Deck 17: Earnings Per Share and Retained Earnings

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 17: Earnings Per Share and Retained Earnings

1

For which one of the following components is earnings per share information required to be presented on the income statement?

A)discontinued operations

B)extraordinary items

C)income from continuing operations

D)cumulative effect of a change in accounting principle

A)discontinued operations

B)extraordinary items

C)income from continuing operations

D)cumulative effect of a change in accounting principle

C

2

Basic earnings per share is computed as

A)Net Income / Total Number of Common Shares Outstanding

B)(Net Income - Preferred Dividends)/ Total Number of Common Shares Outstanding

C)(Net Income - Preferred Dividends)/ Weighted-Average Number of Common Shares Outstanding

D)Net Income / Weighted-Average Number of Common Shares Outstanding

A)Net Income / Total Number of Common Shares Outstanding

B)(Net Income - Preferred Dividends)/ Total Number of Common Shares Outstanding

C)(Net Income - Preferred Dividends)/ Weighted-Average Number of Common Shares Outstanding

D)Net Income / Weighted-Average Number of Common Shares Outstanding

C

3

On January 1, 2010, a corporation had 10, 380 shares of common stock outstanding, and on June 1, it reacquired 6, 000 shares.Despite a net loss for the year of $180, 000, the company declared and paid cash dividends of $24, 000 and $28, 000 on common and preferred stock, respectively.The earnings per share for 2010 was

A)($33.72)

B)($30.24)

C)($22.10)

D)($18.60)

A)($33.72)

B)($30.24)

C)($22.10)

D)($18.60)

B

4

Common shares outstanding are increased as a result of a stock dividend or stock split.For purposes of calculating the earnings per share, when is the stock dividend or stock split considered to have occurred?

A)at the beginning of the earliest comparative period for which earnings per share information is presented

B)at the end of the earliest comparative period for which earnings per share information is presented

C)at the beginning of the year declared

D)as of the date of declaration

A)at the beginning of the earliest comparative period for which earnings per share information is presented

B)at the end of the earliest comparative period for which earnings per share information is presented

C)at the beginning of the year declared

D)as of the date of declaration

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

On January 1, 2010, Smith Company had 21, 000 shares of common stock outstanding and issued an additional 4, 500 shares on May 1.The company declared and paid a cash dividend of $30, 000 and earned $330, 000 net income.The earnings per share for the year was

A)$15.00

B)$13.75

C)$12.94

D)$12.50

A)$15.00

B)$13.75

C)$12.94

D)$12.50

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

On January 1, a corporation had 50, 000 shares of common stock outstanding.On April 1, the company declared a 20% stock dividend, and on August 1, the company had a 3-for-1 stock split.On December 1, the company issued an additional 6, 000 shares.The denominator in the earnings per share calculation would be

A)186, 000

B)180, 500

C)180, 000

D)173, 000

A)186, 000

B)180, 500

C)180, 000

D)173, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

On January 1, a corporation had 20, 000 shares of common stock outstanding.An additional 4, 000 shares were issued on July 1, and on November 1, the company declared a 3-for-1 stock split.The denominator in the earnings per share calculation would be

A)36, 000

B)56, 000

C)66, 000

D)72, 000

A)36, 000

B)56, 000

C)66, 000

D)72, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

On January 1, a corporation had 10, 380 shares of common stock outstanding.On August 1, it sold an additional 6, 000 shares.During the year, dividends of $4, 800 and $56, 000 were declared and paid on the common and preferred stock, respectively.Net income for the year was $240, 000.The basic earnings per share for the year was

A)$10.56

B)$11.23

C)$14.29

D)$18.63

A)$10.56

B)$11.23

C)$14.29

D)$18.63

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

On January 1, 2010, Walters Corporation had 24, 000 shares of common stock outstanding.On April 1, it reacquired 2, 400 shares; on July 1, it issued 10, 800 shares; on October 1, it issued another 9, 600 shares; and on December 1, it reacquired 600 shares.The weighted average number of common shares outstanding for 2010 was

A)26, 950

B)28, 900

C)29, 950

D)41, 400

A)26, 950

B)28, 900

C)29, 950

D)41, 400

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

A simple capital structure consists of

A)only preferred stock

B)only common stock outstanding

C)common stock and common stock options only

D)preferred stock and preferred stock options

A)only preferred stock

B)only common stock outstanding

C)common stock and common stock options only

D)preferred stock and preferred stock options

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

On January 1, 2010, Libby Corporation had 18, 000 shares of common stock outstanding, and reacquired 2, 000 shares on July 1.The company earned net income of $110, 800 and paid a cash dividend on its preferred stock of $36, 000.The earnings per share for the year was

A)$4.40

B)$5.54

C)$3.74

D)$4.68

A)$4.40

B)$5.54

C)$3.74

D)$4.68

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, 2010, Kuper Corporation had 12, 000 shares of common stock outstanding.Kuper reacquired 1, 000 shares on May 1, and issued another 5, 000 shares on September 1.The company also has 10, 000 shares of $20 par, 10%, noncumulative preferred stock outstanding on which no dividends have been declared during the last two years.The company had a $45, 360 loss for the year.The earnings per share for the year is

A)($5.03)

B)($3.78)

C)($3.49)

D)($1.95)

A)($5.03)

B)($3.78)

C)($3.49)

D)($1.95)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1, a corporation had 60, 000 shares of common stock outstanding.On March 1, the company reacquired 12, 000 shares, and it declared a 10% stock dividend on October 1.The denominator in the earnings per share calculation would be

A)44, 200

B)40, 800

C)55, 000

D)60, 000

A)44, 200

B)40, 800

C)55, 000

D)60, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

On January 1, 2010, Brennen Corporation had 20, 000 shares of common shares outstanding.During the year, it sold another 2, 600 shares on July 1 and reacquired 600 shares on November 1.The corporation earned $337, 600 net income.The company also has 15, 000 shares of $10 par value, 6%, cumulative preferred stock on which no dividends have been declared for the last two years.The basic earnings per share for the year is

A)$15.92

B)$15.65

C)$15.50

D)$15.08

A)$15.92

B)$15.65

C)$15.50

D)$15.08

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following items would not be included in a basic earnings per share calculation?

A)undeclared dividends on noncumulative preferred stock

B)declared dividends on noncumulative preferred stock

C)undeclared dividends on cumulative preferred stock

D)declared dividends on cumulative preferred stock

A)undeclared dividends on noncumulative preferred stock

B)declared dividends on noncumulative preferred stock

C)undeclared dividends on cumulative preferred stock

D)declared dividends on cumulative preferred stock

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

Reporting basic earnings per share is required for which type of corporate capital structure?

A)simple

B)complex

C)primary

D)both simple and complex

A)simple

B)complex

C)primary

D)both simple and complex

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following indicators is intended to show the potential impacts of possible future events on a corporation's performance?

A)basic earnings per share

B)cash flow per share

C)diluted earnings per share

D)price/earnings ratio

A)basic earnings per share

B)cash flow per share

C)diluted earnings per share

D)price/earnings ratio

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following indicators is a company prohibited from reporting?

A)cash flow per share

B)basic earnings per share

C)diluted earnings per share

D)price/earnings ratio

A)cash flow per share

B)basic earnings per share

C)diluted earnings per share

D)price/earnings ratio

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

When calculating earnings per share, dividends declared on noncumulative preferred stock, but not paid, should be

A)added to net income in the earnings per share numerator

B)excluded from the earnings per share numerator

C)deducted from net income in the earnings per share numerator

D)deferred from the earnings per share numerator until paid

A)added to net income in the earnings per share numerator

B)excluded from the earnings per share numerator

C)deducted from net income in the earnings per share numerator

D)deferred from the earnings per share numerator until paid

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following items would be included in a basic earnings per share calculation?

A)declared dividends on noncumulative preferred stock

B)declared dividends on cumulative preferred stock

C)undeclared dividends on cumulative preferred stock

D)all of these

A)declared dividends on noncumulative preferred stock

B)declared dividends on cumulative preferred stock

C)undeclared dividends on cumulative preferred stock

D)all of these

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

When a corporation has a loss from continuing operations, the basic earnings per share is

A)greater than the diluted earnings per share

B)less than the diluted earnings per share

C)equal to the diluted earnings per share

D)not reported

A)greater than the diluted earnings per share

B)less than the diluted earnings per share

C)equal to the diluted earnings per share

D)not reported

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

How will a company's retained earnings and total stockholders' equity be affected by the recording of the declaration of a stock dividend? (Assume the stock dividend is distributed at a later date.)

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

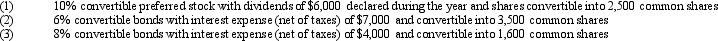

Given the following convertible securities, determine the appropriate ranking to determine their impact on diluted earnings per share calculations:

A)1, 2, 3

B)3, 1, 2

C)2, 1, 3

D)1, 3, 2

A)1, 2, 3

B)3, 1, 2

C)2, 1, 3

D)1, 3, 2

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

The term deficit in financial accounting means

A)net loss

B)a negative retained earnings balance

C)a negative cash balance

D)a negative stockholders' equity total

A)net loss

B)a negative retained earnings balance

C)a negative cash balance

D)a negative stockholders' equity total

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

Which one of the following statements concerning earnings per share amounts is true?

A)Earnings per share related to discontinued operations must be reported on the income statement.

B)Earnings per share related to extraordinary items must be reported on the income statement.

C)Earnings per share related to continuing operations must be reported on the income statement.

D)Earnings per share related to the cumulative effect of a change in accounting principle must be reported on the income statement.

A)Earnings per share related to discontinued operations must be reported on the income statement.

B)Earnings per share related to extraordinary items must be reported on the income statement.

C)Earnings per share related to continuing operations must be reported on the income statement.

D)Earnings per share related to the cumulative effect of a change in accounting principle must be reported on the income statement.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

Smock Corporation had 30, 000 shares of common stock outstanding during the year.In addition, there were compensatory stock options to purchase 3, 000 shares of common stock at $20 a share outstanding the entire year.The average market price for the common stock during the year was $36 a share.The unrecognized compensation cost (net of tax)relating to these options was $4 a share.The denominator to compute the diluted earnings per share is

A)31, 000

B)31, 333

C)31, 667

D)33, 000

A)31, 000

B)31, 333

C)31, 667

D)33, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

In the determination of the diluted earnings per share, convertible securities are

A)included if they are dilutive

B)included whether they are dilutive or not

C)included if they are antidilutive

D)not included

A)included if they are dilutive

B)included whether they are dilutive or not

C)included if they are antidilutive

D)not included

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

In calculating earnings per share, a company uses the treasury stock method when

A)it needs to value the cash received for a convertible bond

B)it recognizes the assumed impact of exercising outstanding warrants

C)it develops a methodology to handle the premium paid on exercised stock options

D)it needs to value treasury stock repurchased during the year

A)it needs to value the cash received for a convertible bond

B)it recognizes the assumed impact of exercising outstanding warrants

C)it develops a methodology to handle the premium paid on exercised stock options

D)it needs to value treasury stock repurchased during the year

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

The potential dilutive effect of the exercise of stock options or warrants will affect which of the following when calculating diluted earnings per share?

A)the earnings per share numerator

B)the earnings per share denominator

C)both the numerator and the denominator

D)neither the numerator nor the denominator

A)the earnings per share numerator

B)the earnings per share denominator

C)both the numerator and the denominator

D)neither the numerator nor the denominator

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

Under the if-converted method, the impact of various convertible securities on the diluted earnings per share calculation are ranked from

A)the lowest impact to the highest impact

B)the highest impact to the lowest impact

C)the least number of assumed shares issued to the most

D)the most number of assumed shares issued to the least

A)the lowest impact to the highest impact

B)the highest impact to the lowest impact

C)the least number of assumed shares issued to the most

D)the most number of assumed shares issued to the least

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

How will a company's working capital and total stockholders' equity be affected by the recording of the declaration of a stock dividend? (Assume the stock dividend is distributed at a later date.)

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Dual presentation of the basic and diluted earnings per share amounts is

A)required for corporations with simple capital structures

B)optional for corporations with simple capital structures

C)optional for corporations of any structure

D)required for corporations with complex capital structures

A)required for corporations with simple capital structures

B)optional for corporations with simple capital structures

C)optional for corporations of any structure

D)required for corporations with complex capital structures

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

How will a company's working capital and current ratio be affected by the recording of a cash dividend on the declaration date? (Assume the dividend is paid on a later date.)

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

Which statement best reflects the issues associated with the computation of diluted earnings per share?

A)Diluted earnings per share represents the potential impact of all shares of common stock.

B)When presenting comparative financial statements, the impact of convertible bonds must be included for both years.

C)Common stock options are considered dilutive when the average market price is greater than the option price.

D)The impact on the denominator is always the determinate of whether or not to use diluted earnings per share.

A)Diluted earnings per share represents the potential impact of all shares of common stock.

B)When presenting comparative financial statements, the impact of convertible bonds must be included for both years.

C)Common stock options are considered dilutive when the average market price is greater than the option price.

D)The impact on the denominator is always the determinate of whether or not to use diluted earnings per share.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Reporting diluted earnings per share is required for which type of corporate capital structure?

A)simple

B)complex

C)diluted

D)primary

A)simple

B)complex

C)diluted

D)primary

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

The assumed conversion of convertible debt and preferred stock in diluted earnings per share calculations affects

A)the numerator only

B)the denominator only

C)both the numerator and denominator

D)neither the numerator nor the denominator

A)the numerator only

B)the denominator only

C)both the numerator and denominator

D)neither the numerator nor the denominator

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

Interest expense on convertible bonds that are dilutive is included in the numerator of the diluted earnings per share calculation at an amount equal to

A)interest expense

B)interest payable

C)interest expense times the tax rate

D)interest expense times one minus the tax rate

A)interest expense

B)interest payable

C)interest expense times the tax rate

D)interest expense times one minus the tax rate

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

How will a company's working capital and net income be affected by the recording of a cash dividend on the declaration date? (Assume the dividend is paid on a later date.)

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

When a corporation has contingently issuable common stock for which the conditions have not been met for issuance, the shares are included in

A)basic earnings per share

B)diluted earnings per share

C)both basic and diluted earnings per share calculations

D)neither basic nor diluted earnings per share calculations

A)basic earnings per share

B)diluted earnings per share

C)both basic and diluted earnings per share calculations

D)neither basic nor diluted earnings per share calculations

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

Under the treasury stock method, the number of shares of common stock assumed to be reacquired is determined by using the

A)ending market price of the stock

B)average market price of the stock

C)beginning market price of the stock

D)par value of the stock

A)ending market price of the stock

B)average market price of the stock

C)beginning market price of the stock

D)par value of the stock

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Aster Corp.has $1, 000, 000, 6%, nonconvertible bonds due in 2015 and $1, 500, 000, 3%, convertible bonds due in 2012.The basic earnings per share is $1.25 and the diluted earnings per share is $1.18.Based upon this information, Aster must disclose

A)basic earnings per share because the convertible bonds are not dilutive

B)basic earnings per share and dilutive earnings per share because the convertible bonds are dilutive

C)basic earnings per share, and the convertible bonds must be disclosed in the stockholders' equity section of the balance sheet

D)basic earnings per share and dilutive earnings per share, and the convertible bonds must be disclosed in the stockholders' equity section of the balance sheet

A)basic earnings per share because the convertible bonds are not dilutive

B)basic earnings per share and dilutive earnings per share because the convertible bonds are dilutive

C)basic earnings per share, and the convertible bonds must be disclosed in the stockholders' equity section of the balance sheet

D)basic earnings per share and dilutive earnings per share, and the convertible bonds must be disclosed in the stockholders' equity section of the balance sheet

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

All of the following types of dividends will result in an increase in liabilities as a result of recording the declaration of a dividend except a (Assume the dividends are paid or distributed on a later date.)

A)cash dividend

B)property dividend

C)scrip dividend

D)stock dividend

A)cash dividend

B)property dividend

C)scrip dividend

D)stock dividend

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

The Farmer Company has issued 10%, fully participating, cumulative preferred stock with a total par value of $300, 000 and common stock with a total par value of $900, 000.Dividends for one previous year are in arrears.How much cash will be paid to the preferred stockholders and the common stockholders, respectively, if cash dividends of $222, 000 are distributed at the end of the current year?

A)$85, 500 and $136, 500

B)$78, 000 and $144, 000

C)$60, 000 and $162, 000

D)$55, 500 and $166, 500

A)$85, 500 and $136, 500

B)$78, 000 and $144, 000

C)$60, 000 and $162, 000

D)$55, 500 and $166, 500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

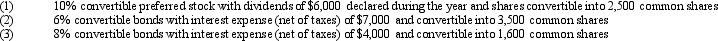

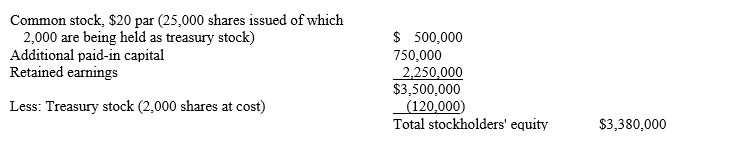

Exhibit 17-1 The Zoeller Corporation's stockholders' equity accounts have the following balances as of December 31, 2010:

- Refer to Exhibit 17-1.On January 2, 2011, the board of directors of Zoeller declared a 5% stock dividend to be distributed on January 31, 2011.The market price per share of Zoeller's common stock was $30 on January 2 and $32 on January 31.As a result of this stock dividend, the retained earnings account should be decreased by

A)zero; only a memorandum entry is required

B)$15, 000

C)$45, 000

D)$48, 000

- Refer to Exhibit 17-1.On January 2, 2011, the board of directors of Zoeller declared a 5% stock dividend to be distributed on January 31, 2011.The market price per share of Zoeller's common stock was $30 on January 2 and $32 on January 31.As a result of this stock dividend, the retained earnings account should be decreased by

A)zero; only a memorandum entry is required

B)$15, 000

C)$45, 000

D)$48, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

The Stamp Company has issued 10%, partially participating, cumulative preferred stock with a total par value of $200, 000 and common stock with a total par value of $800, 000.The preferred stock participates up to 15% of its par value.No dividends are in arrears.How much cash will be paid to the preferred stockholders and the common stockholders, respectively, if cash dividends of $160, 000 are distributed?

A)$50, 000 and $110, 000

B)$20, 000 and $140, 000

C)$30, 000 and $130, 000

D)$32, 000 and $128, 000

A)$50, 000 and $110, 000

B)$20, 000 and $140, 000

C)$30, 000 and $130, 000

D)$32, 000 and $128, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

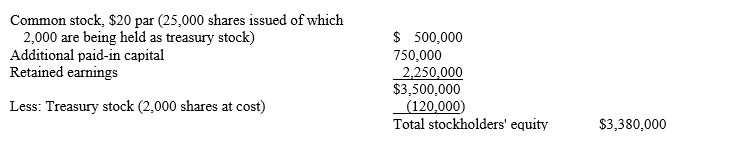

The Martin Company's stockholders' equity accounts have the following balances as of December 31, 2010:  On January 2, 2011, the board of directors of Martin declared a 10% stock dividend to be distributed on February 15, 2011.The market price of Martin Company's common stock was $65 per share on January 2, 2011.On the date of declaration, the retained earnings account should be decreased by

On January 2, 2011, the board of directors of Martin declared a 10% stock dividend to be distributed on February 15, 2011.The market price of Martin Company's common stock was $65 per share on January 2, 2011.On the date of declaration, the retained earnings account should be decreased by

A)zero; only a memorandum entry is required

B)$ 50, 000

C)$149, 500

D)$162, 500

On January 2, 2011, the board of directors of Martin declared a 10% stock dividend to be distributed on February 15, 2011.The market price of Martin Company's common stock was $65 per share on January 2, 2011.On the date of declaration, the retained earnings account should be decreased by

On January 2, 2011, the board of directors of Martin declared a 10% stock dividend to be distributed on February 15, 2011.The market price of Martin Company's common stock was $65 per share on January 2, 2011.On the date of declaration, the retained earnings account should be decreased byA)zero; only a memorandum entry is required

B)$ 50, 000

C)$149, 500

D)$162, 500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

The Logan Company does not carry fire insurance for any of its factories.Instead, the company appropriates retained earnings each year for an amount equal to the estimated annual insurance premiums.During the current year, one of its factories is destroyed by fire.Logan should debit which one of the following accounts to record the destruction

A)Loss Due to Fire

B)Retained Earnings Appropriated for Fire Loss

C)Retained Earnings (Unappropriated)

D)Liability for Fire Loss

A)Loss Due to Fire

B)Retained Earnings Appropriated for Fire Loss

C)Retained Earnings (Unappropriated)

D)Liability for Fire Loss

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

If a company makes a prior period adjustment, which of the following describes how it must be reported?

A)The adjustment is recorded in retained earnings, and previous years' financial statements presented for comparative purposes are not changed.

B)The adjustment is recorded in retained earnings, and previous years' financial statements presented for comparative purposes are adjusted.

C)The adjustment is reported in the current period's income statement as a separate item.

D)The adjustment is recorded as a deferred asset or deferred liability and amortized using the straight-line method.

A)The adjustment is recorded in retained earnings, and previous years' financial statements presented for comparative purposes are not changed.

B)The adjustment is recorded in retained earnings, and previous years' financial statements presented for comparative purposes are adjusted.

C)The adjustment is reported in the current period's income statement as a separate item.

D)The adjustment is recorded as a deferred asset or deferred liability and amortized using the straight-line method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

If a corporation appropriates retained earnings for treasury stock transactions, the appropriation will affect total amounts for retained earnings and stockholders' equity as

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Which statement best represents the relationship between date of declaration, date of record and ex-dividend date, and date of payment, for a cash dividend.

A)The date of payment results in the biggest decrease in the current ratio.

B)The date of record establishes the amount to be received.

C)The ex-dividend date establishes the decrease to cash.

D)The date of declaration establishes the increase to liabilities.

A)The date of payment results in the biggest decrease in the current ratio.

B)The date of record establishes the amount to be received.

C)The ex-dividend date establishes the decrease to cash.

D)The date of declaration establishes the increase to liabilities.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

On October 1, 2010, Black Company declared a property dividend payable in the form of marketable equity securities classified as "available for sale" for financial accounting purposes.The marketable equity securities will be distributed to the common stockholders on December 1, 2010.The investment in equity securities originally cost Black $410, 000 on August 1, 2010.The investment's fair value on various dates is as follows:

The amount credited to Realized Gain on Disposal of Investments resulting from this dividend transaction should be

A)$ 0

B)$20, 000

C)$25, 000

D)$30, 000

The amount credited to Realized Gain on Disposal of Investments resulting from this dividend transaction should be

A)$ 0

B)$20, 000

C)$25, 000

D)$30, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

How will a company's total current liabilities and total stockholders' equity be affected by the declaration of a stock dividend? (Assume the stock dividend is distributed at a later date.)

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

During 2010, Omni Corp.had net income of $300, 000.Included in net income was after-tax interest expense of $20, 000 on convertible bonds.The $200, 000 face value of convertible bonds can be converted into common stock at the rate of 200 shares per $1, 000 bond.Prior to the conversion, there were 400, 000 shares of common stock outstanding.The fully diluted earnings per share is

A)$0.636

B)$0.727

C)$0.750

D)not determinable because the bonds are not dilutive

A)$0.636

B)$0.727

C)$0.750

D)not determinable because the bonds are not dilutive

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

A dividend that represents a return of capital rather than a distribution of retained earnings is called a

A)property dividend

B)stock dividend

C)capital dividend

D)liquidating dividend

A)property dividend

B)stock dividend

C)capital dividend

D)liquidating dividend

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

When a company is determining its dividend policy, the company must adhere to legal requirements.The legal requirements are determined by the

A)Financial Accounting Standards Board (FASB)

B)state in which the company was incorporated

C)Securities and Exchange Commission (SEC)

D)Federal Trade Commission (FTC)

A)Financial Accounting Standards Board (FASB)

B)state in which the company was incorporated

C)Securities and Exchange Commission (SEC)

D)Federal Trade Commission (FTC)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

On November 1, 2010, the Metal Construction Company declared a property dividend payable in the form of bonds held for long-term investment purposes.The bonds will be distributed to the common stockholders on December 15, 2010.The bonds to be distributed to the common stockholders originally cost Metal $210, 000.Fair value of the bonds on various dates is as follows:

Which one of the following amounts should be used to record the appropriate credit to Property Dividends Payable?

A)$210, 000

B)$220, 000

C)$225, 000

D)$230, 000

Which one of the following amounts should be used to record the appropriate credit to Property Dividends Payable?

A)$210, 000

B)$220, 000

C)$225, 000

D)$230, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Exhibit 17-1 The Zoeller Corporation's stockholders' equity accounts have the following balances as of December 31, 2010:

-Refer to Exhibit 17-1.On January 2, 2011, the board of directors of Zoeller declared a 30% stock dividend to be distributed on January 31, 2011.The market price per share of Zoeller's common stock was $30 on January 2 and $32 on January 31.As a result of this stock dividend, the retained earnings account should be decreased by

A)$ 90, 000

B)$270, 000

C)$288, 000

D)zero; only a memorandum entry is required

-Refer to Exhibit 17-1.On January 2, 2011, the board of directors of Zoeller declared a 30% stock dividend to be distributed on January 31, 2011.The market price per share of Zoeller's common stock was $30 on January 2 and $32 on January 31.As a result of this stock dividend, the retained earnings account should be decreased by

A)$ 90, 000

B)$270, 000

C)$288, 000

D)zero; only a memorandum entry is required

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following could be a component of other comprehensive income (loss)?

A)realized gains or losses from sale of investments in available-for-sale securities

B)translation adjustments from converting the financial statements of a company's foreign operations into U.S.dollars

C)gains (losses)on extraordinary items

D)warranty liability adjustments

A)realized gains or losses from sale of investments in available-for-sale securities

B)translation adjustments from converting the financial statements of a company's foreign operations into U.S.dollars

C)gains (losses)on extraordinary items

D)warranty liability adjustments

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

The Carol Company has issued 10%, fully participating, cumulative preferred stock with a total par value of $600, 000 and common stock with a total par value of $900, 000.No dividends are in arrears.How much cash will be paid to the preferred stockholders and the common stockholders, respectively, if cash dividends of $141, 000 are distributed?

A)$ 60, 000 and $90, 000

B)$114, 000 and $27, 000

C)$ 51, 000 and $90, 000

D)$ 60, 000 and $81, 000

A)$ 60, 000 and $90, 000

B)$114, 000 and $27, 000

C)$ 51, 000 and $90, 000

D)$ 60, 000 and $81, 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

During 2010, Pesty Co.had net income of $200, 000 including after-tax interest expense of $30, 000 on convertible bonds.The $300, 000 face value of convertible bonds can be converted into common stock at the rate of 300 shares per $1, 000 bond.Prior to the conversion, there were 400, 000 shares of common stock outstanding.The fully diluted earnings per share is

A)$0.50

B)$0.469

C)$0.408

D)not determinable because the bonds are not dilutive

A)$0.50

B)$0.469

C)$0.408

D)not determinable because the bonds are not dilutive

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

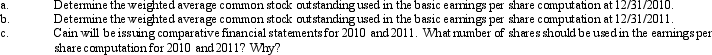

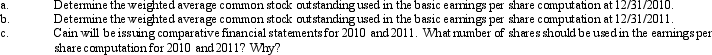

On January 1, 2010, Cain Co.had 20, 000 shares of common stock outstanding.On April 1, 2010 it had a 15% stock dividend.On October 1, 2011 it had a 4:1 stock split.

Required:

Required:

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

On January 1, Roberts reported total stockholders' equity of $1, 300.During the year, $50 of dividends were declared and paid, donated land with a donor book value of $14 and a current fair value of $38 was received, additional common stock was issued for $300, and treasury stock was acquired for $22.The reported total stockholders' equity at December 31 was $1, 406.What was the reported net income or loss for the year?

A)$160 net income

B)$204 net loss

C)$160 net loss

D)$228 net income

E)none of these

A)$160 net income

B)$204 net loss

C)$160 net loss

D)$228 net income

E)none of these

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

The following information is provided for the Columbus Company:

What is the total stockholders' equity of Columbus Company?

A)$212

B)$228

C)$256

D)$272

E)none of these

What is the total stockholders' equity of Columbus Company?

A)$212

B)$228

C)$256

D)$272

E)none of these

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

When recording the receipt of donated assets, the credit could be to

A)Retained Earnings

B)Donated Capital

C)Gain on Donations

D)a contra account to the asset

A)Retained Earnings

B)Donated Capital

C)Gain on Donations

D)a contra account to the asset

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

Rhonda Company had 40, 000 shares of common stock outstanding during 2010 and compensatory stock options to purchase 5, 000 shares of common stock at $10 a share plus a $3 a share unrecognized compensation cost (net of tax).The average market price is $20 a share.The company also had 7% convertible preferred stock on which dividends of $9, 000 were declared.Each preferred share is convertible into 6, 000 common shares.Rhonda's after-tax net income was $88, 000, and the tax rate was 40%.

Required:

Compute 2010 diluted earnings per share for Rhonda Company.

Required:

Compute 2010 diluted earnings per share for Rhonda Company.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

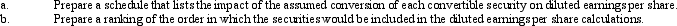

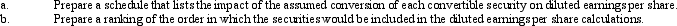

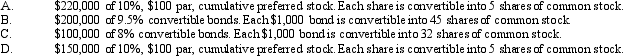

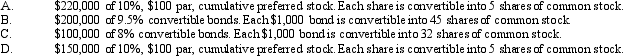

During 2010, Sanchez, Inc.had the following convertible securities outstanding:

A. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

B. of conventible bonds. Each bond is convertible into 45 shares of conmon stock

C. of convertible boncks. Each bond is convertible into 32 shares of common stock.

D. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

Sanchez, Inc.has an income tax rate of 40%.

Required:

A. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

B. of conventible bonds. Each bond is convertible into 45 shares of conmon stock

C. of convertible boncks. Each bond is convertible into 32 shares of common stock.

D. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

Sanchez, Inc.has an income tax rate of 40%.

Required:

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

The two defined sections of stockholders' equity under IFRS are

A)contributed capital and other equity

B)share capital and retained earnings

C)contributed capital and retained earnings

D)share capital and other equity

A)contributed capital and other equity

B)share capital and retained earnings

C)contributed capital and retained earnings

D)share capital and other equity

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

Going Green, Inc.had 18, 000 shares of common stock outstanding on January 1.An additional 6, 000 shares were issued on May 1.The company also had 1, 000 shares of 5.5%, $100 par, convertible preferred stock outstanding during the year.Each share is convertible into 8 shares of common stock.Net income for the year was $82, 500.

Required:

Compute the appropriate earnings per share amount(s)that would appear on the Going Green's income statement.

Required:

Compute the appropriate earnings per share amount(s)that would appear on the Going Green's income statement.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

Murray Co.had 60, 000 common shares outstanding on January 1, 2010.The company sold an additional 4, 500 shares on March 1, issued a 3-for-1 stock split on September 1, and reacquired 3, 600 shares on December 1.The company also declared, but has not paid, a dividend on its 10, 000 shares of 5%, $10 par, noncumulative preferred stock.The net loss for the year was $33, 190.

Required:

Compute Murray Co.'s basic earnings per share for 2010.

Required:

Compute Murray Co.'s basic earnings per share for 2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Monster, Inc.determined the following information concerning its common stock during 2010:

Required:

What should Monster, Inc.use as the denominator for its basic earnings per share calculation for 2010?

Required:

What should Monster, Inc.use as the denominator for its basic earnings per share calculation for 2010?

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

During 2010, Sanchez, Inc.had the following convertible securities outstanding:

Sanchez, Inc.has an income tax rate of 40%.Its reported net income for 2010 was $88, 000, and it had 22, 000 shares of common stock outstanding all year.

Sanchez, Inc.has an income tax rate of 40%.Its reported net income for 2010 was $88, 000, and it had 22, 000 shares of common stock outstanding all year.

Required:

Calculate basic and diluted earnings per share for Sanchez.

Sanchez, Inc.has an income tax rate of 40%.Its reported net income for 2010 was $88, 000, and it had 22, 000 shares of common stock outstanding all year.

Sanchez, Inc.has an income tax rate of 40%.Its reported net income for 2010 was $88, 000, and it had 22, 000 shares of common stock outstanding all year.Required:

Calculate basic and diluted earnings per share for Sanchez.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

How may a corporation report its types of comprehensive income?

A)It may report the amount of accumulated other comprehensive income for each item as part of stockholders' equity.

B)It may report the total amount of accumulated other comprehensive income for all the items as part of stockholders' equity.

C)It may make footnote disclosures of totals only.

D)It may report the amount of accumulated other comprehensive income for each item or in total as part of stockholders' equity.

A)It may report the amount of accumulated other comprehensive income for each item as part of stockholders' equity.

B)It may report the total amount of accumulated other comprehensive income for all the items as part of stockholders' equity.

C)It may make footnote disclosures of totals only.

D)It may report the amount of accumulated other comprehensive income for each item or in total as part of stockholders' equity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

Dave Company had 30, 000 shares of common stock outstanding on January 1 and issued an additional 9, 000 on August 1 of 2010.The company also has $100, 000 of 8% convertible bonds outstanding during the year.Each $1, 000 bond is convertible into 5 shares of common stock.Dave had after-tax net income for the year of $160, 000, and the tax rate was 30%.

Required:

Compute the appropriate earnings per share amount(s)to be reported on Dave Company's 2010 income statement, and explain your answer.

Required:

Compute the appropriate earnings per share amount(s)to be reported on Dave Company's 2010 income statement, and explain your answer.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

Warren, Inc.determined the following information concerning its common stock during 2010:

Required:

What should Warren, Inc.use as the denominator for its basic earnings per share calculation for 2010?

Required:

What should Warren, Inc.use as the denominator for its basic earnings per share calculation for 2010?

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

Specific EPS disclosure is regularly reported for extraordinary items under

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

Comprehensive income represents

A)net income plus "other comprehensive income"

B)net income less dividends paid

C)retained earnings plus net income

D)retained earnings plus "other comprehensive income"

A)net income plus "other comprehensive income"

B)net income less dividends paid

C)retained earnings plus net income

D)retained earnings plus "other comprehensive income"

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

Eric, Inc.began 2011 with 25, 000 common shares outstanding and issued a 20% stock dividend on August 1.The company issued 6, 000 shares on December 1.Eric also has 8, 000 shares of 8%, $20 par, cumulative preferred stock outstanding on which no dividends have been paid during either 2010 or 2011.Net income for 2011 was $165, 060.

Required:

Compute Eric, Inc.'s basic earnings per share for 2011.

Required:

Compute Eric, Inc.'s basic earnings per share for 2011.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following stockholders' equity disclosures are required under both GAAP and IFRS?

A)capital not yet paid in

B)restrictions on the repayment of capital

C)dividend preferences

D)shares reserved for future issuances under sales contracts

A)capital not yet paid in

B)restrictions on the repayment of capital

C)dividend preferences

D)shares reserved for future issuances under sales contracts

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Which one of the following would least likely result in a negative component of stockholders' equity?

A)excess of additional pension liability over unrecognized prior service cost

B)valuation changes in available for sale securities

C)donations

D)unrealized declines in value of marketable equity securities

A)excess of additional pension liability over unrecognized prior service cost

B)valuation changes in available for sale securities

C)donations

D)unrealized declines in value of marketable equity securities

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Differences exist between IFRS and GAAP in the reporting of EPS.Which of the following areas is not an area of difference?

A)adjustment in options calculations for unrecognized compensation cost

B)treatment of unvested contingently issued shares

C)treatment of dividends in arrears for convertible preferred stock

D)treatment of contracts that may be settled in shares or for cash

A)adjustment in options calculations for unrecognized compensation cost

B)treatment of unvested contingently issued shares

C)treatment of dividends in arrears for convertible preferred stock

D)treatment of contracts that may be settled in shares or for cash

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck