Deck 8: Capital Gains and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 8: Capital Gains and Losses

1

If a capital asset acquired on October 27,2001 is sold on April 30,2013 for a gain,the gain is a long- term capital gain.

True

2

If a capital asset acquired August 5,2013 is sold on February 6,2014,any gain is a short-term capital gain.

True

3

Cows used in a farming business are Section 1245 property.

True

4

A taxpayer eligible to use the installment method for reporting gain on the sale of an asset must use the installment method unless he or she elects out of the provision.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

Assuming a taxpayer has no other gains or losses for the year,a loss from the theft of a Section 1231 asset is treated as a capital loss.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

The basis of property received as an inheritance is generally equal to the fair market value at the date of death.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

Taxpayers are allowed to offset net short-term capital losses with net long-term capital gains.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

There is no limit on the amount of capital losses that an individual may deduct against ordinary income.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

Net short-term capital gains may be offset by net long-term capital losses.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

The first day a capital asset,acquired on August 31,2013,may be sold for long-term capital gain or loss treatment is September 1,2014.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

If a taxpayer is relieved of a liability on the disposition of property,the amount of the liability should be included in the amount realized on the sale or other disposition.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

A taxpayer's personal automobile is a capital asset.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

If the proceeds from the sale of property will be collected over a period of more than one year,a taxpayer is required to use the installment method.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

A net long-term gain from the theft of a Section 1231 asset is treated as a Section 1231 gain.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

The amount of ordinary income recognized on the sale of a Section 1245 asset is limited to the total gain realized on the sale.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

An artist's painting is not a capital asset when held by the artist.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

If property is received from a decedent,the taxpayer who inherits the property has the same basis in the property as the decedent.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

The depreciation recapture provisions are designed to prevent taxpayers from converting capital gains into ordinary income.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

Accounts receivable are capital assets.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

For 2013,long-term capital gains are not afforded preferential tax treatment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

To have the like-kind exchange provisions apply,a taxpayer must make an election.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is not true about capital assets?

A)Real property used in a trade or business is not a capital asset.

B)Capital losses may be carried back for 3 years to offset capital gains in those years.

C)For 2013,net long-term capital gains are granted preferential tax treatment.

D)Individual taxpayers may deduct net capital losses of up to $3,000 per year.

E)Shares of stock held for investment are capital assets.

A)Real property used in a trade or business is not a capital asset.

B)Capital losses may be carried back for 3 years to offset capital gains in those years.

C)For 2013,net long-term capital gains are granted preferential tax treatment.

D)Individual taxpayers may deduct net capital losses of up to $3,000 per year.

E)Shares of stock held for investment are capital assets.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

In 2013,the basis of a taxpayer's replacement residence is equal to the cost of the replacement residence less the gain which was deferred on the sale of the old residence.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

The exclusion of gain on the sale of a personal residence may be elected only by a taxpayer who has owned three or more residences.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is a capital asset?

A)Inventory held by a manufacturer

B)Accounts receivable held by a dentist

C)All property owned by a taxpayer other than property specifically noted in the law as an exception

D)Depreciable property and real estate used in a trade or business

A)Inventory held by a manufacturer

B)Accounts receivable held by a dentist

C)All property owned by a taxpayer other than property specifically noted in the law as an exception

D)Depreciable property and real estate used in a trade or business

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

The taxpayer generally has only 1 year to replace involuntarily converted property in order to postpone the recognition of gain.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

If not entirely used in one sale,the unused portion of the $250,000 exclusion on the sale of a taxpayer's principal residence may be used to reduce the recognized gain on the sale of the taxpayer's next residence.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

The exchange of inventory does not qualify for like-kind exchange treatment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

Sol purchased land as an investment on January 12,2004 for $85,000.On January 31,2013,Sol sold the land for $20,000 cash.In addition,the purchaser assumed the mortgage of $70,000 on the land.What is the amount of the realized gain or loss on the sale?

A)$65,000 loss

B)$15,000 loss

C)$5,000 gain

D)$90,000 gain

E)None of the above

A)$65,000 loss

B)$15,000 loss

C)$5,000 gain

D)$90,000 gain

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following is a capital asset?

A)Accounts receivable

B)Copyright held by the author

C)Securities

D)Inventories

E)All of the above are capital assets

A)Accounts receivable

B)Copyright held by the author

C)Securities

D)Inventories

E)All of the above are capital assets

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

The condemnation of property is not an involuntary conversion,since it is done pursuant to a government decree.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following sales results in a short-term gain/loss?

A)A capital asset bought on June 30,2012 and sold June 20,2013.

B)A capital asset bought on July 25,2012 and sold August 19,2013.

C)A capital asset bought on September 12,2006 and sold August 19,2013.

D)A capital asset bought on August 15,2012 and sold August 16,2013.

E)All of the above are long-term gains/losses.

A)A capital asset bought on June 30,2012 and sold June 20,2013.

B)A capital asset bought on July 25,2012 and sold August 19,2013.

C)A capital asset bought on September 12,2006 and sold August 19,2013.

D)A capital asset bought on August 15,2012 and sold August 16,2013.

E)All of the above are long-term gains/losses.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

Sol purchased land as an investment on January 12,2004 for $85,000.On January 31,2013,Sol sold the land for $90,000 cash.What is the nature of the gain or loss?

A)Long-term capital loss

B)Long-term capital gain

C)Short-term capital gain

D)Short-term capital loss

E)None of the above

A)Long-term capital loss

B)Long-term capital gain

C)Short-term capital gain

D)Short-term capital loss

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

In a like-kind exchange,relief from a liability is treated as boot.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

If insurance proceeds exceed the taxpayer's basis in property destroyed by fire and the proceeds are not invested in similar property,the taxpayer may be required to recognize a gain.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

The exchange of shares of stock does not qualify for like-kind exchange treatment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

If a taxpayer sells his personal residence and purchases a new residence,realized gain may be recognized.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

An asset has an original basis of $25,000 and depreciation has been claimed for the asset in the amount of $20,000.If the asset's adjusted basis is $15,000,what is the amount of capital improvements that have been made to the asset?

A)$5,000

B)$10,000

C)$20,000

D)$30,000

E)None of the above

A)$5,000

B)$10,000

C)$20,000

D)$30,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is a capital asset?

A)A literary work held by the author

B)Real estate held by a developer

C)A taxpayer's personal automobile

D)A truck used in a taxpayer's business

E)None of the above

A)A literary work held by the author

B)Real estate held by a developer

C)A taxpayer's personal automobile

D)A truck used in a taxpayer's business

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

If property is inherited by a taxpayer,

A)To the recipient,the basis for the property is the same as the basis to the decedent.

B)At sale date,the basis of the property to the recipient differs depending on whether the property was sold at a gain or a loss.

C)At sale date,the recipient will not have a gain or loss even if the recipient has held the property for more than a year.

D)In general,the basis to the recipient is the fair market value at the decedent's date of death.

A)To the recipient,the basis for the property is the same as the basis to the decedent.

B)At sale date,the basis of the property to the recipient differs depending on whether the property was sold at a gain or a loss.

C)At sale date,the recipient will not have a gain or loss even if the recipient has held the property for more than a year.

D)In general,the basis to the recipient is the fair market value at the decedent's date of death.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

In 2013,Paul,a single taxpayer,has taxable income of $30,000 exclusive of capital gains and losses.Paul incurred a $1,000 short-term capital loss and a $5,000 long-term capital loss.What is the amount of his long-term capital loss carryover to 2014?

A)$0

B)$2,000

C)$3,000

D)$5,000

E)None of the above

A)$0

B)$2,000

C)$3,000

D)$5,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

For purposes of taxation of capital gains:

A)Short-term capital gains are taxed at 5 percent.

B)Ordinary income tax rates are applied to gains on collectibles.

C)Gains on Section 1231 assets may be treated as long-term capital gains,while losses in some cases may be deducted as ordinary losses.

D)Under the provisions of Section 1245,any gain recognized on the disposition of a Section 1245 asset will be classified as a capital gain.

A)Short-term capital gains are taxed at 5 percent.

B)Ordinary income tax rates are applied to gains on collectibles.

C)Gains on Section 1231 assets may be treated as long-term capital gains,while losses in some cases may be deducted as ordinary losses.

D)Under the provisions of Section 1245,any gain recognized on the disposition of a Section 1245 asset will be classified as a capital gain.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

Which one of the following is true about Section 1231 assets?

A)Section 1231 assets are treated like capital assets when they produce losses on sale.

B)Business property held 1 year or less is considered a Section 1231 asset.

C)Section 1231 assets include company stock.

D)Section 1231 asset losses must be netted against 1231 asset gains before tax treatment is determined.

E)All of the above are false.

A)Section 1231 assets are treated like capital assets when they produce losses on sale.

B)Business property held 1 year or less is considered a Section 1231 asset.

C)Section 1231 assets include company stock.

D)Section 1231 asset losses must be netted against 1231 asset gains before tax treatment is determined.

E)All of the above are false.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following assets is not a Section 1231 asset?

A)Equipment used in a business

B)The unharvested crops of a farmer

C)Timber

D)Inventory

E)All of the above are Section 1231 assets

A)Equipment used in a business

B)The unharvested crops of a farmer

C)Timber

D)Inventory

E)All of the above are Section 1231 assets

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

Martha has a net capital loss of $20,000 and other ordinary taxable income of $45,000 for the current tax year.What is the amount of Martha's taxable income after deducting the allowed capital loss?

A)$25,000

B)$35,000

C)$42,000

D)$45,000

E)None of the above

A)$25,000

B)$35,000

C)$42,000

D)$45,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

Martha has a net capital loss of $20,000 and other ordinary taxable income of $45,000 for the current year.What is the amount of Martha's capital loss carryforward?

A)$0

B)$10,000

C)$14,000

D)$17,000

E)None of the above

A)$0

B)$10,000

C)$14,000

D)$17,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

Ben purchased an apartment building on January 1,1994,for $200,000.The building has been depreciated over the appropriate recovery period using the straight-line method.On December 31,2013,the building was sold for $220,000,when the accumulated depreciation was $62,500.Ben is in the highest tax bracket;on his 2013 tax return,he should report:

A)Section 1231 gain of $20,000 and ordinary income of $62,500

B)Section 1231 gain of $62,500 and ordinary income of $20,000

C)Ordinary income of $82,500

D)Section 1231 gain of $20,000 and "unrecaptured depreciation" taxed at 25 percent of

E)None of the above

A)Section 1231 gain of $20,000 and ordinary income of $62,500

B)Section 1231 gain of $62,500 and ordinary income of $20,000

C)Ordinary income of $82,500

D)Section 1231 gain of $20,000 and "unrecaptured depreciation" taxed at 25 percent of

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

48

Sol purchased land as an investment on January 12,2004,for $85,000.On January 31,2013,Sol sold the land for $20,000 cash.In addition,the purchaser assumed the mortgage of $70,000 on the land.What is the amount realized not gain realized)on the sale of the land?

A)$5,000

B)$20,000

C)$70,000

D)$90,000

E)None of the above

A)$5,000

B)$20,000

C)$70,000

D)$90,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

Robert and Becca are in the 25 percent tax bracket.They have a long-term capital gain of $27,000 and a long-term capital loss of $18,000 on sales of stock in 2013.What will their capital gains tax be in 2013?

A)$4,050

B)$6,750

C)$1,350

D)$9,000

E)None of the above is correct

A)$4,050

B)$6,750

C)$1,350

D)$9,000

E)None of the above is correct

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

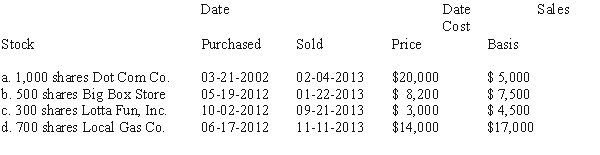

For the year 2013,Susan had salary income of $19,000.In addition she reported the following capital transactions during the year: There were no other items includable in her gross income.What is the amount of her adjusted gross income for 2013?

A)$19,000

B)$21,400

C)$23,000

D)$26,000

E)None of the above

A)$19,000

B)$21,400

C)$23,000

D)$26,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

On December 31,2013,Henry,a sole proprietor,sold for $65,000 a machine that was used in his business.The machine had been purchased in 2003 for $50,000,and when it was sold,it had accumulated depreciation of $20,000 and an adjusted basis of $30,000.For the year 2013,how should this gain be treated?

A)Ordinary income of $35,000

B)Section 1231 gain of $35,000

C)Section 1231 gain of $20,000 and ordinary income of $15,000

D)Section 1231 gain of $15,000 and ordinary income of $20,000

E)None of the above

A)Ordinary income of $35,000

B)Section 1231 gain of $35,000

C)Section 1231 gain of $20,000 and ordinary income of $15,000

D)Section 1231 gain of $15,000 and ordinary income of $20,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is true about capital gains?

A)Short-term capital gains are not netted with other capital gains and losses.

B)For 2013,long-term capital gains are subject to special tax treatment.

C)Long-term capital gains are never taxed.

D)Net short-term capital gains are not netted with net long-term capital losses.

E)None of the above.

A)Short-term capital gains are not netted with other capital gains and losses.

B)For 2013,long-term capital gains are subject to special tax treatment.

C)Long-term capital gains are never taxed.

D)Net short-term capital gains are not netted with net long-term capital losses.

E)None of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

For purposes of determining the adjusted basis of a capital asset at the time of its sale,

A)Capital improvements are added to the basis.

B)Ordinary repairs reduce the adjusted basis.

C)Accumulated depreciation is added to the basis.

D)The basis does not include costs such as title insurance and escrow fees related to the initial purchase.

A)Capital improvements are added to the basis.

B)Ordinary repairs reduce the adjusted basis.

C)Accumulated depreciation is added to the basis.

D)The basis does not include costs such as title insurance and escrow fees related to the initial purchase.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

The adjusted basis of an asset may be determined by the:

A)Selling price + gain realized.

B)Selling price - gain realized.

C)Selling price + capital improvements - accumulated depreciation.

D)Original basis + capital improvements - selling price.

E)None of the above.

A)Selling price + gain realized.

B)Selling price - gain realized.

C)Selling price + capital improvements - accumulated depreciation.

D)Original basis + capital improvements - selling price.

E)None of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

An asset's adjusted basis is computed as:

A)Original basis + capital improvements - accumulated depreciation.

B)Original basis - capital improvements + accumulated depreciation.

C)Original basis + capital improvements + accumulated depreciation.

D)Original basis + capital improvements + gain or loss realized.

E)None of the above.

A)Original basis + capital improvements - accumulated depreciation.

B)Original basis - capital improvements + accumulated depreciation.

C)Original basis + capital improvements + accumulated depreciation.

D)Original basis + capital improvements + gain or loss realized.

E)None of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

For the 2013 tax year,Morgan had $25,000 of ordinary income.In addition,he had an $1,800 long-term capital loss and a $1,500 short-term capital loss.What will be the amount of Morgan's capital loss carryforward to 2014?

A)$0

B)$300

C)$500

D)$3,000

E)$3,300

A)$0

B)$300

C)$500

D)$3,000

E)$3,300

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

In December,2013,Ben and Jeri married,filing jointly)have a long-term capital gain of $55,000 on the sale of stock held for 4 years.They have no other capital gains and losses for the year.After standard deduction and personal exemptions,their ordinary income for the year,before the capital gain,is $72,500,making their total income for the year $127,500,$72,500 + $55,000).In 2013,married taxpayers pay tax of $9,983 at 10 percent and 15 percent rates from the tax table)on the first $72,500 of ordinary taxable income and 25 percent on ordinary taxable income up to $146,400.What is their total tax liability?

A)$9,983

B)$23,733

C)$18,233

D)$13,750

A)$9,983

B)$23,733

C)$18,233

D)$13,750

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

Carlos bought a building for $111,000 in 2009.He built an addition to the building for $24,000.In 2013,he sold it for $190,000.What was his long-term capital gain?

A)$190,000

B)$55,000

C)$79,000

D)$175,000

E)$59,000

A)$190,000

B)$55,000

C)$79,000

D)$175,000

E)$59,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

Bennett purchased a tract of land for $20,000 in 2004 when he heard that a new highway was going to be constructed through the property and the land would soon be worth $200,000.The highway project was abandoned in 2013 and the value of the land fell to $15,000.Bennett can claim a loss in 2013 of:

A)$0

B)$5,000

C)$165,000

D)$180,000

E)None of the above

A)$0

B)$5,000

C)$165,000

D)$180,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

In 2013,Marc,a single taxpayer,has ordinary income of $35,000.In addition,he has $3,000 in short- term capital gains,short-term capital losses of $6,000,and long-term capital gains of $4,000.What is Marc's adjusted gross income AGI)for 2013?

A)$32,000

B)$39,000

C)$36,000

D)$34,000

A)$32,000

B)$39,000

C)$36,000

D)$34,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

Perry acquired raw land as an investment in 1996.The land cost $60,000.In 2013,the land is sold for a total sales price of $120,000,consisting of $10,000 cash and the buyer's note for $110,000.If Perry elects to recognize the entire gain in the year of sale,what is his recognized gain in 2013?

A)$50,000

B)$60,000

C)$100,000

D)$110,000

E)None of the above

A)$50,000

B)$60,000

C)$100,000

D)$110,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

On August 8,2013,Sam,single,age 62,sold for $210,000 his principal residence,which he has lived in for 10 years,and which had an adjusted basis of $60,000.On November 1,2013,he purchased a new residence for $80,000.For 2013,Sam should recognize a gain on the sale of his residence of:

A)$0

B)$25,000

C)$50,000

D)$130,000

E)None of the above

A)$0

B)$25,000

C)$50,000

D)$130,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

Perry acquired raw land as an investment in 1996.The land cost $60,000.In 2013,the land is sold for a total sales price of $120,000,consisting of $10,000 cash and the buyer's note for $110,000.Assume that Perry uses the installment method to recognize the gain and receives only the $10,000 down payment in the year of sale.How much gain should Perry recognize in 2013?

A)$5,000

B)$5,833

C)$7,000

D)$9,000

E)None of the above

A)$5,000

B)$5,833

C)$7,000

D)$9,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is correct with respect to the deferral provisions of the Tax Code?

A)The like-kind exchange provision is elective.

B)The involuntary conversion provision is elective.

C)The exclusion of gain on the sale of a personal residence is elective.

D)Both the like-kind exchange and the involuntary conversion provisions are elective.

E)None of the above.

A)The like-kind exchange provision is elective.

B)The involuntary conversion provision is elective.

C)The exclusion of gain on the sale of a personal residence is elective.

D)Both the like-kind exchange and the involuntary conversion provisions are elective.

E)None of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

Simonne,a single taxpayer,bought her home in La Jolla 25 years ago for $45,000.She has lived continuously in the home since she purchased it.In December,2013,she sells her home for $405,000.What is Simonne's taxable gain on the sale?

A)$0

B)$360,000

C)$235,000

D)$110,000

A)$0

B)$360,000

C)$235,000

D)$110,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

In 2013,Tim sells Section 1245 property for $28,000 that he had purchased in 2007.Tim has claimed $5,000 in depreciation on the property and originally purchased it for $15,000.How much of the gain is taxable as ordinary income?

A)$5,000

B)$8,000

C)$18,000

D)$13,000

E)None of the above is correct

A)$5,000

B)$8,000

C)$18,000

D)$13,000

E)None of the above is correct

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

Terry has a casualty gain of $1,000 and a casualty loss of $5,400,before the $100 floor and before the adjusted gross income limitation.The gain and loss were the result of two separate casualties occurring during 2013 and both properties were personal-use assets.If Terry itemizes deductions on her 2013 return and has adjusted gross income of $25,000,what is Terry's gain or net itemized deduction as a result of these casualties?

A)$5,300 itemized deduction,$1,000 capital gain

B)$4,300 itemized deduction

C)$1,800 itemized deduction

D)$2,800 itemized deduction,$1,000 capital gain

E)None of the above

A)$5,300 itemized deduction,$1,000 capital gain

B)$4,300 itemized deduction

C)$1,800 itemized deduction

D)$2,800 itemized deduction,$1,000 capital gain

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is true?

A)A taxpayer's personal residence qualifies for a like-kind exchange.

B)A taxpayer who sells a personal residence may always exclude the realized gain from taxable income.

C)A one-time election is available to taxpayers 55 years of age or older which allows them to sell their personal residences and to exclude all of the realized gain.

D)None of the above are true.

E)All of the above are true.

A)A taxpayer's personal residence qualifies for a like-kind exchange.

B)A taxpayer who sells a personal residence may always exclude the realized gain from taxable income.

C)A one-time election is available to taxpayers 55 years of age or older which allows them to sell their personal residences and to exclude all of the realized gain.

D)None of the above are true.

E)All of the above are true.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

Simon sold investment property 2 years ago for $750.Simon's basis in the property was $300.Simon is receiving $150 per year from the buyer.Simon reports this income on the installment method.If Simon collects $150 in principal during the current year,how much gain should he report from the sale for the year?

A)$0

B)$75

C)$90

D)$150

E)None of the above

A)$0

B)$75

C)$90

D)$150

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

Johnny owned a gas station with an adjusted basis of $300,000.After it was destroyed in a fire,he received $600,000 from the insurance company.Within the next year,he bought a new gas station for $480,000.What is Johnny's taxable gain and what is the basis in the new building?

A)$120,000;$300,000

B)$180,000;$300,000

C)$120,000;$480,000

D)$120,000;$600,000

E)$180,000;$480,000

A)$120,000;$300,000

B)$180,000;$300,000

C)$120,000;$480,000

D)$120,000;$600,000

E)$180,000;$480,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

Tim sells land to Brad for $75,000.Tim originally purchased the land for $50,000.Brad agrees to pay Tim five annual installments of $15,000 each.In year three,Brad makes his third installment of $15,000.How much taxable gain will Tim have in year three?

A)$30,000

B)$20,000

C)$5,000

D)$10,000

E)All the taxable gain should be recognized in year one

A)$30,000

B)$20,000

C)$5,000

D)$10,000

E)All the taxable gain should be recognized in year one

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

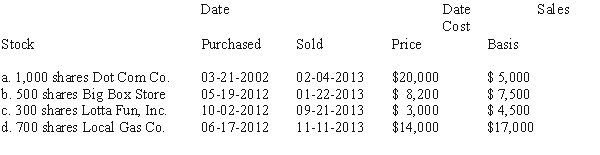

Emily sold the following investments during the year:  For each stock,calculate the amount and the nature of the gain or loss.

For each stock,calculate the amount and the nature of the gain or loss.

For each stock,calculate the amount and the nature of the gain or loss.

For each stock,calculate the amount and the nature of the gain or loss.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

In January 2013,Keyaki Construction Company exchanged an old truck,which cost $54,000 and had accumulated depreciation of $18,000,for a new truck having a fair market value of $65,000.In connection with the exchange,Keyaki paid $35,000 in cash.What is the tax basis of the new truck?

A)$54,000

B)$65,000

C)$71,000

D)$89,000

E)None of the above

A)$54,000

B)$65,000

C)$71,000

D)$89,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

Sally acquired an apartment building in 1998 for $150,000 and sold it for $400,000 in 2013.At the time of the sale,there is $55,000 of accumulated straight-line depreciation on the apartment building.Assuming Sally is in the 35 percent tax bracket for ordinary income,how much of her gain is taxed at 15 percent?

A)None

B)$55,000

C)$250,000

D)$305,000

E)$400,000

A)None

B)$55,000

C)$250,000

D)$305,000

E)$400,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

Joseph exchanged land tax basis of $36,000),that he had held for 4 years as an investment,for similar land valued at $40,000 which was owned by Adrian.In connection with this transaction,Adrian assumed Joseph's $12,000 mortgage.As a result of this transaction Joseph should report a long-term capital gain of:

A)$0

B)$4,000

C)$12,000

D)$16,000

E)None of the above

A)$0

B)$4,000

C)$12,000

D)$16,000

E)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is true of a like-kind exchange:

A)There must be no cash exchanged to qualify.

B)The properties exchanged cannot be personal residences.

C)Office furniture can be exchanged for computers.

D)A new holding period for capital gains treatment starts on the day the exchange is completed.

A)There must be no cash exchanged to qualify.

B)The properties exchanged cannot be personal residences.

C)Office furniture can be exchanged for computers.

D)A new holding period for capital gains treatment starts on the day the exchange is completed.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

Casualty gains and losses from business or investment property:

A)May be treated differently depending on whether the property has been held 1 year or less or has been held over 1 year.

B)Are treated the same as casualty gains and losses from personal property.

C)Are subject to the 10 percent of adjusted gross income limitation.

D)Are not subject to the depreciation recapture provisions.

A)May be treated differently depending on whether the property has been held 1 year or less or has been held over 1 year.

B)Are treated the same as casualty gains and losses from personal property.

C)Are subject to the 10 percent of adjusted gross income limitation.

D)Are not subject to the depreciation recapture provisions.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

Which one of the following qualifies as a like-kind exchange?

A)A chicken held by a farmer exchanged for medical services.

B)A home owned and lived in by a taxpayer exchanged for a new personal residence.

C)IBM stock exchanged for Exxon stock.

D)A Dodge Ram pickup truck used in business traded in for a new Ford 250 pickup truck also intended for business use.

E)None of the above are like-kind property.

A)A chicken held by a farmer exchanged for medical services.

B)A home owned and lived in by a taxpayer exchanged for a new personal residence.

C)IBM stock exchanged for Exxon stock.

D)A Dodge Ram pickup truck used in business traded in for a new Ford 250 pickup truck also intended for business use.

E)None of the above are like-kind property.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

Jerry bought his home 15 years ago for $60,000.Three years ago Jerry married Debbie and she moved into the same house and has lived there since.If they sell Jerry's house in December,2013 for $340,000,what is their taxable gain on a joint tax return?

A)$0

B)$280,000

C)$155,000

D)$30,000

A)$0

B)$280,000

C)$155,000

D)$30,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

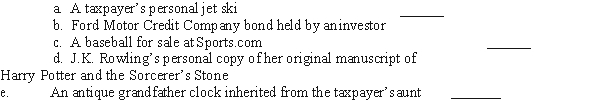

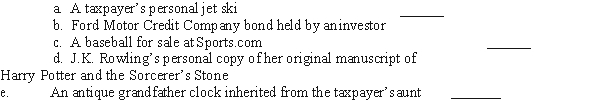

If the following are capital assets,mark with a "Yes." If they are not capital assets,mark with a "No."

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck