Deck 6: Additional Aspects of Financial Reporting and Financial Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/94

Play

Full screen (f)

Deck 6: Additional Aspects of Financial Reporting and Financial Analysis

1

An operating segment is a reportable segment if it

A)satisfies the revenue test, profit test, and asset test

B)satisfies the revenue test, profit test, or asset test

C)operates predominately within a single industry

D)satisfies the net income test

A)satisfies the revenue test, profit test, and asset test

B)satisfies the revenue test, profit test, or asset test

C)operates predominately within a single industry

D)satisfies the net income test

B

2

Under GAAP for segment reporting, a company must report

A)a measure of profit or loss for each reportable segment

B)factors used to identify its reportable segments

C)the types of products and services from which each reporting segment derives its revenues

D)all of these choices

A)a measure of profit or loss for each reportable segment

B)factors used to identify its reportable segments

C)the types of products and services from which each reporting segment derives its revenues

D)all of these choices

D

3

An auditor's report contains all of the following paragraphs except

A)introductory

B)scope

C)definition

D)conclusion

A)introductory

B)scope

C)definition

D)conclusion

D

4

If the information contained in the financial statements is not presented fairly in conformity with generally accepted accounting principles, the auditor will issue a(n)

A)modified opinion

B)qualified opinion

C)adverse opinion

D)disclaimer of opinion

A)modified opinion

B)qualified opinion

C)adverse opinion

D)disclaimer of opinion

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

5

Tanner Company identified three operating segments by analyzing its types of products produced.Information related to those segments for 2010 is presented below: For measurement purposes, Tanner typically allocates common expenses to segments based on the ratio of a segment's profit before common expenses to total profit before common expenses.As this allocation method reasonably allocates common expenses to segments, Segment A's operating profit for segment reporting purposes would be

A)$ 0

B)$ 50, 000

C)$ 75, 000

D)$100, 000

A)$ 0

B)$ 50, 000

C)$ 75, 000

D)$100, 000

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

6

An auditor issues an audit report that expresses three opinions.Which of the following is not one of those opinions?

A)whether management's assessment of the company's internal control over its financial reporting is appropriate

B)whether management's assessment that the financial statements are based upon the proper use of GAAP

C)whether the company maintained effective internal control over its financial reporting

D)whether the company's financial statements present fairly the results of operations and cash flows in conformity with GAAP

A)whether management's assessment of the company's internal control over its financial reporting is appropriate

B)whether management's assessment that the financial statements are based upon the proper use of GAAP

C)whether the company maintained effective internal control over its financial reporting

D)whether the company's financial statements present fairly the results of operations and cash flows in conformity with GAAP

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

7

An operating segment is a component of a company

A)that engages in business activities to earn revenues and incur expenses

B)whose operating results are regularly reviewed by the company's chief operating officer for budgeting and evaluation purposes

C)for which financial information is available

D)all of these choices

A)that engages in business activities to earn revenues and incur expenses

B)whose operating results are regularly reviewed by the company's chief operating officer for budgeting and evaluation purposes

C)for which financial information is available

D)all of these choices

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

8

Information reported or disclosed about the profit or loss of reportable segments consists of

A)a measure of operating profit or loss

B)segment revenues (separated into sales to external customers and intersegment sales)

C)interest revenue and interest expense

D)all of these choices

A)a measure of operating profit or loss

B)segment revenues (separated into sales to external customers and intersegment sales)

C)interest revenue and interest expense

D)all of these choices

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following auditor opinions would be appropriate when the auditor is unable to determine if a company's statements were prepared in conformity with GAAP?

A)adverse opinion

B)qualified opinion

C)disclaimer of opinion

D)unqualified opinion

A)adverse opinion

B)qualified opinion

C)disclaimer of opinion

D)unqualified opinion

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

10

The following information relates to the Anna Corporation: According to the segment reporting requirements under GAAP, which of these segments are considered reportable segments?

A)B and C

B)B and D

C)B, C, and D

D)A, B, C, and D

A)B and C

B)B and D

C)B, C, and D

D)A, B, C, and D

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

11

In the Management Report contained in the audited annual report, management acknowledges its responsibility for all of the following except

A)preparing and presenting the financial statements

B)correcting all internal control deficiencies prior to issuance of the financial statements

C)designing and maintaining appropriate internal controls

D)evaluating the effectiveness of the internal controls

A)preparing and presenting the financial statements

B)correcting all internal control deficiencies prior to issuance of the financial statements

C)designing and maintaining appropriate internal controls

D)evaluating the effectiveness of the internal controls

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

12

The "scope" paragraph of an unqualified audit opinion states that the auditor

A)examined all of the information used to prepare the financial statements.

B)followed GAAP.

C)established internal control procedures.

D)used the audit as a basis for the opinion.

A)examined all of the information used to prepare the financial statements.

B)followed GAAP.

C)established internal control procedures.

D)used the audit as a basis for the opinion.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

13

Given the following segment information: Which of the above operating segments are considered reportable segments?

A)V, W, and X

B)V, W, X, and Y

C)V, W, X, Y, and Z

D)V, W, X, and Z

A)V, W, and X

B)V, W, X, and Y

C)V, W, X, Y, and Z

D)V, W, X, and Z

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

14

Which one of the following need not be disclosed for reportable segments?

A)interest revenue and expense

B)profit or loss

C)capital expenditures for long-lived assets

D)seasonal revenues

A)interest revenue and expense

B)profit or loss

C)capital expenditures for long-lived assets

D)seasonal revenues

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

15

Full disclosure is desirable for all of the following reasons except

A)it helps to prevent the inappropriate use of insider information

B)it helps financial markets to operate more efficiently

C)it helps financial markets to operate more cost effectively

D)it eliminates the need for financial analysis

A)it helps to prevent the inappropriate use of insider information

B)it helps financial markets to operate more efficiently

C)it helps financial markets to operate more cost effectively

D)it eliminates the need for financial analysis

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

16

Which one of the following statements regarding market efficiency is false?

A)The prices of securities traded in the capital markets fully reflect all publicly available and privately held information.

B)The prices of securities are adjusted based on new information almost immediately in an unbiased manner.

C)Market prices adjust in an immediate manner because of the communication system in the marketplace.

D)An individual investor cannot use published information to earn an "abnormal" return on a security investment with a given amount of risk.

A)The prices of securities traded in the capital markets fully reflect all publicly available and privately held information.

B)The prices of securities are adjusted based on new information almost immediately in an unbiased manner.

C)Market prices adjust in an immediate manner because of the communication system in the marketplace.

D)An individual investor cannot use published information to earn an "abnormal" return on a security investment with a given amount of risk.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

17

For operating segments, which one of the following is not included in the determination of whether a segment is reportable?

A)segment assets

B)revenues

C)profit (loss)

D)cash flows

A)segment assets

B)revenues

C)profit (loss)

D)cash flows

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

18

The group that has oversight over the financial reporting process of a company is called the

A)Audit Committee

B)Financial Oversight Committee

C)Financial Reporting Committee

D)Financial Accounting Standards Board

A)Audit Committee

B)Financial Oversight Committee

C)Financial Reporting Committee

D)Financial Accounting Standards Board

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

19

Segment reporting results in disaggregated financial data.This can be important to the readers of financial statements because it defines the

A)risk of investing in this company.

B)nature of the economies in which the company operates.

C)major customers of the company.

D)products sold by the company.

A)risk of investing in this company.

B)nature of the economies in which the company operates.

C)major customers of the company.

D)products sold by the company.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following auditor opinions would be appropriate when a company's financial statements are presented fairly in conformity with GAAP except for the effects of a certain item?

A)adverse opinion

B)qualified opinion

C)disclaimer of opinion

D)unqualified opinion

A)adverse opinion

B)qualified opinion

C)disclaimer of opinion

D)unqualified opinion

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

21

The financial information to be reported separately for each reportable segment should include

A)that segment's reported revenues from intersegment sales

B)interest revenue

C)total capital expenditures for long-lived assets

D)all of these choices

A)that segment's reported revenues from intersegment sales

B)interest revenue

C)total capital expenditures for long-lived assets

D)all of these choices

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

22

Disclosures for reportable segments include all of the following except

A)revenues

B)operating profit or loss

C)segment assets

D)cash balances

A)revenues

B)operating profit or loss

C)segment assets

D)cash balances

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

23

According to GAAP, the conceptual view of interim reporting is that interim reporting

A)should be viewed primarily as an integral part of an annual period

B)should be viewed as if the interim report was an annual accounting period

C)need not follow most generally accepted accounting principles

D)is an optional form of disclosure for most companies

A)should be viewed primarily as an integral part of an annual period

B)should be viewed as if the interim report was an annual accounting period

C)need not follow most generally accepted accounting principles

D)is an optional form of disclosure for most companies

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following inventory procedures cannot be applied for interim reporting?

A)estimation of inventory using gross profit method

B)delayed recognition of permanent losses from inventory market declines

C)delayed recognition of temporary inventory market declines

D)delayed recognition of temporary LIFO liquidations

A)estimation of inventory using gross profit method

B)delayed recognition of permanent losses from inventory market declines

C)delayed recognition of temporary inventory market declines

D)delayed recognition of temporary LIFO liquidations

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

25

A difficulty can arise in preparing an interim report because

A)there is insufficient time for the staff to prepare the report

B)it is difficult to determine meaningful operating results for an interval of less than a year

C)a fiscal year involves twelve months and the annual report must report monthly totals

D)quarterly reporting is more valuable than an interim report

A)there is insufficient time for the staff to prepare the report

B)it is difficult to determine meaningful operating results for an interval of less than a year

C)a fiscal year involves twelve months and the annual report must report monthly totals

D)quarterly reporting is more valuable than an interim report

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

26

Cooper Company experienced a permanent loss due to an inventory market decline in June 2010 in the amount of $800, 000.The loss was not recovered by its fiscal year of December 31, 2010.How should this loss have been reflected in Cooper's interim quarterly financial reports?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is not true concerning interim financial reporting and inventories?

A)A company that uses LIFO and encounters a temporary partial liquidation of its base period inventory must include the effects of the liquidation in the period in which it occurred.

B)Provisions for write-downs to market should generally be the same for both the annual and interim reporting.

C)A company that utilizes a periodic inventory system and uses estimated gross profit rates to determine costs of goods sold during interim periods should disclose any significant adjustments that result from reconciliation with the annual physical inventory.

D)The same inventory pricing method used for annual reporting should generally be used for interim reporting.

A)A company that uses LIFO and encounters a temporary partial liquidation of its base period inventory must include the effects of the liquidation in the period in which it occurred.

B)Provisions for write-downs to market should generally be the same for both the annual and interim reporting.

C)A company that utilizes a periodic inventory system and uses estimated gross profit rates to determine costs of goods sold during interim periods should disclose any significant adjustments that result from reconciliation with the annual physical inventory.

D)The same inventory pricing method used for annual reporting should generally be used for interim reporting.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

28

Interim summarized financial information for publicly traded companies must contain certain data.Which of the following data does not have to be disclosed?

A)seasonal revenues, costs, and expenses

B)results of discontinued operations

C)capital leases

D)changes in accounting principles or estimates

A)seasonal revenues, costs, and expenses

B)results of discontinued operations

C)capital leases

D)changes in accounting principles or estimates

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

29

An inventory loss from market value declines of $200, 000 occurred in August 2010.Marco Sales Company recorded this loss in August after its March 31 and June 30 interim reports were issued.None of this loss was recovered by the end of the year.How should this loss be reflected in Marco's quarterly income statements?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

30

Fritz Sales Company spent $180, 000 to advertise in a national sales booklet on April 7, 2010.The booklet is distributed exclusively at the national sales convention during the week beginning on May 14, 2010.Assuming Fritz has a fiscal year ending on December 31, what amount of expense should be included in Fritz's quarterly income statement for the three months ended June 30, 2010, as a result of this advertising expenditure?

A)$ 0

B)$ 45, 000

C)$ 60, 000

D)$180, 000

A)$ 0

B)$ 45, 000

C)$ 60, 000

D)$180, 000

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

31

Pratt, Inc.paid its executives a $320, 000 bonus based on profit results for the fiscal year ended December 31, 2010.Based on its master budgets for 2011, Pratt estimates its bonuses for the fiscal year ended December 31, 2011, will be $300, 000.What amount, if any, should Pratt recognize as an expense for bonuses in its quarterly income statement for the three months ended March 31, 2011?

A)$ 0

B)$ 75, 000

C)$100, 000

D)$300, 000

A)$ 0

B)$ 75, 000

C)$100, 000

D)$300, 000

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

32

The information reported about the reportable segments of an enterprise may be disclosed

A)within the body of the financial statements with supporting footnotes

B)entirely in the footnotes to the financial statements

C)in a separate schedule that is an integral part of the financial statements

D)all of these choices

A)within the body of the financial statements with supporting footnotes

B)entirely in the footnotes to the financial statements

C)in a separate schedule that is an integral part of the financial statements

D)all of these choices

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

33

Disclosures required for reportable segments include all of the following except

A)depreciation, depletion, and amortization expense

B)capital expenditures for additions to long-lived assets

C)research and development expenditures

D)interest revenue and interest expense

A)depreciation, depletion, and amortization expense

B)capital expenditures for additions to long-lived assets

C)research and development expenditures

D)interest revenue and interest expense

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is true concerning interim financial reporting?

A)An extraordinary item is defined as being material based on the relationship of the item to the interim period results.

B)The results of a disposal of a business segment may be considered material for the interim period but not for the annual period.

C)No income tax effect will be recognized in an interim period that incurs a loss.

D)The income tax rate to be used for an interim period is based on an estimated income tax rate on annual income.

A)An extraordinary item is defined as being material based on the relationship of the item to the interim period results.

B)The results of a disposal of a business segment may be considered material for the interim period but not for the annual period.

C)No income tax effect will be recognized in an interim period that incurs a loss.

D)The income tax rate to be used for an interim period is based on an estimated income tax rate on annual income.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is an acceptable practice as it relates to interim financial reporting?

A)delayed recognition of permanent inventory market declines until year-end

B)delayed recognition of unplanned standard cost system variances until year-end

C)use of the variable costing inventory method for determining inventory costs

D)use of the gross profit method to determine interim inventory amounts

A)delayed recognition of permanent inventory market declines until year-end

B)delayed recognition of unplanned standard cost system variances until year-end

C)use of the variable costing inventory method for determining inventory costs

D)use of the gross profit method to determine interim inventory amounts

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following should be included in disclosures about the assets of a reportable segment?

A)a measure of the total assets of the segment

B)total additions to current assets

C)research and development expenditures

D)general corporate assets

A)a measure of the total assets of the segment

B)total additions to current assets

C)research and development expenditures

D)general corporate assets

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

37

In its first interim period, Deuce had $500 of income before taxes and an estimated annual tax rate of 40%.In its second interim, Deuce had $800 of income before taxes and its estimated annual tax rate changed to 30%.Deuce's tax expense for the second interim period was

A)$190

B)$240

C)$320

D)$390

A)$190

B)$240

C)$320

D)$390

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

38

Minimum disclosures are not required as part of interim reporting for

A)sales or gross revenues

B)primary and fully diluted earnings per share

C)contingent items

D)segment information

A)sales or gross revenues

B)primary and fully diluted earnings per share

C)contingent items

D)segment information

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

39

On January 17, 2010, THX Company received rent of $90, 000 from a tenant.The rent is for the period January through September 2010.What amount of revenue should THX recognize in the quarterly income statement for the three months ended March 31, 2010, as a result of this cash receipt?

A)$90, 000

B)$30, 000

C)$22, 500

D)$ 0

A)$90, 000

B)$30, 000

C)$22, 500

D)$ 0

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

40

On January 3, 2010, Emanuel Co.paid $60, 000 for insurance on its buildings for the calendar year 2010.In the first week of April 2010, the company made unanticipated major repairs to its equipment at a cost of $240, 000.These repairs benefited operations for the remainder of 2010.How should these expenses be reflected in Emanuel Co.'s quarterly income statements?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

41

A comparison of a company's performance with that of its own past results is known as

A)vertical analysis

B)intercompany comparison

C)horizontal analysis

D)intracompany comparison

A)vertical analysis

B)intercompany comparison

C)horizontal analysis

D)intracompany comparison

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

42

All of the following relate directly to the Securities and Exchange Commission except

A)Regulation S-X

B)Financial Reporting Releases

C)Form 10-Q

D)Statements of Financial Accounting Concepts

A)Regulation S-X

B)Financial Reporting Releases

C)Form 10-Q

D)Statements of Financial Accounting Concepts

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

43

Which one of the following ratios helps to indicate a company's effectiveness in meeting the stockholder profitability objectives?

A)profit margin

B)acid-test

C)dividend yield

D)inventory turnover

A)profit margin

B)acid-test

C)dividend yield

D)inventory turnover

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

44

A comparison of a company's performance with that of competitors is known as

A)vertical analysis

B)horizontal analysis

C)intracompany comparisons

D)intercompany comparisons

A)vertical analysis

B)horizontal analysis

C)intracompany comparisons

D)intercompany comparisons

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

45

One test of a company's liquidity is the

A)debt ratio

B)acid-test ratio

C)return on stockholders' equity

D)price-earnings ratio

A)debt ratio

B)acid-test ratio

C)return on stockholders' equity

D)price-earnings ratio

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

46

Given the following information regarding accounts receivable: What is the accounts receivable turnover?

A)4 times

B)6 times

C)8 times

D)10 times

A)4 times

B)6 times

C)8 times

D)10 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following ratios is a test of a company's short-term debt-paying ability?

A)profit margin

B)price/earnings

C)acid-test

D)times interest earned

A)profit margin

B)price/earnings

C)acid-test

D)times interest earned

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

48

In horizontal analysis

A)changes in a company's operating results and financial position over time are expressed in percentages as well as dollars

B)monetary relationships between items on the financial statements of a period are expressed in percentages as well as dollars

C)financial statements are expressed only in percentages

D)liquidity ratios, generally involving components of the company's working capital, are computed

A)changes in a company's operating results and financial position over time are expressed in percentages as well as dollars

B)monetary relationships between items on the financial statements of a period are expressed in percentages as well as dollars

C)financial statements are expressed only in percentages

D)liquidity ratios, generally involving components of the company's working capital, are computed

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

49

Bistro Company incurred a permanent inventory loss of $80, 000 in April 2010 after the March 31, 2010 quarterly financial statements were issued.What amount of this loss should be reflected in the quarterly income statement for the three months ended June 30, 2010?

A)$ 0

B)$20, 000

C)$26, 667

D)$80, 000

A)$ 0

B)$20, 000

C)$26, 667

D)$80, 000

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

50

In vertical analysis

A)financial statements are expressed only in percentages

B)changes in a company's operating results and financial position over time are expressed in percentages as well as dollars

C)net income is usually expressed as 100% and all other components of the income statement are expressed accordingly

D)monetary relationships between items on one period's financial statements are expressed in percentages as well as dollars

A)financial statements are expressed only in percentages

B)changes in a company's operating results and financial position over time are expressed in percentages as well as dollars

C)net income is usually expressed as 100% and all other components of the income statement are expressed accordingly

D)monetary relationships between items on one period's financial statements are expressed in percentages as well as dollars

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

51

Which one of the following statements related to financial information is not true?

A)Liquidity refers to the company's ability to change the amounts and timing of cash flows to adapt to unexpected needs and opportunities.

B)In general, the higher the risk of an investment, the higher the return on investment expected by investors.

C)Return on capital can be provided only after return of capital.

D)Operating capability describes the company's ability to maintain a given level of operations.

A)Liquidity refers to the company's ability to change the amounts and timing of cash flows to adapt to unexpected needs and opportunities.

B)In general, the higher the risk of an investment, the higher the return on investment expected by investors.

C)Return on capital can be provided only after return of capital.

D)Operating capability describes the company's ability to maintain a given level of operations.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

52

A company's current ratio of 2:1 will decrease if the company

A)declares a 10% stock dividend on its common stock

B)receives cash from a customer on account

C)pays a creditor on account

D)purchases merchandise on account

A)declares a 10% stock dividend on its common stock

B)receives cash from a customer on account

C)pays a creditor on account

D)purchases merchandise on account

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

53

Which one of the following is considered a liquidity ratio?

A)debt ratio

B)receivables turnover

C)current ratio

D)profit margin

A)debt ratio

B)receivables turnover

C)current ratio

D)profit margin

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

54

Based upon the following information, which company has the best collection policy?

A)Company A

B)Company B

C)Company C

D)Not enough information is available to determine an answer.

A)Company A

B)Company B

C)Company C

D)Not enough information is available to determine an answer.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

55

Hodges Company has a current ratio of 1.6 to 1.Salaries payable accrued last quarter are paid this quarter.What is the effect of this payment on the current ratio this quarter?

A)increase

B)decrease

C)no effect

D)cannot determine from information presented

A)increase

B)decrease

C)no effect

D)cannot determine from information presented

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

56

Given the following information:

What is the price/earnings ratio?

A)3.3 times

B)2.9 times

C)3.8 times

D)4.5 times

What is the price/earnings ratio?

A)3.3 times

B)2.9 times

C)3.8 times

D)4.5 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

57

Which one of the following ratios is an indicator of the long-run safety of a firm?

A)profit margin

B)times interest earned

C)earnings per share

D)return on stockholders' equity

A)profit margin

B)times interest earned

C)earnings per share

D)return on stockholders' equity

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

58

Extensible Business Reporting Language (XBRL)

A)is limited to the manual comparison of data reported in the SEC 10K report.

B)is expected to complete the development of its system of "tags" for all U.S.GAAP in 10 years.

C)enables recognition and extraction of items of information for various analytical purposes

D)has been applied extensively by financial analysts for over 30 years

A)is limited to the manual comparison of data reported in the SEC 10K report.

B)is expected to complete the development of its system of "tags" for all U.S.GAAP in 10 years.

C)enables recognition and extraction of items of information for various analytical purposes

D)has been applied extensively by financial analysts for over 30 years

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

59

Given the following information: What is the quick ratio?

A)0.75 times

B)1.75 times

C)2.5 times

D)3.75 times

A)0.75 times

B)1.75 times

C)2.5 times

D)3.75 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

60

An annual report filed with the SEC is called a

A)Annual Consolidated Report

B)Form 10A

C)Form 10K

D)Form 10Q

A)Annual Consolidated Report

B)Form 10A

C)Form 10K

D)Form 10Q

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

61

The Latin Company is made up of five operating segments.Information concerning these segments for 2010 is shown below:

Included in Latin's operating expenses are general corporate expenses of $16, 000.

Required:

Based on the provisions of current GAAP, prepare a schedule that reflects required disclosures about operating segments from the above information for Latin Company exclusive of any footnotes.

Included in Latin's operating expenses are general corporate expenses of $16, 000.

Required:

Based on the provisions of current GAAP, prepare a schedule that reflects required disclosures about operating segments from the above information for Latin Company exclusive of any footnotes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

62

Exhibit 6-1 Morgan Company reported the following information for the year ended December 31, 2010:

- Refer to Exhibit 6-1.Morgan's 2010 price/earnings ratio was

A)0.17 times

B)5.25 times

C)6.00 times

D)4.67 times

- Refer to Exhibit 6-1.Morgan's 2010 price/earnings ratio was

A)0.17 times

B)5.25 times

C)6.00 times

D)4.67 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

63

Ralph Mechanical has just completed a year during which legislative action has changed the tax laws twice.As a result Ralph's estimated tax rate has varied somewhat.The table below shows management's best estimates of the effective tax rate at the end of each quarter along with quarterly income before tax.

Required:

Using guidelines from current GAAP, calculate the tax expense that would be reported in the

a. first quarter financial results

b. second quater financial results

c. third quater financial results

d. fourth cuarter financial results

Required:

Using guidelines from current GAAP, calculate the tax expense that would be reported in the

a. first quarter financial results

b. second quater financial results

c. third quater financial results

d. fourth cuarter financial results

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

64

Under GAAP, a company should identify its operating segments for financial reporting through the use of the "management approach." The management approach is based on the way a company's management organizes the company's segments for making operating decisions and for assessing performance.

Required:

Describe how a company determines an operating segment using the "management approach."

Required:

Describe how a company determines an operating segment using the "management approach."

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

65

Falconhead Supply had three operating segments during 2010.In determining whether these segments are considered reportable segments, Falconhead has gathered the following information:

In addition, Falconhead has incurred $100, 000 of common expenses that can be reasonably allocated to the three segments.Since most of the common costs relate to the physical operating capability of Falconhead, a reasonable allocation method is to allocate the common costs to each segment based on the ratio of a segment's assets to total assets of the three segments.

Required:

Compute the profit (loss)for each operating segment under current GAAP provisions.

In addition, Falconhead has incurred $100, 000 of common expenses that can be reasonably allocated to the three segments.Since most of the common costs relate to the physical operating capability of Falconhead, a reasonable allocation method is to allocate the common costs to each segment based on the ratio of a segment's assets to total assets of the three segments.

Required:

Compute the profit (loss)for each operating segment under current GAAP provisions.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

66

Exhibit 6-1 Morgan Company reported the following information for the year ended December 31, 2010:

- Refer to Exhibit 6-1.Morgan's 2010 dividend yield was

A)2.4%

B)3.8%

C)6.9%

D)114%

- Refer to Exhibit 6-1.Morgan's 2010 dividend yield was

A)2.4%

B)3.8%

C)6.9%

D)114%

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

67

The following information was obtained from the Clovis Company:

Required:

a. Using the revenue test, which segments should be separately reported?

b. Using the asset test, which segments shou'd be separately reported?

c. Using the profit (loss) test, which segments should be separately reported?

Required:

a. Using the revenue test, which segments should be separately reported?

b. Using the asset test, which segments shou'd be separately reported?

c. Using the profit (loss) test, which segments should be separately reported?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

68

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's return on total assets during 2010 was

A)20.0%

B)26.9%

C)31.4%

D)36.7%

- Refer to Exhibit 6-2.Green's return on total assets during 2010 was

A)20.0%

B)26.9%

C)31.4%

D)36.7%

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

69

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's return on stockholders' equity for 2010 was

A)16.3%

B)26.3%

C)27.1%

D)28.0%

- Refer to Exhibit 6-2.Green's return on stockholders' equity for 2010 was

A)16.3%

B)26.3%

C)27.1%

D)28.0%

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

70

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's 2010 profit margin was

A)8.1%

B)10.8%

C)13.5%

D)18.1%

- Refer to Exhibit 6-2.Green's 2010 profit margin was

A)8.1%

B)10.8%

C)13.5%

D)18.1%

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

71

In the first quarter of 2010, Hill Caterpillar Sales reported $900 of income before taxes.The estimated effective tax rate was 20%.In the second quarter, the company reported $800 of income before taxes, and the estimated effective tax rate increased to 25%.

Required:

Compute the second quarter tax expense for Hill Caterpillar Sales.

Required:

Compute the second quarter tax expense for Hill Caterpillar Sales.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

72

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's current ratio at December 31, 2010, was

A)3.67 times

B)2.33 times

C)1.33 times

D)0.43 times

- Refer to Exhibit 6-2.Green's current ratio at December 31, 2010, was

A)3.67 times

B)2.33 times

C)1.33 times

D)0.43 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

73

The following information was obtained from the accounting records of the Guerra Corporation for 2010:

Assuming a business year consisting of 365 days, what was Guerra's number of days' sales in inventories for 2010?

A)46.6 days

B)43.6 days

C)40.6 days

D)36.7 days

Assuming a business year consisting of 365 days, what was Guerra's number of days' sales in inventories for 2010?

A)46.6 days

B)43.6 days

C)40.6 days

D)36.7 days

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

74

The Philip Company had the following information available for the fiscal year ended December 31, 2010: Philip's inventory turnover for 2010 was

A)3 times

B)4 times

C)5.33 times

D)6 times

A)3 times

B)4 times

C)5.33 times

D)6 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

75

A difference between the segment disclosures required by IFRS and GAAP is that

A)under GAAP each segment's liabilities must be disclosed under certain circumstances, while under IFRS liabilities by segment need not be disclosed

B)under IFRS each segment's cash balances must be disclosed under certain circumstances, while under GAAP cash balances by segment need not be disclosed

C)under IFRS each segment's total assets must be disclosed under certain circumstances, while under GAAP total assets by segment need not be disclosed

D)under IFRS each segment's liabilities must be disclosed under certain circumstances, while under GAAP liabilities by segment need not be disclosed

A)under GAAP each segment's liabilities must be disclosed under certain circumstances, while under IFRS liabilities by segment need not be disclosed

B)under IFRS each segment's cash balances must be disclosed under certain circumstances, while under GAAP cash balances by segment need not be disclosed

C)under IFRS each segment's total assets must be disclosed under certain circumstances, while under GAAP total assets by segment need not be disclosed

D)under IFRS each segment's liabilities must be disclosed under certain circumstances, while under GAAP liabilities by segment need not be disclosed

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's acid-test ratio at December 31, 2010, was

A)3.67 times

B)2.33 times

C)1.33 times

D)0.43 times

- Refer to Exhibit 6-2.Green's acid-test ratio at December 31, 2010, was

A)3.67 times

B)2.33 times

C)1.33 times

D)0.43 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

77

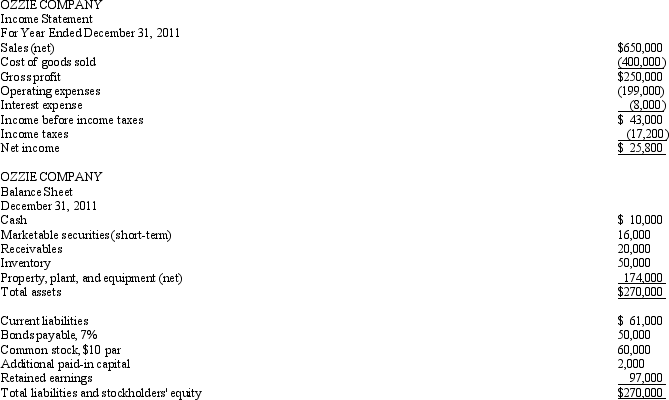

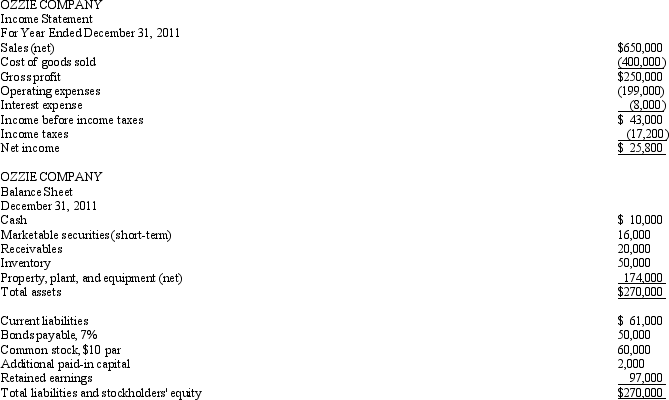

The financial statements for the Ozzie Company are presented below.

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:

Required:

Based on the data provided for Ozzie Company, compute the following ratios for 2011:

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:Required:

Based on the data provided for Ozzie Company, compute the following ratios for 2011:

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

78

The following information was obtained from the records of Trophy Company for 2010: How many times was interest earned in 2010?

A)1.25 times

B)1.75 times

C)2.75 times

D)32.5 times

A)1.25 times

B)1.75 times

C)2.75 times

D)32.5 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

79

Monroe Company reported the following information for the year ended December 31, 2010: Monroe's earnings per share for 2010 was

A)$6.67

B)$6.00

C)$5.11

D)$0.15

A)$6.67

B)$6.00

C)$5.11

D)$0.15

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

80

Exhibit 6-2 Given the following information for the Green Company:

- Refer to Exhibit 6-2.Green's accounts receivable turnover for 2010 was

A)2.2 times

B)26.0 times

C)27.4 times

D)28.9 times

- Refer to Exhibit 6-2.Green's accounts receivable turnover for 2010 was

A)2.2 times

B)26.0 times

C)27.4 times

D)28.9 times

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck