800,000; Accrued Expenses, $20,000; and Deferred Income Tax Liability, $120,000. Total assets was $1,470,000. The debt to assets ratio is:

A) 0.27

B) 1.37

C) 0.65

D) 0.73

A) 0.27

B) 1.37

C) 0.65

D) 0.73

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

If bonds were initially issued at a discount, the interest expense on the bonds calculated using the effective interest method will:

A) decrease as the bonds approach their maturity date.

B) increase as the bonds approach their maturity date.

C) remain constant throughout the bonds' life.

D) fluctuate throughout the bonds' life.

A) decrease as the bonds approach their maturity date.

B) increase as the bonds approach their maturity date.

C) remain constant throughout the bonds' life.

D) fluctuate throughout the bonds' life.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements about bond accounting under the effective interest method is correct?

A) The cash interest paid is calculated as the bond face value ´ the market rate.

B) The interest expense is calculated as the carrying value ´ the market rate.

C) The difference between the cash interest paid and the interest expense is added to the carrying value of bonds sold at a premium.

D) The difference between the interest expense and the interest paid is deducted from the carrying value of bonds sold at a discount.

A) The cash interest paid is calculated as the bond face value ´ the market rate.

B) The interest expense is calculated as the carrying value ´ the market rate.

C) The difference between the cash interest paid and the interest expense is added to the carrying value of bonds sold at a premium.

D) The difference between the interest expense and the interest paid is deducted from the carrying value of bonds sold at a discount.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

Max's Tire Center

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's balance sheet in 2012?

A) Total liabilities increased 8.7% during 2012.

B) The total of liabilities & equity is $500,000 in 2012.

C) Total liabilities is 27.6% of total assets in 2012.

D) Total liabilities is 30% of total liabilities & equity in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's balance sheet in 2012?

A) Total liabilities increased 8.7% during 2012.

B) The total of liabilities & equity is $500,000 in 2012.

C) Total liabilities is 27.6% of total assets in 2012.

D) Total liabilities is 30% of total liabilities & equity in 2012.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

Rating Corporation's balance sheet showed the following amounts for its liability accounts: Accounts Payable, $100,000; Bonds Payable, $150,000; Taxes Payable, $20,000; and Deferred Income Tax Liability, $5,000. Total assets was $500,000. The debt to assets ratio is:

A) 0.20

B) 0.35

C) 1.22

D) 0.55

A) 0.20

B) 0.35

C) 1.22

D) 0.55

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

Britt Company

Selected data from Britt Company's financial statements are provided below:

-If a company's current ratio is 3.0 and the current liabilities are $100,000, then the current assets are:

A) $400,000.

B) $300,000.

C) $103,000.

D) $ 33,333.

Selected data from Britt Company's financial statements are provided below:

-If a company's current ratio is 3.0 and the current liabilities are $100,000, then the current assets are:

A) $400,000.

B) $300,000.

C) $103,000.

D) $ 33,333.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

Faultless, Inc.

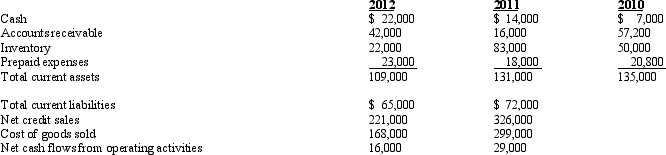

Selected data from Faultless' financial statements are provided below:

-Refer to the financial information presented for Faultless, Inc. What is the company's current ratio for 2012?

A) 0.3

B) 3.0

C) 1.0

D) 0.9

Selected data from Faultless' financial statements are provided below:

-Refer to the financial information presented for Faultless, Inc. What is the company's current ratio for 2012?

A) 0.3

B) 3.0

C) 1.0

D) 0.9

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

Bassell Enterprises has long-term assets of $800, current liabilities of $500, and long-term liabilities of $600. If the current ratio is 2.5, then current assets must be:

A) $2,000.

B) $1,250.

C) $ 625.

D) $ 200.

A) $2,000.

B) $1,250.

C) $ 625.

D) $ 200.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

Tyson Construction Inc.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. Determine the cash interest to be paid on June 30, 2012.

A) $50,000

B) $40,000

C) $42,400

D) $46,000

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. Determine the cash interest to be paid on June 30, 2012.

A) $50,000

B) $40,000

C) $42,400

D) $46,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

Creative Products Company

The following question(s) are based on items that might appear on the balance sheet of a company like the Creative Products Company. Identify how each item would be most likely classified on its balance sheet.

-

Refer to the information provided for Creative Products Company. Premium on Bonds Payable will appear as:

A) an addition to a long-term liability.

B) a revenue.

C) a long-term asset.

D) a contra-liability.

The following question(s) are based on items that might appear on the balance sheet of a company like the Creative Products Company. Identify how each item would be most likely classified on its balance sheet.

-

Refer to the information provided for Creative Products Company. Premium on Bonds Payable will appear as:

A) an addition to a long-term liability.

B) a revenue.

C) a long-term asset.

D) a contra-liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

On January 2, 2012, Golden Corporation sold $800,000 of bonds for $785,000. The bonds will mature in 10 years and pay interest annually on December 31. Golden properly recorded the payment of interest and amortization of the discount using the effective interest method. Which of the following statements is true about the carrying value of the bonds and/or the unamortized discount at the end of 2012?

A) The carrying value will be less than $785,000.

B) The carrying value will be $785,000.

C) The carrying value will be greater than $785,000.

D) The unamortized premium will be more than $15,000.

A) The carrying value will be less than $785,000.

B) The carrying value will be $785,000.

C) The carrying value will be greater than $785,000.

D) The unamortized premium will be more than $15,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

With the effective interest method of amortization, the amortization of a bond discount results in a(n):

A) increase in stockholders' equity.

B) decrease in liabilities.

C) increase in interest expense.

D) decrease in interest expense.

A) increase in stockholders' equity.

B) decrease in liabilities.

C) increase in interest expense.

D) decrease in interest expense.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

Tyson Construction Inc.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What is the carrying value of the bonds at the end of ten years before the final maturity payment is made?

A) $ 850,000

B) $1,200,000

C) $1,000,000

D) $1,150,000

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What is the carrying value of the bonds at the end of ten years before the final maturity payment is made?

A) $ 850,000

B) $1,200,000

C) $1,000,000

D) $1,150,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

State Corporation

Below is a note on Disclosure of Leases for the State Corporation.

The State Corporation leases office, warehouse and showroom space, retail stores and office equipment under operating leases, which expire no later than 2027. The Corporation normalizes fixed escalations in rental expense under its operating leases. Minimum annual rentals under non-cancelable operating leases, excluding operating cost escalations and contingent rental amounts based upon retail sales, are payable as follows:

Fiscal year ending March 31,

Rent expense was $12,551,000; $8,911,000; and $5,768,000 for the years ended March 31, 2012, 2011, and 2010, respectively.

-

Refer to the information provided for State Corporation. What are the two types of leases that a company can have? Describe each briefly.

Below is a note on Disclosure of Leases for the State Corporation.

The State Corporation leases office, warehouse and showroom space, retail stores and office equipment under operating leases, which expire no later than 2027. The Corporation normalizes fixed escalations in rental expense under its operating leases. Minimum annual rentals under non-cancelable operating leases, excluding operating cost escalations and contingent rental amounts based upon retail sales, are payable as follows:

Fiscal year ending March 31,

Rent expense was $12,551,000; $8,911,000; and $5,768,000 for the years ended March 31, 2012, 2011, and 2010, respectively.

-

Refer to the information provided for State Corporation. What are the two types of leases that a company can have? Describe each briefly.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

The amount of money the borrower agrees to repay at maturity of a bond is usually referred to as the ____________________.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

On January 1, 2012, Hawkeye Corporation issued $5,000,000 of 8% bonds, due in five years with interest payable annually on December 31. The market rate is 9 percent. Calculate the present value (market value) of the bonds.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

State Corporation

Below is a note on Disclosure of Leases for the State Corporation.

The State Corporation leases office, warehouse and showroom space, retail stores and office equipment under operating leases, which expire no later than 2027. The Corporation normalizes fixed escalations in rental expense under its operating leases. Minimum annual rentals under non-cancelable operating leases, excluding operating cost escalations and contingent rental amounts based upon retail sales, are payable as follows:

Fiscal year ending March 31,

Rent expense was $12,551,000; $8,911,000; and $5,768,000 for the years ended March 31, 2012, 2011, and 2010, respectively.

-

Refer to the information provided for State Corporation. Does the note disclosure show evidence of the two types of leases?

Below is a note on Disclosure of Leases for the State Corporation.

The State Corporation leases office, warehouse and showroom space, retail stores and office equipment under operating leases, which expire no later than 2027. The Corporation normalizes fixed escalations in rental expense under its operating leases. Minimum annual rentals under non-cancelable operating leases, excluding operating cost escalations and contingent rental amounts based upon retail sales, are payable as follows:

Fiscal year ending March 31,

Rent expense was $12,551,000; $8,911,000; and $5,768,000 for the years ended March 31, 2012, 2011, and 2010, respectively.

-

Refer to the information provided for State Corporation. Does the note disclosure show evidence of the two types of leases?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

Creative Products Company

The following question(s) are based on items that might appear on the balance sheet of a company like the Creative Products Company. Identify how each item would be most likely classified on its balance sheet.

-

Refer to the information provided for Creative Products Company. Current portion of long-term debt will appear as a:

A) current liability.

B) long-term liability.

C) current asset.

D) long-term asset.

The following question(s) are based on items that might appear on the balance sheet of a company like the Creative Products Company. Identify how each item would be most likely classified on its balance sheet.

-

Refer to the information provided for Creative Products Company. Current portion of long-term debt will appear as a:

A) current liability.

B) long-term liability.

C) current asset.

D) long-term asset.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

On January 1, 2012, Investor Corporation issued $10,000,000, 10-year, 5% bonds at 85. Interest payments are made annually.

Required:

A) Give the journal entry to record the issuance of the bonds on january 1,2012 .

B) Give the joumal entry necessary to recognize the interest expense for 2012 uncler the straight-line amoutization method

C) Give the iournal entry to record the repayment of the loan principal on December .

Required:

A) Give the journal entry to record the issuance of the bonds on january 1,2012 .

B) Give the joumal entry necessary to recognize the interest expense for 2012 uncler the straight-line amoutization method

C) Give the iournal entry to record the repayment of the loan principal on December .

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

Flounder Inc.

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. What is the carrying value of the bonds at the end of the ten years before the final maturity payment is made?

A) $800,000

B) $662,356

C) $137,643

D) $0

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. What is the carrying value of the bonds at the end of the ten years before the final maturity payment is made?

A) $800,000

B) $662,356

C) $137,643

D) $0

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

Flounder Inc.

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. The interest payment on June 30, 2012, is:

A) $30,000

B) $32,237

C) $31,740

D) $36,000

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. The interest payment on June 30, 2012, is:

A) $30,000

B) $32,237

C) $31,740

D) $36,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

With the effective interest method of amortization, the amortization of a bond premium results in a(n)

A) increase in liabilities.

B) decrease of stockholders' equity.

C) increase in interest expense.

D) decrease in interest expense.

A) increase in liabilities.

B) decrease of stockholders' equity.

C) increase in interest expense.

D) decrease in interest expense.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

Flounder Inc.

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. What is the carrying value of the bonds after the first interest payment is made on June 30, 2012?

A) $662,356.40

B) $666,097.78

C) $670,063.65

D) $133,902.22

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. What is the carrying value of the bonds after the first interest payment is made on June 30, 2012?

A) $662,356.40

B) $666,097.78

C) $670,063.65

D) $133,902.22

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

Tyson Construction Inc.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What amount besides the interest payment would Tyson repay its bondholders on the maturity date?

A) $ 850,000

B) $1,150,000

C) $1,000,000

D) only the last interest payment

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What amount besides the interest payment would Tyson repay its bondholders on the maturity date?

A) $ 850,000

B) $1,150,000

C) $1,000,000

D) only the last interest payment

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

On January 1, 2012, Lead Inc. issues $10,000,000, five-year, 9 percent bonds at 98. The discount at the time of sales is $200,000. Interest is paid semiannually on June 30, and December 31.

Required:

A) Frovide the jounal entry to record the issuance of the bonds on January .

B) Provide the jounal entry to recogrize the interest expense on June 30 and December 31, 2012-2016 using straight-line amoutization

C) Give the journal entry to record the repayment of the loan principal on December 31,2016.

Required:

A) Frovide the jounal entry to record the issuance of the bonds on January .

B) Provide the jounal entry to recogrize the interest expense on June 30 and December 31, 2012-2016 using straight-line amoutization

C) Give the journal entry to record the repayment of the loan principal on December 31,2016.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

Obligations that extend beyond one year are referred to as ____________________.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

Flounder Inc.

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. The interest expense on the bonds at June 30, 2012, is:

A) $79,482.77.

B) $36,000.00.

C) $39,741.38.

D) $29,806.04.

Use the information provided for Flounder Inc. to answer the question(s) using the effective interest method.

On January 1, 2012, Flounder Inc. issued $800,000, 10-year, 9% bonds for $662,356. The bonds pay interest on June 30 and December 31. The market rate is 12%.

-

Refer to the information provided for Flounder Inc. The interest expense on the bonds at June 30, 2012, is:

A) $79,482.77.

B) $36,000.00.

C) $39,741.38.

D) $29,806.04.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

Tyson Construction Inc.

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What is the carrying value of the bonds after the first interest payment is made on June 30, 2012?

A) $1,135,915.00

B) $1,131,351.60

C) $1,140,478.40

D) $1,000,000.00

Use the information provided for Tyson Construction Inc. to answer the following question(s) using the effective interest method.

On January 2, 2012, Tyson Construction Inc. issued $1,000,000, 10-year bonds for $1,135,915. The bonds pay interest on June 30 and December 31. The stated rate is 10% and the market rate is 8%.

-

Refer to the information provided for Tyson Construction Inc. What is the carrying value of the bonds after the first interest payment is made on June 30, 2012?

A) $1,135,915.00

B) $1,131,351.60

C) $1,140,478.40

D) $1,000,000.00

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

On January 1, 2012, Upgrade Co. issued $1,000,000 of 10 percent bonds at face value. These bonds are due in five years with interest payable annually on December 31.

Required:

(A) Provide the joumal entry necessary to recognize the interest expense on December 31, 2012-2016

(B) Provide the jounal entry to record the repayment of the loan principal on December 31, 2016.

Required:

(A) Provide the joumal entry necessary to recognize the interest expense on December 31, 2012-2016

(B) Provide the jounal entry to record the repayment of the loan principal on December 31, 2016.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck